3 years ago, my friend contacted me to seek my advice as she and her husband each bought a leveraged whole-life endowment plan from the bank. This friend of mine is risk-averse and has always been saving her money through bank fixed deposits. It was the first time she was exposed to a leveraged endowment product. She and her husband were enticed by the high monthly income payout from the endowment through leveraging.

My advice to her back then was to be careful of the interest rate as I feel that the interest rate risk was not properly communicated to her by the bank. Although the product suits her needs, she probably should not leverage and expose herself to unwanted risk during her retirement years, especially so with a risk-averse profile.

What is premium financing?

Basically, premium financing is using borrowed money from the bank to purchase life insurance products such as universal life, single premium whole life, and whole life endowment plan. Hence, the policy owner is only required to pay a small portion (usually 30% of the total premium), while paying the interest either quarterly, half-yearly or yearly depending on the financing package.

The bank will usually offer a spread plus cost of fund. The spread is the interest that the bank will earn while the cost of the fund usually will reflect the interbank interest rate. Do take note that each bank computes its cost of funds differently. There are some banks that offer the cost of funds in relation to the Singapore Overnight Rate Average also known as SORA.

Why is premium financing attractive?

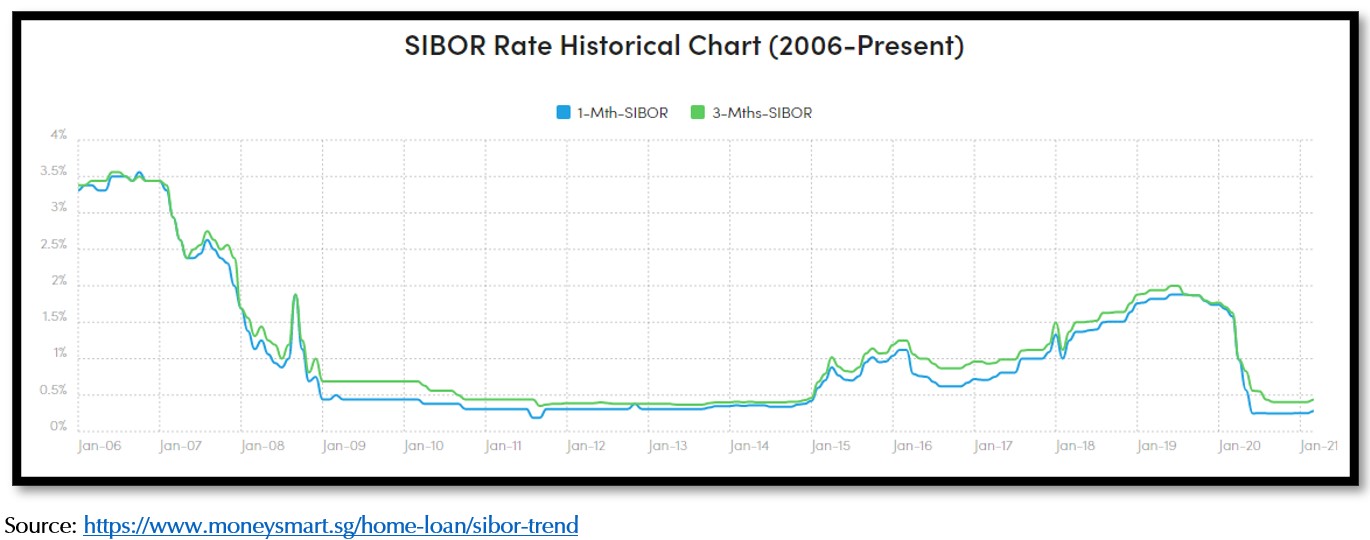

Before the SORA rate was introduced in 2019, banks in Singapore often used the Singapore Interbank Offered Rate also known as SIBOR for premium financing. Let us take a look at the SIBOR Rate Historical Chart.

Based on the data shown above, SIBOR has remained relatively low since the Great Financial Crisis in 2008, at about 0.3% to 0.4% from the year 2009 to the end of 2014. The cost of borrowing money from the bank was relatively low during that period, and hence premium financing could have cost less than 1% per year.

After that, the historical SIBOR rate was relatively responsive to Fed’s decisions on rate hikes starting from the year 2015 but subsequently, due to the COVID-19 situation, Fed reduced the interest rate since the year 2020.

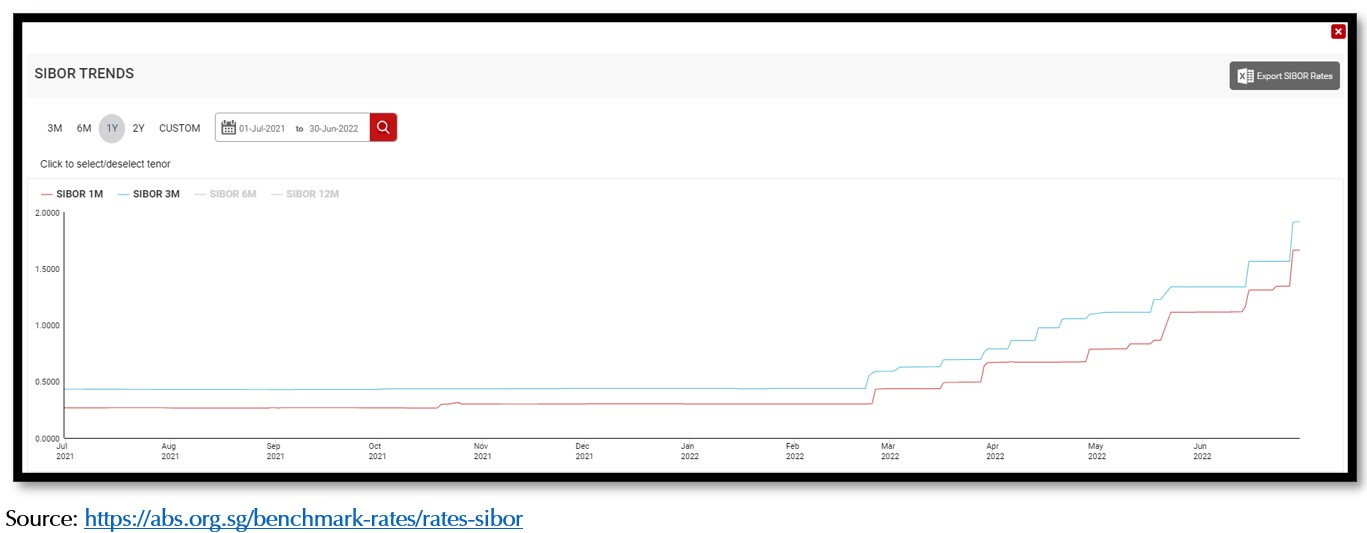

Let us look at another SIBOR rate trend in the past 1 year (relatively responsive towards Fed rate hike):

We can observe that in the recent trend of rising inflation for the past 1 year, the counter approach is to raise the interest rate. Hence, we observe that the SIBOR responded according to the Fed rate hike decisions starting from March 2022.

From this, we can see that interest rates can be relatively volatile, and the movement of the interest rate is dependent on the global market economy. Hence, individuals who undergo premium financing will experience volatility when paying the cost. And this may not be a situation where an individual who is very risk-averse wants to be in.

The sales pitch for premium financing usually involves the following:

1) Estate Creation – A lump sum payout to beneficiaries upon demise.

Having the idea of just paying 30% of the premium while borrowing the remaining at a low cost. Hence, with the remaining 70% of the premium, the individual can use it for his own leisure or retirement.

2) Whole Life Endowment Plan – Monthly income payout to the policy owner for a lifetime.

There are typically a few types of sales pitches for leveraging such a plan. One is treating this policy as “purchasing property without paying ABSD (Additional Buyer Stamp Duty)”. This sales pitch typically targets a group of clients who wants to purchase property for rental income and yet do not wish to pay for the ABSD due to the cooling measures. Do take note that property and insurance are 2 different classes of products and should not even be classified under the same umbrella.

The second sales pitch for such a whole-life endowment plan is usually using the benefit illustration to showcase the difference in monthly income payout using actual premium payable and leveraged premium payable. Most of the time, individuals will be enticed by the higher monthly income payable assuming they do leverage using the product.

Key reasons for premium financing

As we know that in the current market, there are 2 main reasons:

- Creating a legacy amount

- Creating higher monthly income

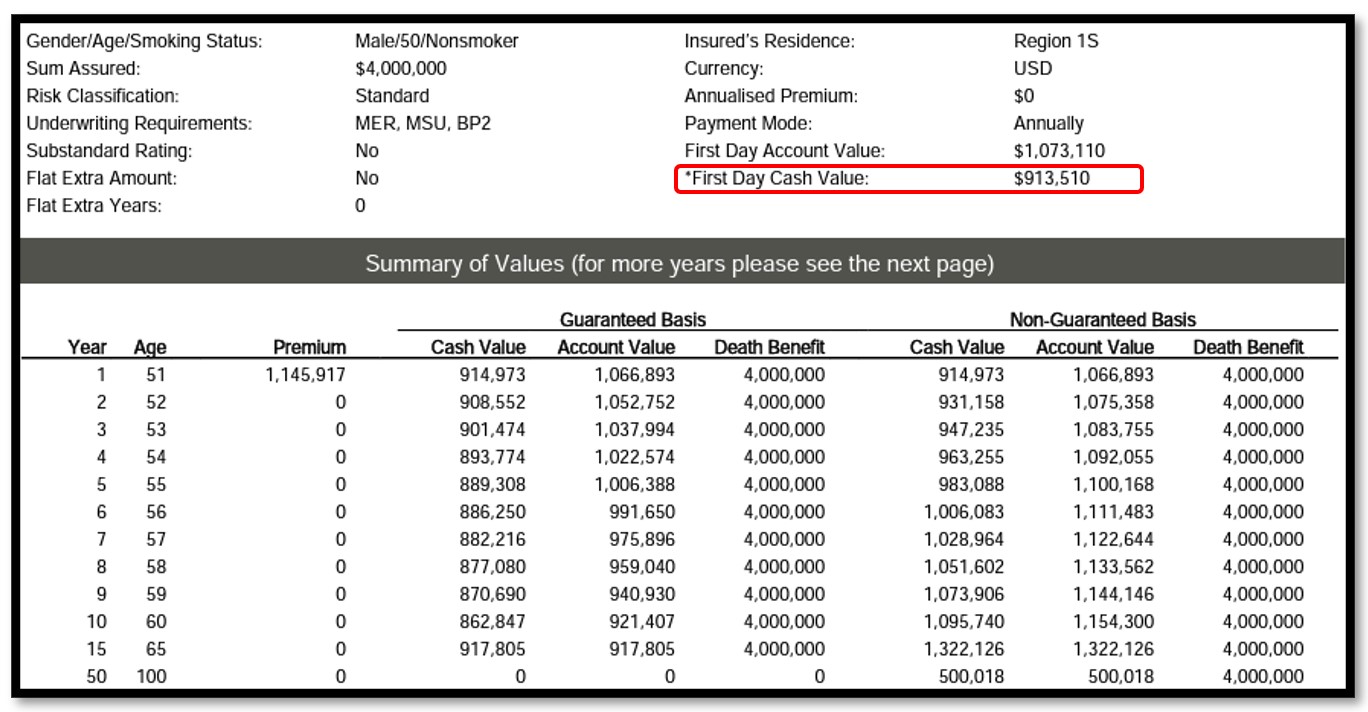

Here are some schools of thought when an individual is using Universal Life for estate creation. Let’s take a look at the chart below:

In this illustration, the policy owner will require to pay a premium of US$1,145,917 to cover the death benefit of US$4,000,000. Through premium financing, the bank can loan a maximum of 90% based on day 1 cash value which is highlighted in red. The loan amount will be US$822,159; hence, the policy owner is only required to make a payment of US$323,758. Let’s assume the interest rate is 1% between the year 2009 to the end of the year 2014, the actual yearly cost will be US$8,221.59. Usually, to cover the interest rate cost, the client will invest the remaining amount which he saved from paying the Universal Life policy – US$822,159 into a dividend-paying fund with a return of between 3% to 5% which essentially is capable of covering the premium financing cost and yet having some surplus for own spending. With such a strategy set up, the client is often attracted to it as it provides a solution for estate creation and also a supplement of retirement income from the surplus dividend income payout from the investment.

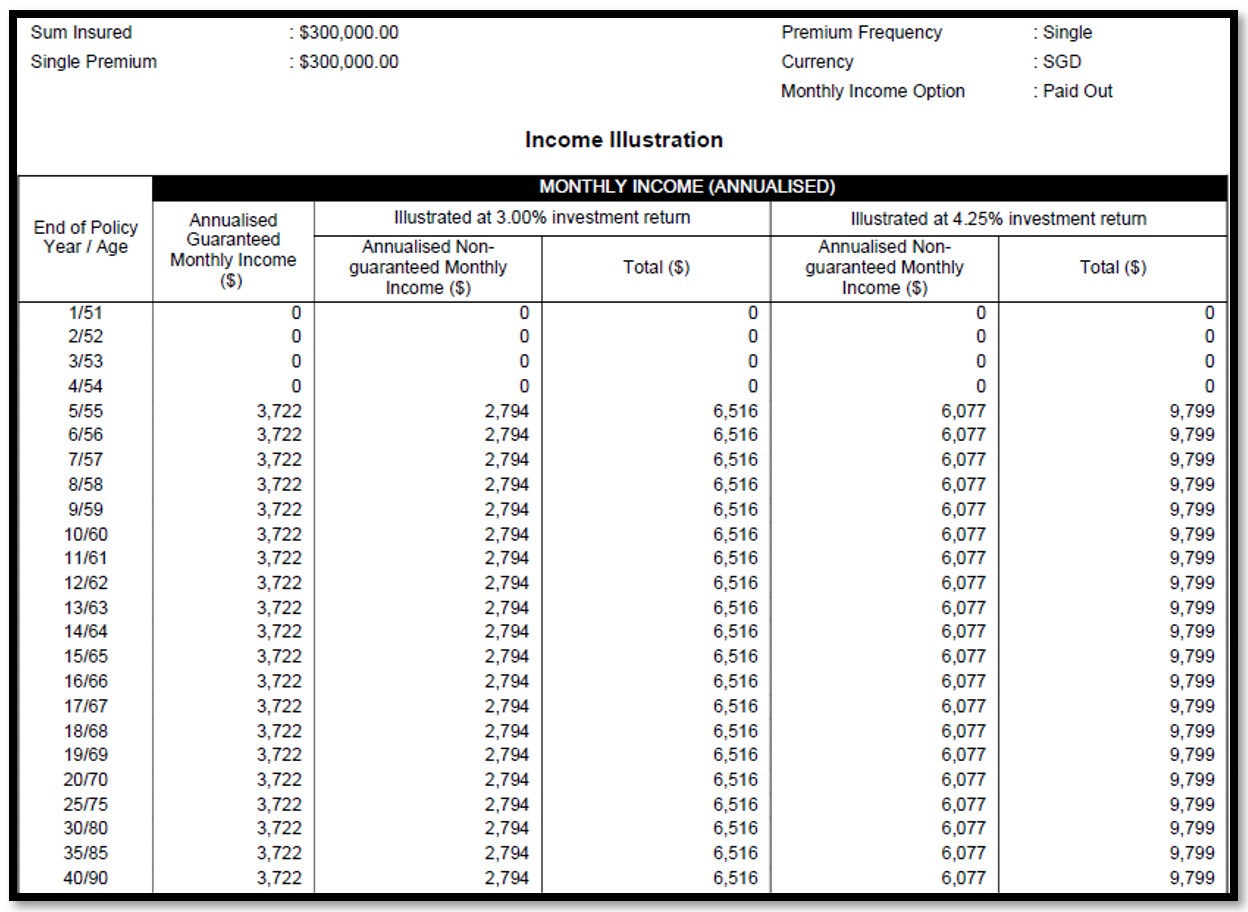

If we dive into the thought of leveraging a Whole Life Endowment plan, here are some illustrations which we can reflect upon. These examples are based on annual payout calculation:

We can observe that if the policy owner is to purchase a Whole Life Endowment plan, there will be a guaranteed monthly income of about $310 ($3,722 ÷ 12) and a total monthly income of up to $816 ($9,799 ÷ 12) which is inclusive of a non-guaranteed bonus.

Let us take a look at the next chart if the policy owner is to leverage:

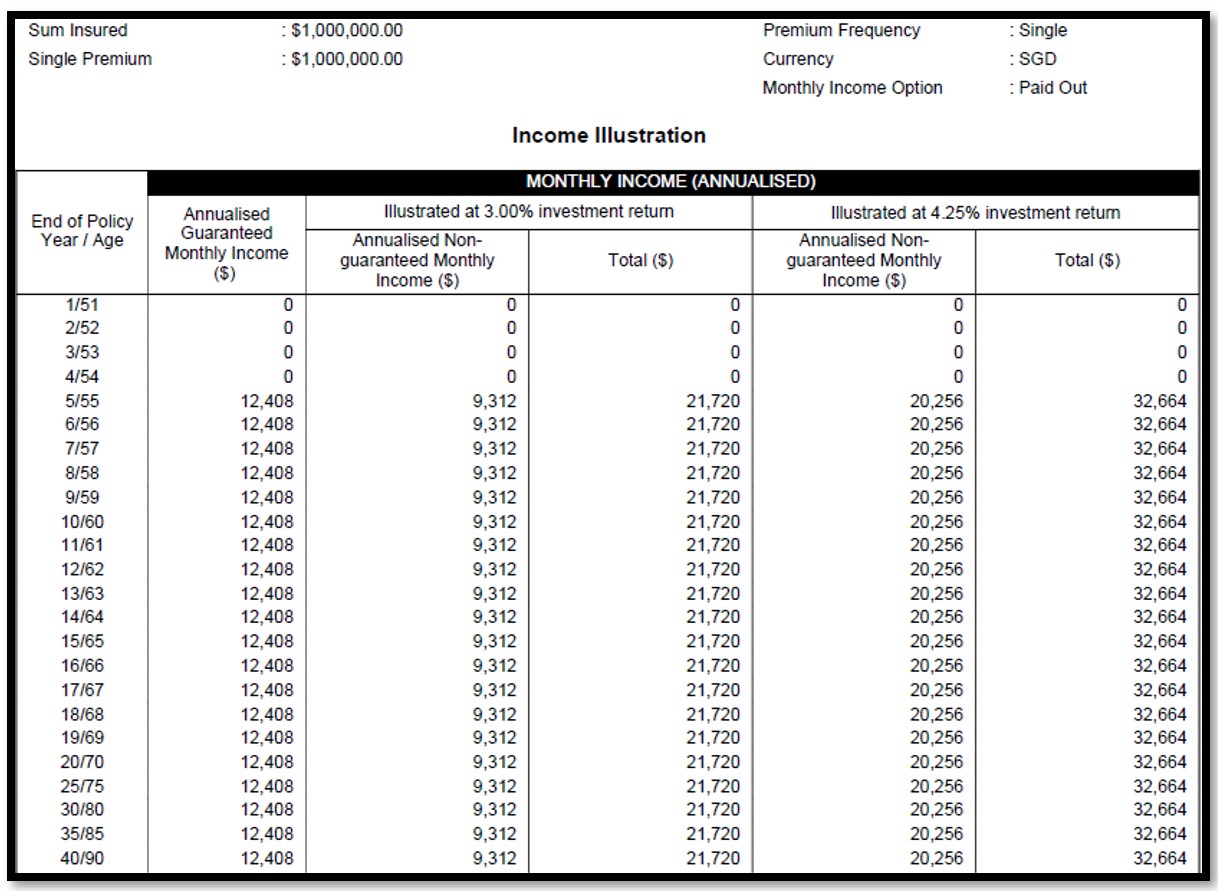

What we observe is that with the leverage effect, the policy owner gets to borrow $700,000 from the bank to purchase a $1 million policy while paying only $300,000. With this policy, the policy owner now can receive a guaranteed monthly income of $1,034 ($12,408 ÷ 12) and a total monthly income of up to $2,722 ($32,664 ÷ 12) which is inclusive of a non-guaranteed bonus. Assuming the cost of leverage is 1% from the period of the year 2009 to the end of the year 2014, the yearly cost would be $7,000. If we net off the yearly financing cost from the total annual income of up to $32,664, it would be $25,664 which converts into a monthly income of up to $2,138.

Based on this analysis, it is still attractive for the policy owner to leverage as he would still earn the difference in a total monthly income of up to $1,322 for doing nothing.

The untold risks

From the above examples of using Universal Life and Whole Life Endowment, there are certain risks involved in the premium financing method that some policy owners may not have thought of or understood.

1) Interest rate risk

In the earlier part of this article, we mentioned that interest rates can be volatile and is highly dependent on the global market economy. With rising interest rates, the cost of financing will increase as well, hence, the return from the insurance policy will be greatly reduced. If the policy owner only has 1 plan that pays out monthly income for his retirement, he has to be more prudent and be informed of this interest rate risk that he may have to face in the later part of his retirement years.

2) Insurance investment risk

If the insurer’s investment performance is not doing well, we should not expect that they give a higher bonus tier in the non-guaranteed section. There are times insurance companies may cut bonuses if their underlying investment is not doing well and we should not have a high expectation that insurance companies might apply the smoothing bonus effect. Smoothing bonus effect applies to “participating fund” which we can associate to whole life, endowment type of plans underlying investment. Usually, insurance company wants to avoid fluctuation in the non-guaranteed bonuses which they declare from year to year, so they adopt this strategy to hold back a portion of bonuses in years where the investment fund has achieved good performance so the bonuses can be maintained and paid to policy owner during the poor performance years. The same goes for Universal Life’s crediting rate if the bond market is doing poorly.

Double-edged sword effect – We have seen a good return example from the earlier part of the article on premium financing. However, with the rise of interest rates, global bear market, and cutting of bonuses from the insurance companies, the policy owner may eventually face negative returns. It means that the investment return from the dividend-paying fund or insurance bonus payout is not capable of funding the financing cost.

3) Liquidity risk (exit plan)

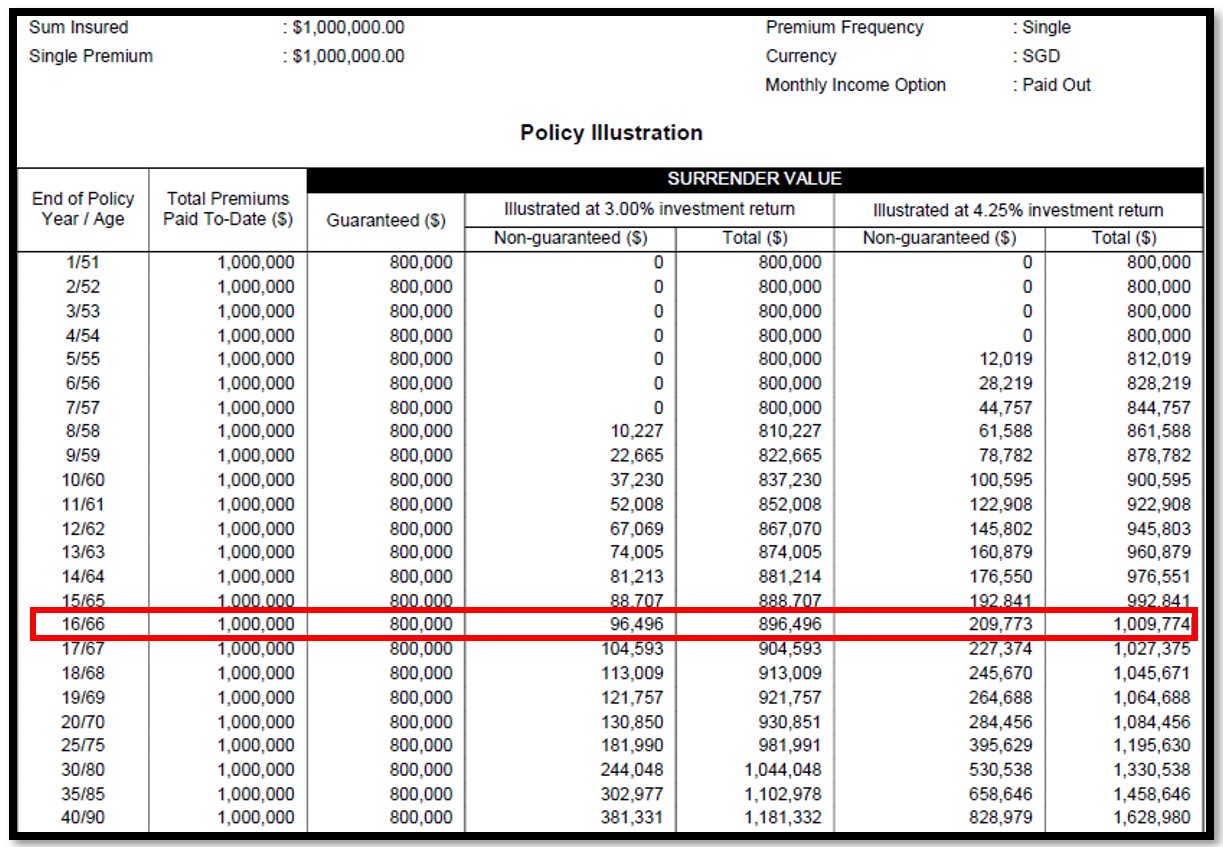

With the above-mentioned 2 risks, the policy owner may consider terminating the plan and get out before the financing cost increases. However, let us take a look at the chart below:

Based on the illustration, we can see that the earliest breakeven point is in the 16th year and that is if the insurance company’s underlying investment is doing well every year and paying out higher-tier bonuses. However, we know that it might not be possible as this would mean that the global market is consistently doing well every year. Hence, the policy owner may not be willing to terminate the policy due to rising financing costs. Unless the policy owner is willing to cut losses to prevent incurring the rising financing costs during interest rate hikes.

Do take note that this is just an example and different insurance companies’ plans are designed differently.

Alternatives to premium financing

If there are concerns about creating a legacy or building up retirement income, there are alternatives we can look into:

Estate creation

1) Term plan till age 99 and invest the rest – We can simply use the most traditional way of creating a legacy while using the investment to fund the insurance. The key disadvantage is longevity risk. Assuming the policy owner lives beyond age 99, he will not be entitled to the insurance proceed.

2) Variable Universal Life – Policy owners can explore using existing investment assets to create a legacy for their beneficiaries without using additional cash or leveraging. Unlike universal life, variable universal life offers policy owners to retain investment control and decision or offer the advisory model.

Retirement income

1) CPF LIFE – It is great to build up CPF saving as the return from CPF is almost as good and risk-free as it is guaranteed by the government. Apart from it, the CPF also provides a good interest rate return.

2) Investment assets – While we should not depend on a single stream of income during our retirement years, it is always good to diversify our retirement fund. Investments can come in a variety of types such as bonds, stocks, mutual funds, REITs, property, etc.

3) Annuity plan – While rare in Singapore, such plans enslave a lifetime of income to fund for retirement.

We know that there is no such thing as a low-risk, high-return product. Many times, we would relate that to either scams or hidden risks that we are not aware of.

In life, it is not always about chasing after high returns, but rather understanding your own risk appetite and assessing whether the risk is worth taking before purchasing a product.

It is also important to work with an adviser who is willing to provide constant risk coaching and guidance in your journey of wealth planning.

To date, I am glad to know that my risk-averse friend has managed to clear her leveraged endowment loan to the bank due to the rising interest rate.

This is an original article written by our Insurance Team at Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. Demystifying Universal Life Policies (I)

2. Why Buy Term and Invest the Rest Is Not the Whole Story

3. Can You Still Buy Insurance if You Have Medical Conditions?

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.