If today you are gifted one million dollars to start a portfolio, how would you begin investing it? Assuming you have decided what to invest in, how would you go about it, would you invest all your capital into markets on day one via Lump-Sum Investment (LSI), or would you rather spread out your investments equally over a fixed period via Dollar Cost Averaging (DCA)?

Which approach is more ideal? How does either strategy affect long-term portfolio returns? Is there even a difference? And with DCA, is there an optimal period funds should be “drip-fed” into markets like over 6 months or 12 months? Why not longer? These are typical questions that some of our clients ask us just before we implement their wealth plans.

DCA is commonly recognised and recommended as a good way to start investing, as it helps an investor to navigate the unknowns of market movements and volatility by spreading out their risk over time and averaging down their cost in event of a market downturn. It may appear at first glance that LSI is riskier, after all, it can be psychologically unnerving for some to put all their capital in at one go, especially for first-time investors.

DCA generally seems like the more sensible and palatable way to start investing as it offers a good balance between some short-term downside protection and participation in long-term market returns. However, over a longer time frame, is it true that LSI is riskier than DCA?

Taking an Evidence-Based Approach

An in-depth case study and analysis was conducted by Vanguard where portfolios of varying asset allocations between equities and bonds were constructed, with their monthly and ending portfolio returns back-tested and compared over 10-year rolling periods across USA, UK & Australia markets.

The data stretches as far back as 85 years for USA from January 1926 through to December 2011, 35 years for UK from January 1976 to December 2011 and 27 years for Australia from January 1984 to December 2011.

For the LSI case study, the assumption was that $1 million being invested immediately and then held for 10 years. For DCA, the same amount was sequentially invested in equal amounts over differing periods ranging from 6, 12, 18, 24, 30 and even up to 36 months. Both portfolios ended up with identical asset allocations and remain invested till the end of 10 years.

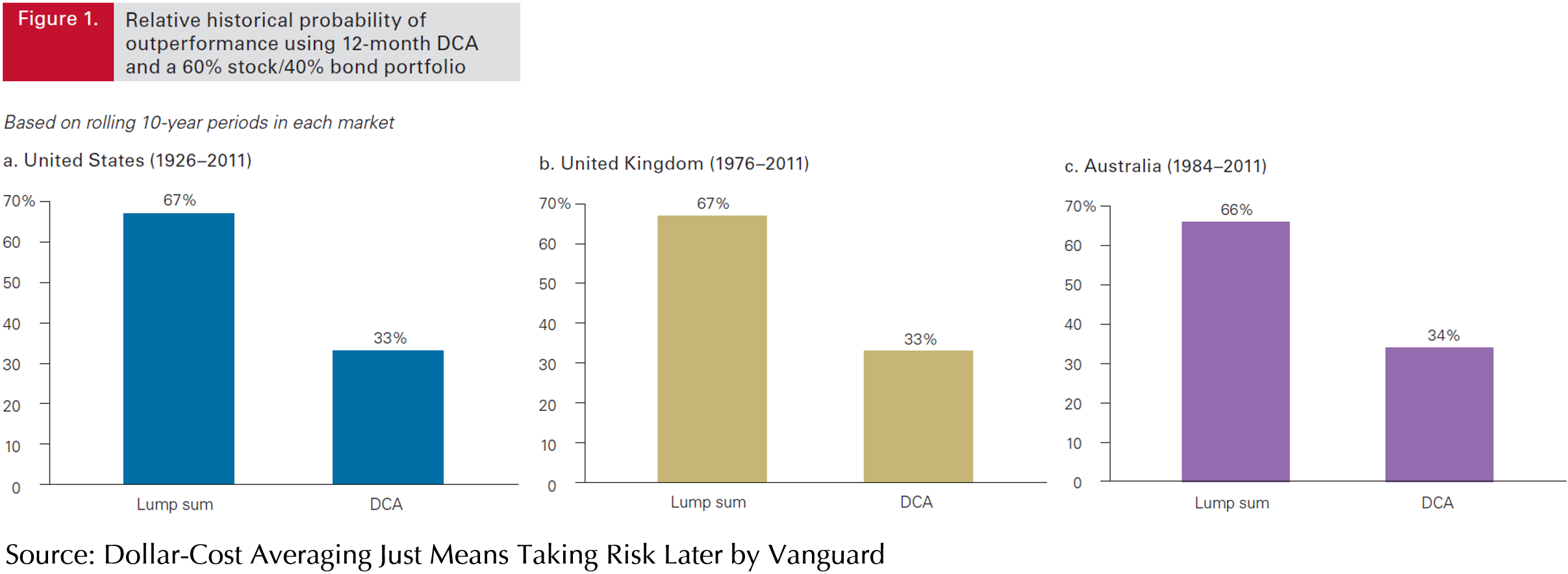

Figure 1 below shows the historical outperformance of LSI versus a 12-month DCA for a balanced portfolio of 60% equities and 40% bonds. In other words, investing via LSI on average gives you a higher or 66% probability of portfolio outperformance compared to DCA. Meaning to say on average if you invest lumpsum, your portfolio will end up with a higher portfolio value after 10 years, approximately two-thirds of the time.

Does Asset Allocation Make a Difference?

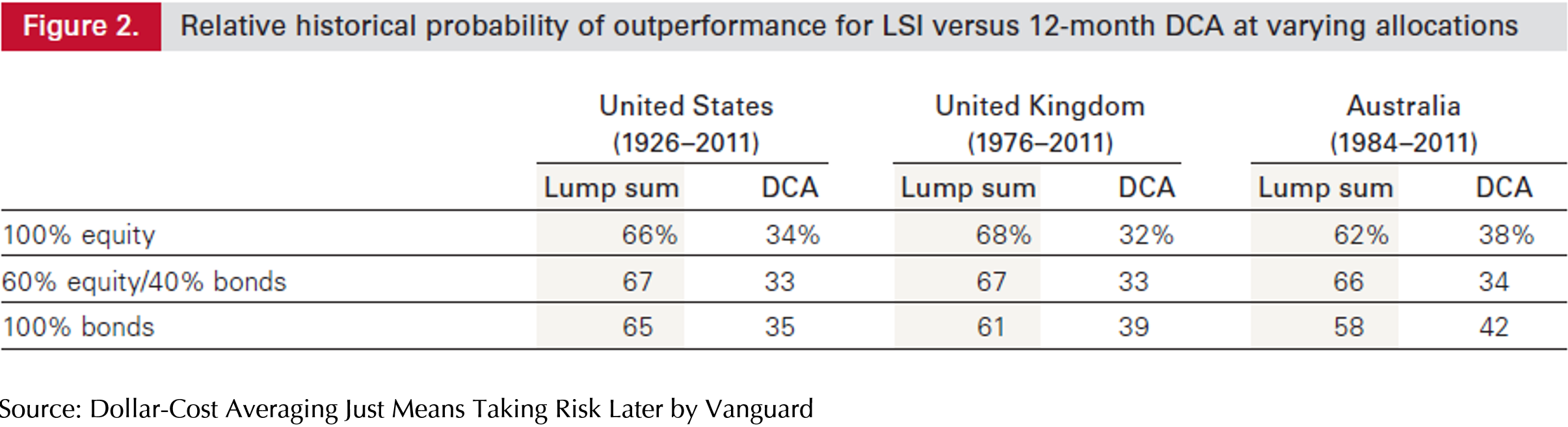

If you are wondering whether asset allocation plays a determinant factor, the same analysis was performed across different equity/bond allocations including full allocations to 100% equities and 100% bonds. Applying the same parameters to the extreme ends of equity and bond allocations, Figure 2 shows that LSI portfolios generally recorded higher returns than DCA portfolios. This shows the outperformance of LSI persists regardless of asset allocation.

Thus far, the comparative analyses are based on a 12-month DCA period, what if the DCA duration was extended, how would that affect the probabilities of outperformance between LSI and DCA? As shared earlier, the same analysis was conducted using 6-, 18-, 24-, 30 and 36-month DCA periods, and applied across all 3 markets using the same 10-year rolling returns time frame.

It turns out LSI still outperformed DCA in a greater number of 10-year periods regardless of the length of the DCA period. Furthermore, it was found that generally, the longer the DCA period, the higher the probability that LSI portfolios would outperform and end up with a higher ending value. For example, in USA, for a DCA period of 36 months, it was found that LSI outperformed in approximately 90% of the 10-year periods.

Is It Worth the Risk?

From the evidence shared, we can fairly conclude that there are benefits to investing via LSI. Although it feels counter-intuitive putting your money in on day 1 compared to spreading it out, odds are in your favour that your portfolio returns will be higher in the long run. However, is the trade-off between potential higher returns and lowering the portfolio’s risk worthwhile?

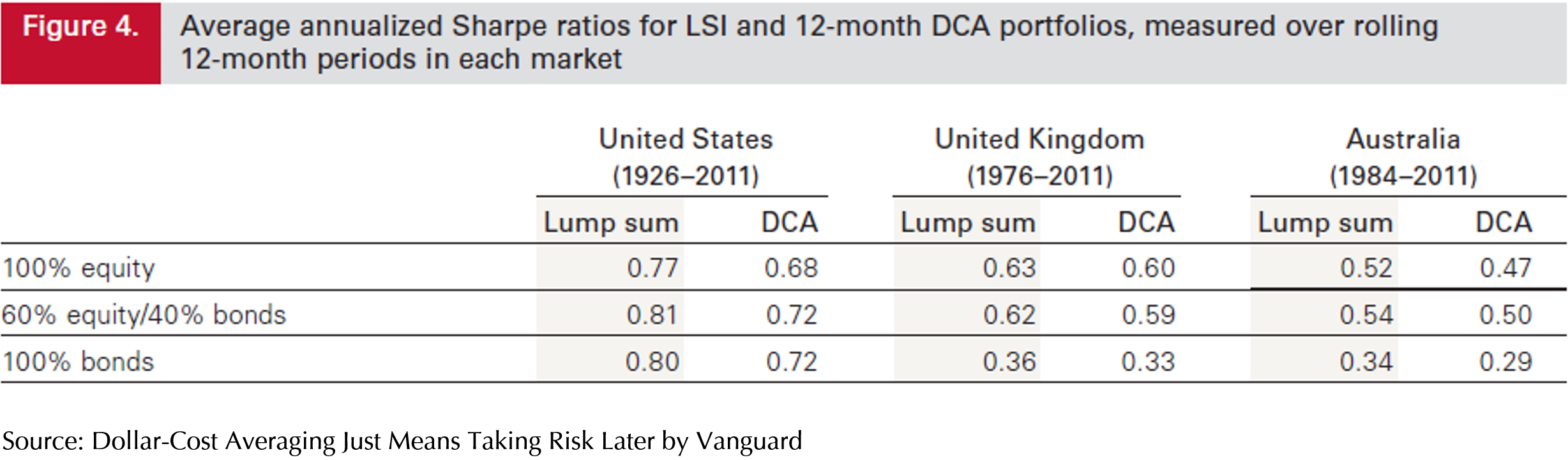

Comparing Sharpe ratios during the first 12 months may shed some light and gives us a better feel for the risk-adjusted returns of each strategy. Sharpe ratio simply measures an investment’s excess return above the risk-free rate per unit of risk or volatility. It may be that DCA provides a better risk-adjusted return than LSI, despite having lower ending portfolio values on average.

Figure 4 below compares the average annualised Sharpe ratios of LSI and 12-month DCA portfolios, over 12-month rolling periods for all 3 markets.

Surprisingly, it turns out that LSI portfolios also have consistently higher average Sharpe ratios across different asset allocations and markets, providing slightly better risk-adjusted returns. Perhaps investing via LSI is not as risky as we think, maybe not in the same way we perceive risk.

The Case for DCA

At this point, it is important to take a step back and understand that the data discussed so far involves averages and probabilities, DCA investments have outperformed LSI historically as well, just on fewer occasions. It is entirely possible for a DCA strategy to outperform LSI in particular market conditions, and actual returns for investors using either approach may be higher or lower at any point where future trends change.

Although LSI outperforms DCA more often than not, and the risk-adjusted portfolio returns are higher, the strength of DCA lies in its ability to help investors reduce short-term portfolio volatility and gain some downside protection in the event of market downturns.

In the same research, having analysed 1,021 12-month periods in US markets from 1926 – 2011, it was found that LSI had 229 periods (22.4%) where portfolios declined versus 180 periods (17.6%) for DCA. Interestingly, the average loss during LSI periods was $84,001 while the average loss for DCA periods was $56,947 which is significantly lesser.

So like insurance, DCA can lessen the impact of worse-case scenarios and provide short-term downside protection. However, it does so at the cost of sacrificing some potential portfolio upside, which you can think of as the cost or “insurance premiums” to pay. This can be beneficial if it helps ease investors’ nerves and gives them the confidence to start their investment journey.

For some investors, this is a trade-off they will be happy to take as their tolerance for risk is less and they value more portfolio stability over higher potential gains. It is therefore understandable for more risk-averse investors to consider a DCA strategy, especially during periods of market turbulence, as it gives them more peace of mind and reduces the emotional impact of loss and regret should they make a lumpsum investment just prior to a market downturn.

Is There a Clear Winner?

While we can say to clients it is statistically sensible to invest their monies via lumpsum, our individual perceptions of risk may differ and sometimes it is difficult to connect our heads with our hearts. Some investors just feel safer spreading out their investments, especially during times of fear, market volatility, and sensationalised headlines.

At Providend, the peace of mind and comfort of our clients is something we deeply value, and if investing via DCA helps our clients sleep better at night and stay invested, we will certainly do so and incorporate it as part of our implementation plan.

To wrap things up, if you have a sizeable amount of money to invest today, LSI is a logical and sensible way to start as markets always go up in the long run, albeit not in a straight line. As long as there continues to be a positive risk premium in global equity and bond markets over holding cash as history and the data show, we should have the confidence to invest for the long term and capture the market returns.

At the same time, investing via DCA is a useful tool to manage volatility in times of uncertainty. It is perfectly suitable for investors wanting to ease themselves into markets to take advantage of lower prices, while still having a measure of downside protection.

If you have a need to invest today and have clearly established your goals, identified a suitable asset allocation that matches your risk tolerance, and have a sufficiently long-time horizon, do not let market turbulence and economic fears deter you from embarking on your investment journey, take the first step towards achieving your goals.

This is an original article written by Heng Tee Jin, Associate Adviser at Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. How to Build a Good Wealth Plan

2. The Time to Invest Is Now

3. How to Invest Cautiously

We do not charge a fee at the first consultation meeting. If you would like an honest opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.