My recent conversations with my mother have been about her declining stamina and her need to take more rest stops on her morning walks. This may be a sign of sarcopenia, a gradual loss of muscle mass, strength and function due to ageing. She is also concerned about developing dementia, which may affect her quality of life and her ability in managing her finances. Although I have been nominated as her donee in her Lasting Power of Attorney, we have not had a detailed discussion on her healthcare preferences and financial details. My mum also worries about not remembering her digital login details like Facebook, Google photos, online CDP and bank accounts.

All her concerns may also apply to other seniors as it is, in a way, related to end-of-life planning.

This prompted me to think through ways to help her address her worries.

Basically, there are three main areas of concern,

- Age-related muscle health

- Advance care planning and mental health issues

- Accessing digital assets and legacy planning

Age-related muscle health

Sarcopenia is an age-related, involuntary loss of skeletal muscle mass and strength. As we age, we may lose our muscle mass and if we do not manage it well, it could increase our risk of falling and frailty. Similar to our retirement fund which can be eroded by inflation, we need to manage it to at least keep pace with inflation.

We can understand our muscle health by using the SARC-F questionnaire, which consists of questions in five areas: Strength (S), Assistance walking (A), Rising from a chair (R), Climbing stairs (C), and Falls (F). Improving our muscle health requires us to have a good protein diet and resistance training to ensure that we continue to build muscle or lose it as minimum as possible. This prompted me to encourage my mum to join a senior activity gym centre and have a nutritionist review her diet.

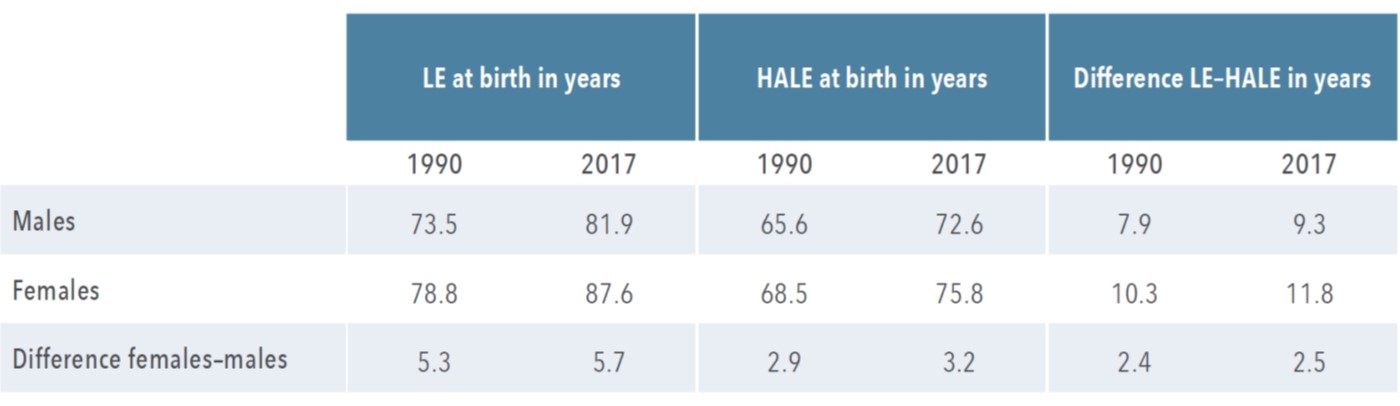

According to a MOH report in 2019, The Burden of Disease in Singapore, 1990-2017, although Singaporeans’ life expectancy has increased by 8.7 years to 84.8 years, one of the longest in the world, its healthy life expectancy – or healthspan – has increased by only 7.2 years to 74.2 years. This may be the reality that we will face if we are not vigilant with our health, spending about 10 years of our twilight years in poor health.

Singapore Life Expectancy (LE) and Healthy Life Expectancy (HALE) at birth, males and females, 1990 and 2017.

Advance care planning and mental health issues

To help my mum develop her care plan and to document it, we use the advance care planning (ACP) process. More information can be found on the Agency of Integrated Care (AIC) website. To create the ACP document, we first need to get an advance care planning facilitator to help document our wishes and appoint our Nominated Healthcare Spokesperson (NHS). The ACP document will then be a basis to understand her future health and personal care that is consistent with her values and preferences.

Like muscle health, mental health will require screening and activities to help detect and reduce our risk of developing dementia or depression. Be physically and socially active. Keep our minds active, do cognitive training games like puzzles, Sudoku, word games or even Mahjong. Joining the activities in the Active Ageing Centre will definitely be helpful.

Accessing digital assets and legacy planning

One of the main challenges for seniors is technology, and my mum also finds it tough to access all the online platforms and documents. She is having difficulty keeping up with all the digital documentation. The good news is that there is now a new digital vault in My Legacy, an initiative under the Smart Nation “LifeSG” Strategic National Project.

Things are now a lot easier as all the different documentation such as wills, LPA, CPF nomination and important documents like statements and digital assets and emotional wills can all be kept in a safe place with the appointed trust person to access it at the time it is needed. Of course, this can also be reviewed on a time-to-time basis.

Ageing and living well allow my mum to leave her legacy. Although she has done her LPA and will, what is equally important besides financial assets, is her other legacy to us. We spoke about what she wants to leave behind for her loved ones like the recipes of the food we enjoy eating, the photo memories of us travelling together, the ang pow and coin collection for her grandchildren in their respective Zodiac signs.

At the same time, she also spoke about topping up her grandchildren’s CPF Medisave as a form of gift and a reminder for prudent savings. I also encourage her to write or video down her thoughts and wishes for us. This can be a form of an emotional will.

I am really glad that I have the opportunity to help my mum think through her end-of-life planning. It was a meaningful process which allows us to spend time focusing on the things that matter — celebrating our relationships and leaving a lasting legacy.

This is an original article written by Lee Chee Kian, Senior Client Adviser of Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. Embrace Longevity, Be Well Prepared to Celebrate Life

2. The Importance of End-of-Life Planning

3. How Much Life Insurance Do You Need

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.