Retirement planning and security in a rapidly changing world

The world we live in today is full of volatility and uncertainty. COVID-19 has impacted us greatly in ways we could not have imagined pre-pandemic. Given such fundamental shifts, should retirees and pre-retirees continue to rely on past assumptions to build their retirement planning strategies and retirement investment portfolios, especially with rising inflation and cost of living?

Challenges faced by seniors

When AN LIVING was founded four years ago, its purpose was to address the challenges of an ageing population and work with like-minded policymakers and partners to ensure that seniors are equipped with additional and reliable income streams in retirement.

The challenges being:

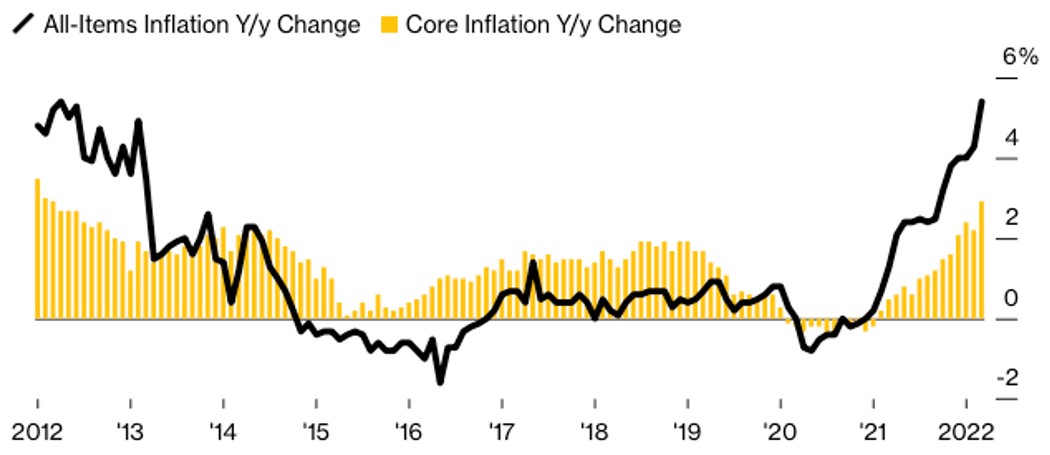

1. Rising inflation which is currently at a 10-year high of 5.4% (as of March 2022) and is expected to remain elevated – translating to increasingly higher prices that strain retiree households and reduce the capacity of pre-retirees to put aside savings for their retirement.

Source: Bloomberg, Singapore Department of Statistics, Monetary Authority of Singapore (Link)

Source: Bloomberg, Singapore Department of Statistics, Monetary Authority of Singapore (Link)

2. Rising healthcare costs that outpace the cost of living due to the effects of an ageing population, as well as new medical advancements which mean that previously untreatable conditions may now be treated and older, less effective treatments may be replaced with better but costlier methods. The effect of this is that while lifespans become longer and the quality of life improves, they come at a higher cost.

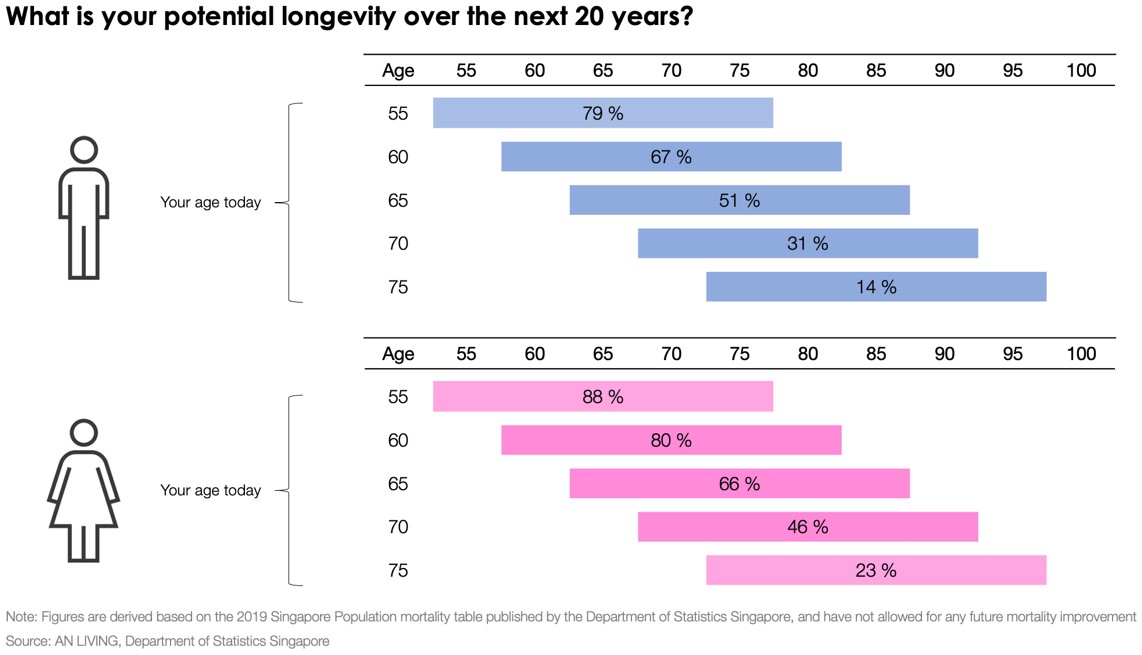

3. Mortality improvements will erode retirement funds – the life expectancy of Singaporeans is among the highest in the world at 81.4 and 85.7 for men and women respectively in 2019. These figures are expected to increase further in the coming years. A common misinterpretation of these figures is that people believe these are the ages they can expect to live until, when the reality is that these numbers are simply an average.

What is more relevant to seniors is to reframe the data from the perspective of their present age and gender to better understand their potential longevity over the next 20 years.

We worked with actuaries to derive the above figures from Singstat’s Singapore Population mortality data and provide an important point of reference for retirement planning and wealth management strategies for what can be for many, a considerably longer retirement ahead.

When home is where the heart and wealth resides

A home is not just a roof over our heads and four walls that provide shelter, it also has deep emotional meaning for many of us.

This is especially so for a family home where you grew up or raised a family in, a place filled with nostalgia and fond memories that make it irreplaceable and hard to part with. For example, for those who have inherited a property from their parents, the emotional attachment often prevents siblings from selling the house. Every little picture or piece of furniture has a memory, and sadly the failure to come to a decision on what to do with the property can at times lead to it falling into a state of disrepair.

For seniors currently still living in their private properties, it is often for sentimental reasons that they are keen to continue living in the same house despite having extra space after their children have flown the nest and moved out.

There are also practical reasons why some seniors find it hard to sell and downsize their homes. For one, there is the security and convenience of living in familiar surroundings and a close-knit community. Other reasons commonly cited include the high costs and effort needed to find a new place and the physical difficulties associated with moving at an older age.

But with rising inflation and Singaporeans living much longer, there is a real worry that seniors may outlive their retirement funds. To fund their retirement needs, many have looked into selling their homes and moving to a smaller unit, in effect, using the proceeds from the sale to finance their retirement.

For those who prefer to age in place however, unlocking liquidity from the home which can be used

for investment, healthcare and other spending needs in retirement is an option worth

considering.

AN LIVING Wealth Access

Most financial products and services are structured to help with the accumulative and decumulative aspects of a person’s wealth journey. During the accumulative phase, housing is included in wealth planning as housing loans are being paid off. However once fully paid up as a wealth asset, it is not considered in a person’s retirement planning as it typically does not generate income for as long as it is lived in.

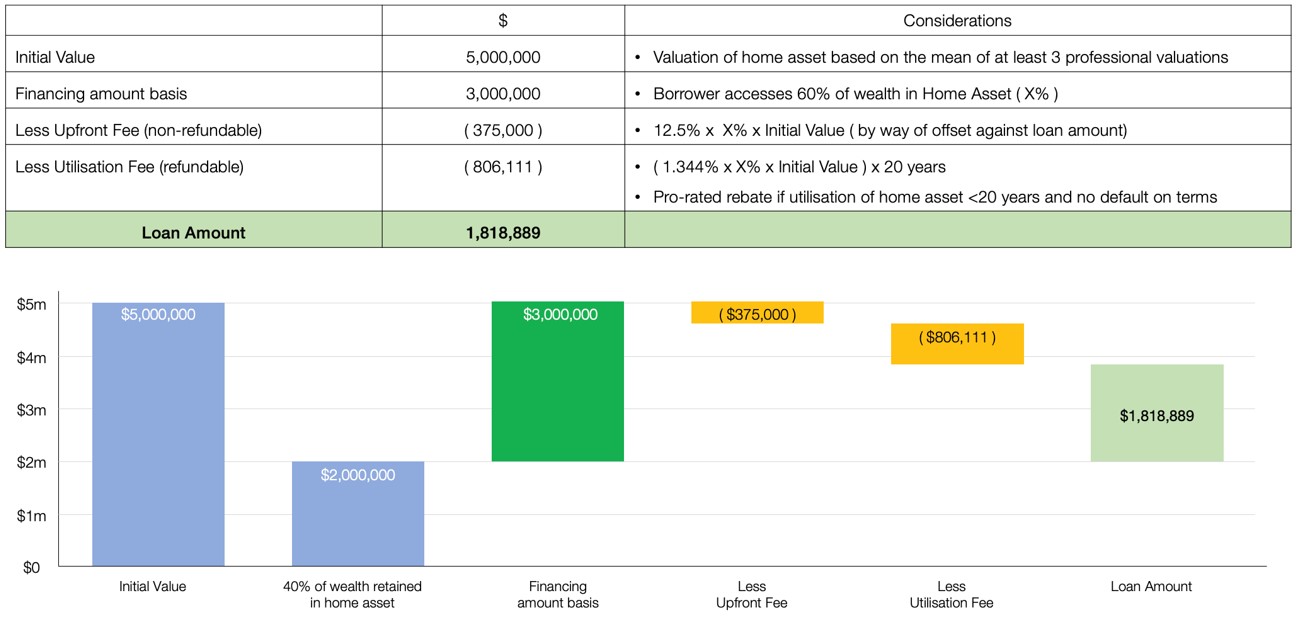

This is the reason AN LIVING Wealth Access was introduced – to allow accredited investors aged 55 and above to turn a portion of illiquid wealth in their freehold or 999-year leasehold homes into monthly CPF LIFE and investment payouts, while continuing to live in the same property. In exchange for an agreed portion of the home’s future sales proceed, a 20-year interest free[1] loan calculated based on current home valuation and required fees will be disbursed.

The total amount from the loan will first be used to top up the senior’s CPF Retirement Account to the prevailing Enhanced Retirement Sum, thus maximising CPF LIFE monthly payouts from age 65 onwards for as long as he or she lives. CPF is one of the best, if not the best retirement financial planning tool available that is unique to Singapore.

Following the required top ups for CPF, the remaining loan amount will be used to create a sound retirement income plan to be managed and advised by Providend, a financial advisory firm on AN LIVING’s panel of approved financial advisers which via their proven RetireWell methodology helps to mitigate longevity, inflation, market and withdrawal risks.

This solution combines the best of both wealth instruments in Singapore – housing assets and CPF – to enable a reliable income stream and possible investment returns in retirement years, and one can start drawing from these as early as in his or her mid-fifties.

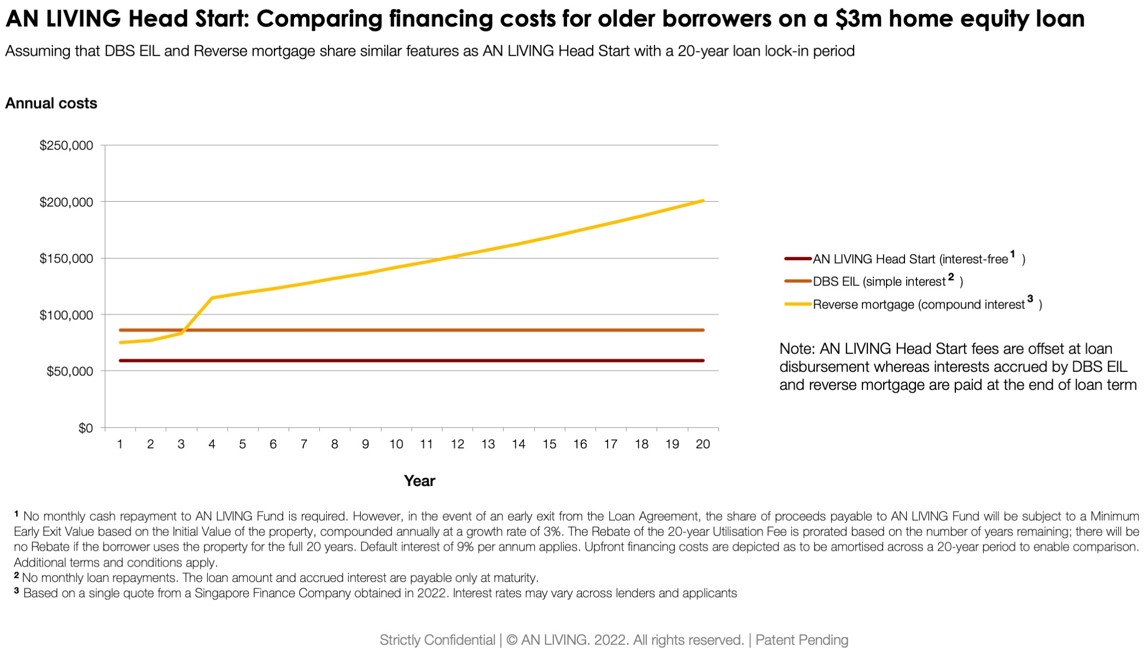

Financing costs

The home financing instruments that most of us are familiar with are traditional mortgages which are paid off using a part of our salaries during the accumulative phase of our lives and typically terminate at a borrower’s age of 65, which coincides with when most people plan their retirement age.

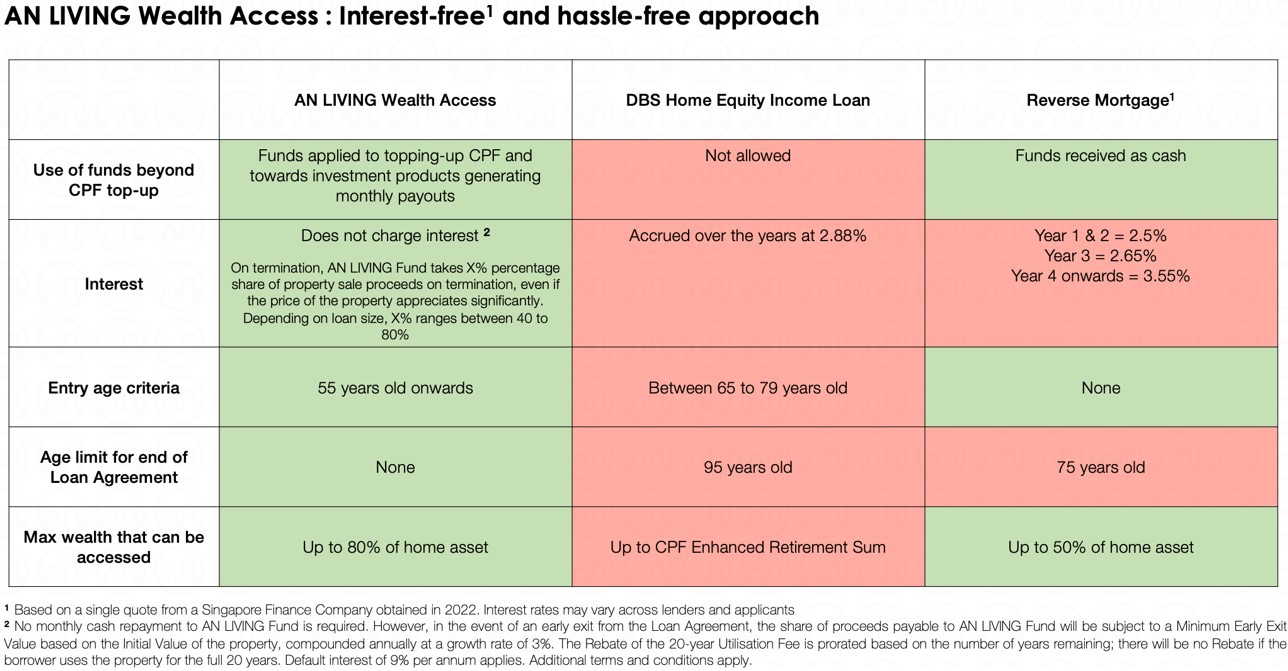

Beyond this threshold, banks and finance companies allow retirees to borrow against the value of their homes but at typically conservative ratios, age limitations and high interest rates. Such product features therefore limit their usage to short-term financing as the power of compounding interest works against the borrower over the long term. It does not help either that interest rates are rising rapidly and make these products ever more expensive for seniors.

AN LIVING Wealth Access was designed by retirement specialists to mitigate this particular risk by being interest-free and instead take a X% percentage share of the property sale proceeds (based on the financing percentage on the home’s value) when the loan ends in the future.

AN LIVING Wealth Access was then further enhanced to remove repayment risks via a series of upfront fees that are set-off from the loan amount, thereby enabling cost efficiencies that can be passed back to the borrower.

The result is clear, especially when financing costs available to older borrowers are compared with the assumption of DBS Home Equity Income Loan and reverse mortgage schemes sharing similar features as AN LIVING Wealth Access with a 20-year lock-in period.

A viable instrument

Singapore has been advocating the philosophy of ‘ageing in place’, with seniors encouraged to age in place in their own homes and in the communities where they live.

To share a real-life example, a couple in their mid-60s whom we served had previously considered downsizing to unlock additional funds for their retirement while also allowing them to travel more. However, since becoming grandparents, they have been helping to care for their grandchildren in their home while their daughter works.

The luxury of space for the grandchildren and their helper – which their freehold property affords them – is something they cherish. In addition to sentimental reasons, the home also enables them to continue living in close proximity to their neighbours who have over the years become lifelong friends.

After looking at several housing options as part of their downsizing plans, this couple realised that the home they are living in now is still the best option for their family’s needs.

With AN LIVING Wealth Access to augment their legacy and estate planning, they are looking to use part of the loan amount following the CPF top-up, to renovate the apartment to make it more conducive for their grandchildren and for hosting larger gatherings with their growing family and retired friends, while the rest of the loan amount will be deployed for their essential and discretionary expenses.

Making a life decision ahead of a wealth decision

Christopher Tan wrote in this article a year ago – that in order to live the good life, one has to make life decisions first before wealth decisions. This piece of advice has resonated with me from the day I read it.

Most people would invariably be weighing up the opportunity costs of this product which would inherently be the financing costs versus the desire to maximise the potential gains of their home assets in the future.

How about considering a different perspective in framing these same costs against the opportunity to live a better life with more buffer?

It is a deeply personal question that each of us will have to find our own answer to and given the limited time that we have in this world, I would leave you to ponder below snippet of a conversation between Charlie Brown and Snoopy.

[1] No monthly cash repayment to AN LIVING Fund is required. However, in the event of an Early Exit from the Loan Agreement, the share of proceeds payable to AN LIVING Fund will be subject to a Minimum Early Exit Value based on the Initial Value of the property, compounded annually at a growth rate of 3%. The Rebate of the 20-year Utilisation Fee is prorated based on the number of years remaining; there will be no Rebate if the borrower uses the property for the full 20 years. Default interest of 9% per annum applies. Additional terms and conditions apply.

This is an original article written by Jonathan Teoh, Founder and Director, Strategy & Partnerships of AN LIVING – a socially conscious enterprise that focuses on helping seniors enhance their financial security, in line with Singapore’s goal of becoming a “Nation for All Ages”.

For more related resources, check out:

1. RetireWell Part 1: Drawing Down Retirement Money

2. Should You Buy Retirement Income Products?

3. Chasing Returns in the Retirement Game

At Providend, we do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.