Whenever we talk about retirement planning, the focus has almost always been on accumulating towards retirement. Very little has been spoken about withdrawing during retirement. But planning for retirees on how they can spend in this phase of their lives is extremely important and arguably more complex than accumulation. This is because some of the risks faced in retirement are not only unique to retirees but if they pan out, can disrupt their lifestyle. These 5 risks are:

- Longevity risk – The risk of living too long and having their money run out before they do.

- Inflation risk – The risk of losing purchasing power and so the quality of their lifestyle goes down with time.

- Healthcare risk – The risk of not being able to cope with increased medical and wellness expenses. This becomes more real when they are older.

- Investment risk – Besides the risk of not being able and willing to bear with the volatility of markets and thus causing retirees to sell out early and thus lose money, the sequence of returns from investment portfolios affect retirees more than accumulators. As an example, if retirees are withdrawing from their portfolios during periods of negative returns, they are selling down at a bad time and this increases the chance of their money running out faster. For accumulators, since they do not need to sell down, they can just ride through the volatilities of the markets during their accumulating years.

- Overspending/underspending risk – The risk of not having a systematic and organised way of spending such that retirees overspend in the earlier years of retirement leaving insufficient funds for the later part of their lives or conversely, retirees are too prudent and leave behind too much without living their lives to the fullest.

Over the past one and a half decades, I have noticed that product manufacturers have been launching products to provide an income solution to the retirees. Fund houses and most recently, roboadvisers have been launching income paying unit trusts. Insurers for the longest time have been rolling out retirement income products. In this short article, I would like to focus on the relevance of these products that have been widely sold.

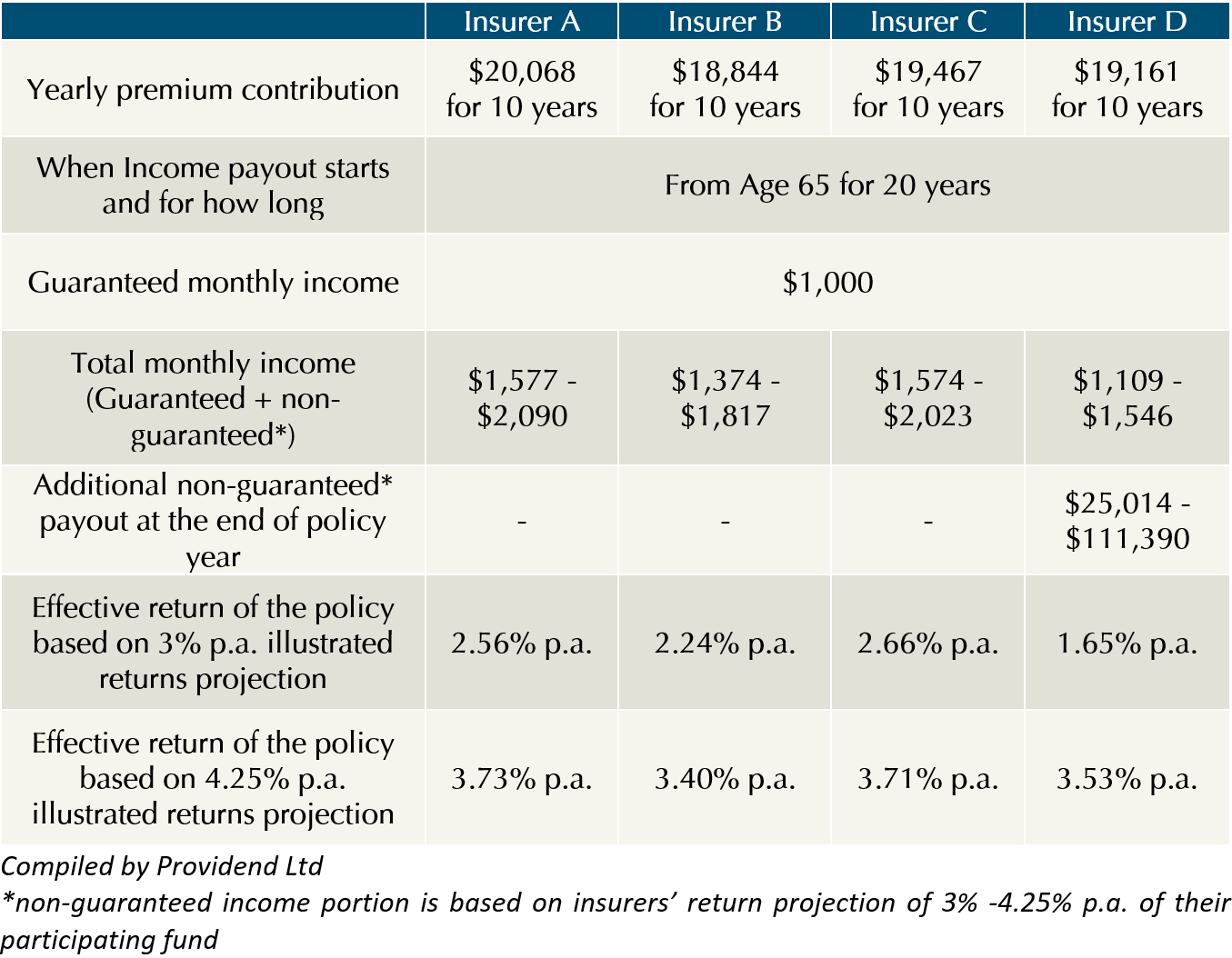

A retirement income product is one that pays out a stream of monthly or yearly income but the actual payout is dependent on the performance of its investment (i.e. life fund). You can either pay premiums annually for say, the first 10 years and from the 21st policy year onwards to be able to receive an annual income for the next 20 years. Alternatively, you can also pay one lump sum (called single premium) and receive an annual income say, 3 years later till age 100. The combinations are plenty, but you get the idea. They are like the old annuity products with a difference that they may not pay for as long as you live. We compared 4 of such regular premium products based on a 45-year-old male to give you an idea of how well they fare.

From the table, we can see that the rate of return on premiums paid based on total income payout at 3% p.a. projection of the insurer’s participating fund ranges from 1.65% p.a. to 2.66% p.a. whereas for the 4.25% p.a. projection, the rate of return ranges from between 3.40% to 3.73% p.a. While the rate of return for the higher projection of the insurer’s participating fund looks decent, whether insurers can deliver it in the next 20 or more years remain to be seen. Over the past 2 decades of my career, I have already witnessed insurers reducing these projection rates a couple of times. So, what does all these mean?

Firstly, if you want a safe retirement income floor (SRIF) in your retiring years, the “CPF Retirement Combo Pack” which is made up of the special and retirement accounts (SA/RA), together with CPF LIFE is a better retirement income “product” as the return is higher, pays for as long as you live and for now the return of at least 4% p.a. as well as your capital is guaranteed by the Singapore government. So, before you buy your next retirement income product, you may want to first consider topping up your CPF SA or RA if you still qualify. After you have done so and if you want a higher SRIF, you may then think about using retirement income products to complement it.

Secondly, because of the low returns of such products, it is not a good idea to buy it when there is still 10 to 20 years more before you need the income. With a longer time horizon, you should invest in the financial markets because you probably have a need for higher returns and have a higher ability to ride out the volatilities of the markets. Some may argue that not everyone is willing to take investment risk and isn’t buying retirement income products better than nothing? All I can say is that an ethical adviser would spend a lot of time helping you better understand investing so that you will feel comfortable investing for the long term. One of the reasons why the return for insurance products is low is because it pays out good sales commissions. To simply say that clients want it without taking sufficient time to provide a better and more suitable alternative is a lousy excuse. It makes us salespeople and not advisers. And for that matter, if we encounter bad products for the clients, even if they want it, we should be professional enough to tell clients that we do not want to be part of the transaction.

Finally, please understand that whether it is retirement income products or income paying unit trusts, they are simply products and not plans. Products are like ingredients to a recipe which requires a good chef to cook up a great dish. A good wealth adviser (the chef) is one who can draw up a customized spending plan (recipe) and cleverly use (cook) various products and other assets such as CPF LIFE, retirement income insurance, properties, investments etc. to give their clients a reliable stream of income throughout their life (the great dish).

The writer, Christopher Tan, is Chief Executive Officer of Providend, Singapore’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

The edited version of this article has been published in The Business Times on 21st February 2022.

In the near two decades that we have worked with retirees, we understand one thing: Reliability of income is more important than return on investment at this phase of your life.

As such, we have developed a proprietary methodology called RetireWell, that can help you draw down strategically from your retirement nest egg.

Our Retirewell methodology was featured in The Business Times every month for almost a year in 2017 and has 11 parts to it.

With Retirewell, we will design a plan that will give you a safe and reliable stream of income for the rest of your life, with provisions for legacy in the event of demise, so that you can live up your retirement with peace of mind.

For more related resources, check out:

1. Retire Well in a High Interest, High Inflation Environment

2. Tackling the Complexity of Retirement Spending

3. Providend’s Money Wisdom Podcast S2E5: 4% Rule, Dividend Investing, RetireWell™ – Which Spending Strategy Is Best for Retirees?

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.