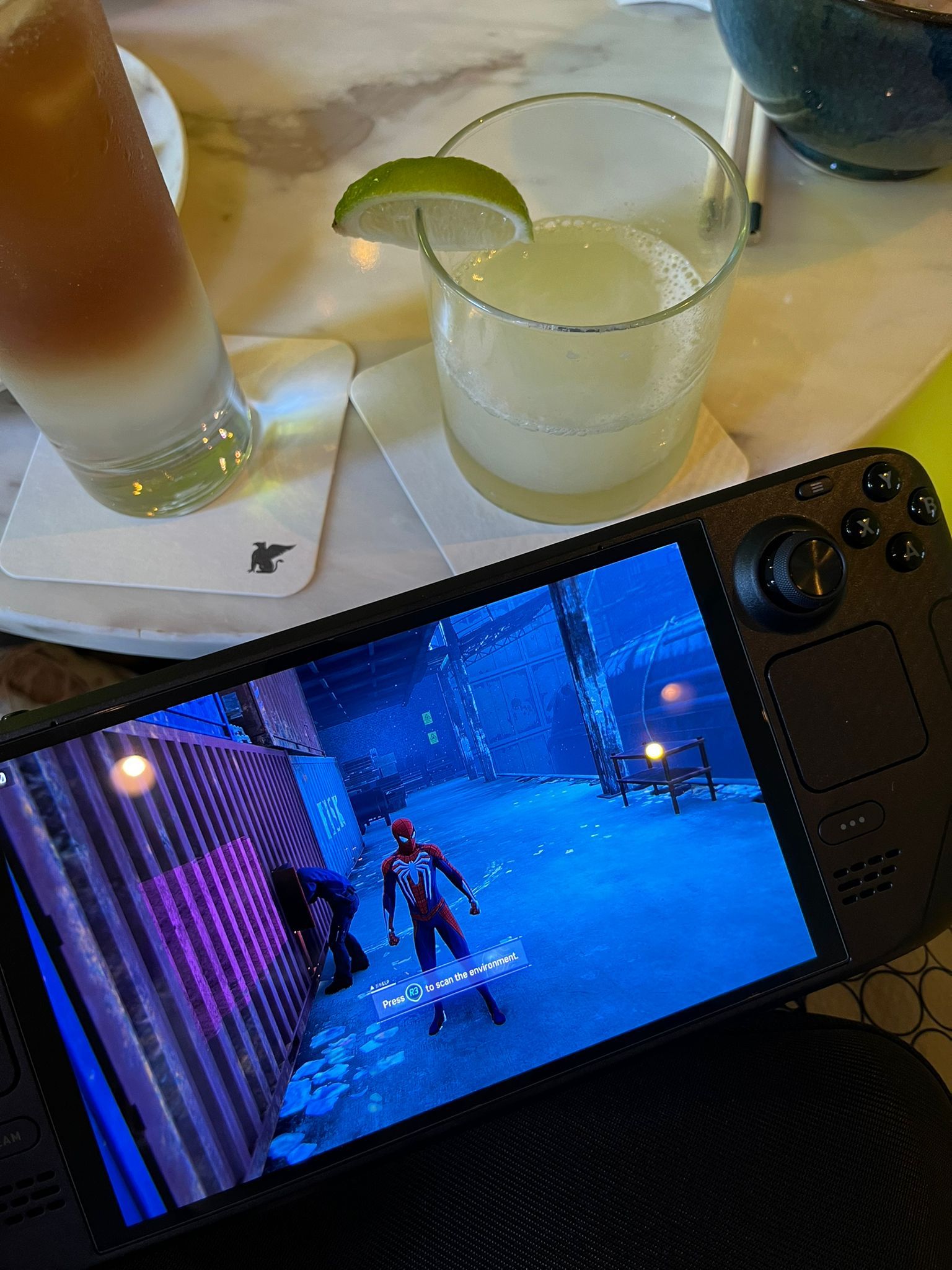

“Well, what’s that?” the man bellowed while polishing his glassware. I peeked up sheepishly from my screen, still mashing buttons and beating up digital thugs.

“It’s… a Steam Deck.”

I braced myself for potential ridicule, acutely aware that pulling out a portable game console at a bar is deemed a socially awkward thing to do. In my defence, it was only 5 pm and I was the only patron around, but that also meant that I had the full attention of the bartender who I thought must be wondering why I was playing video games at his drinking establishment.

“Oh! Do you mind?” the scruffy man said instead as he excitedly abandoned his chores and came around the bar to peer over my shoulder. With almost childlike enthusiasm, he let out an exuberant wow at Spider-Man swinging flawlessly through New York on a handheld device.

We soon got into a spirited discussion about video games – yes, two grown men at a bar in central Christchurch conversing about PlayStations, video game graphics, and the latest Harry Potter game.

“And yeah, that’s my retirement plan.” the man added with a tinge of wistfulness, referring to his backlog of games he hadn’t had the time to complete.

Owing to the nature of my work, the words “retirement plan” caught my attention. It was also instinctively curious to me the manner the phrase was used. People often talk about their retirement plans in terms of numbers, projections, and dollar amounts. Here, in this dimly lit speakeasy, the plan brought up was something far more personal and vivid.

As I listened to the bartender share his dreams of enjoying his hobby to the fullest in retirement, I couldn’t help but feel a sense of admiration for his clarity of purpose. Many of us dutifully do our sums to ensure we have enough for our later years, and this is surely a prudent thing to be done. As we focus on the numbers, however, it is far too easy to overlook what is perhaps the more important part of retirement: what exactly are we going to do once we actually achieve financial independence?

The chance encounter reminded me that both sides of the coin are important when it came to preparing for one’s retirement. Just as those who have not put aside enough would likely struggle financially during their later years, it is not uncommon for people to experience a loss of purpose and boredom during their retirement without preparing for life after work. A good plan therefore considers beyond the monetary aspects of retirement and sets a blueprint of what our days will be like after we settle into our golden years.

While it may seem daunting, you don’t have to instantly come up with what you might be spending the rest of your life doing. Just as our retirement nest egg is built up over time and compounding returns, one’s ideal retirement life is shaped by the people we meet, the choices we make, and the experiences we accumulate along the way.

For many, these can be the families we start, the friends we make, and the hobbies we develop.

For others, these can be the games we play and the fleeting but memorable conversations we share with strangers in a random, unassuming bar.

So what on earth was I doing in a bar on a weekday afternoon in sunny New Zealand? I didn’t know it then when I first sat on the barstool, but now I realise – as someone who has recently rediscovered the joys of video gaming and started learning the art of making cocktails – I was, in fact, working hard on shaping my retirement.

This is an original article written by Seth Wee, Client Adviser at Providend, the first fee-only wealth advisory firm in Southeast Asia and a leading wealth advisory firm in Asia.

For more related resources, check out:

1. Reflecting Deeper on My Money Habits: Gaining Clarity, Confidence, and Comfort

2. RetireWell™ Epilogue 2: Retirement – It’s About the Kind of Life You Want to Lead

3. Money Wisdom Podcast S1E38: Retirement Planning Beyond the Wealth Aspect

*Providend is very excited to share that we are now ready to extend our service offerings to the younger accumulators who are looking for holistic, independent, conflict-free wealth advice!

For this group of younger accumulators, we know that it is not easy to make retirement planning a priority when other financial goals – buying a first home, for example, or saving for a child’s education – appear more pressing. Learn how we can help here.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.