Within the ongoing time commitments of work and family, I enjoy spending some of my personal free time to do readings on various topics. Apart from just learning and getting new insights, I found it nice to also set aside some quiet time for myself.

I’m also part of a book club that calls ourselves the “Rationalist Book Club”, which I suppose is a reflection of the thinking preferences of most of its participants. We would pick a book to read, and every 6 weeks or so, meet up over a Sunday afternoon to discuss our thoughts and reflections, with some occasional debate that comes along.

The most recent book that we covered was “Factfulness: Ten Reasons We’re Wrong About the World – and Why Things Are Better Than You Think” by the late Hans Rosling which was published in 2018. The book focuses on the idea that we are constantly wrong (proven to be worse than chimpanzees) about many things about the world because we systematically overestimate how bad things are, based on key metrics such as poverty levels, life expectancy and mortality rates, as well as education levels. And this is presented in the form of various key instincts that distorts our perspectives, some of which I found worth sharing today.

The Gap Instinct

The first instinct shared was about our tendency to divide all kinds of things into 2 distinct and often conflicting groups, such as how the world is distinctly divided into the rich versus the poor.

Consider this question: In all low-income countries across the world today, how many girls finish primary school?

A: 20%

B: 40%

C: 60%

On average, only 7% were found to get the correct answer, which is C: 60%. Most people guessed that it was just 20%, which really is only the case for a very small handful of countries in the world, such as Afghanistan or South Sudan. And even so, at most 2% of the world’s girls live in these places.

Similar results were also found when participants were asked about life expectancy, undernourishment, water quality and vaccination rates. An overwhelming majority of people believed that life in low-income countries is much worse than it is.

A follow-up question was about what proportion of the world do we think live in these low-income countries (which we now know is not as bad)? While the average guess was 59%, the actual answer was only 9% of the world live in low-income countries.

The world is in a much better place today, but our views are often stuck in historic times. Child mortality rates (number of children that die before 5 years old for every thousand births) are a strong indicator of human progress (the lower the number, the better). For example, over a span of 30+ years, Saudi Arabia went from 242 to just 35 while Malaysia went from 93 to a mere 14 due to having sufficient food, proper sewage systems, good access to healthcare and higher education levels of their caregivers. And there is no single country where child mortality has increased.

The Fear Instinct

The human brain doesn’t have the mental capacity to absorb and process every piece of information that is available. Hence, it must critically be able to filter and ignore irrelevant information from our attention. Unfortunately, evolution has also made us prioritise information that is more dramatic, to keep us away from danger. And the media knows this.

While the world has gradually gotten better over the years, headlines that are unlikely to get past our attention filters are: “Malaria continues to gradually decline.”, or “Meteorologists correctly predicted yesterday that there would be mild weather in London today.”. Instead, what is more likely to catch our attention easily are topics such as earthquakes, wars, diseases, and terrorist attacks. These unusual events are more newsworthy than everyday ones, and if we’re not careful, we will come to believe that this is really what the world is like.

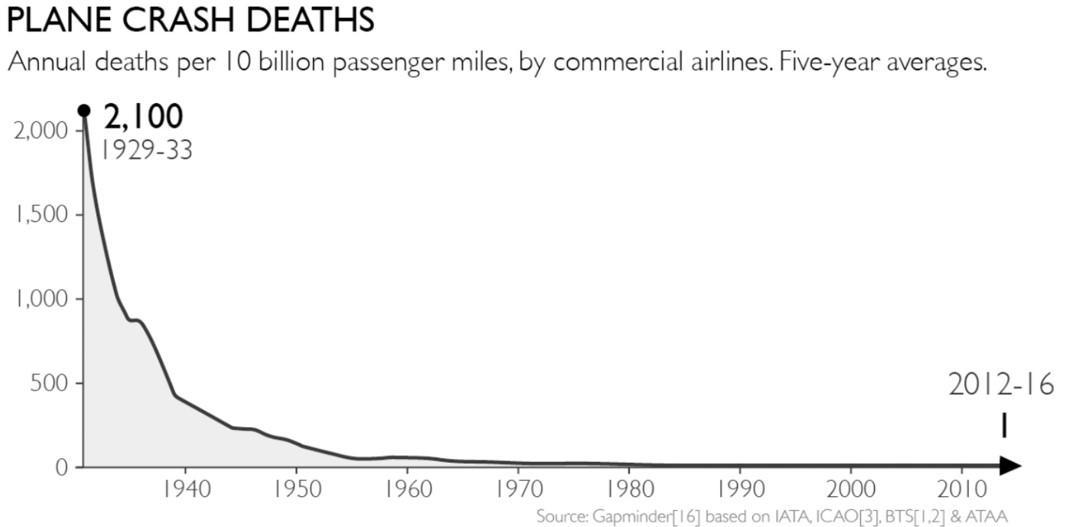

In 2016, a total of 40 million commercial passenger flights landed safely and was the second safest year in aviation history. Over the past 70 years, annual deaths per 10 billion passenger miles dropped from 2,100 to only 1 today, or in other words, flying has gotten 2,100 times safer. Again, such information is not newsworthy.

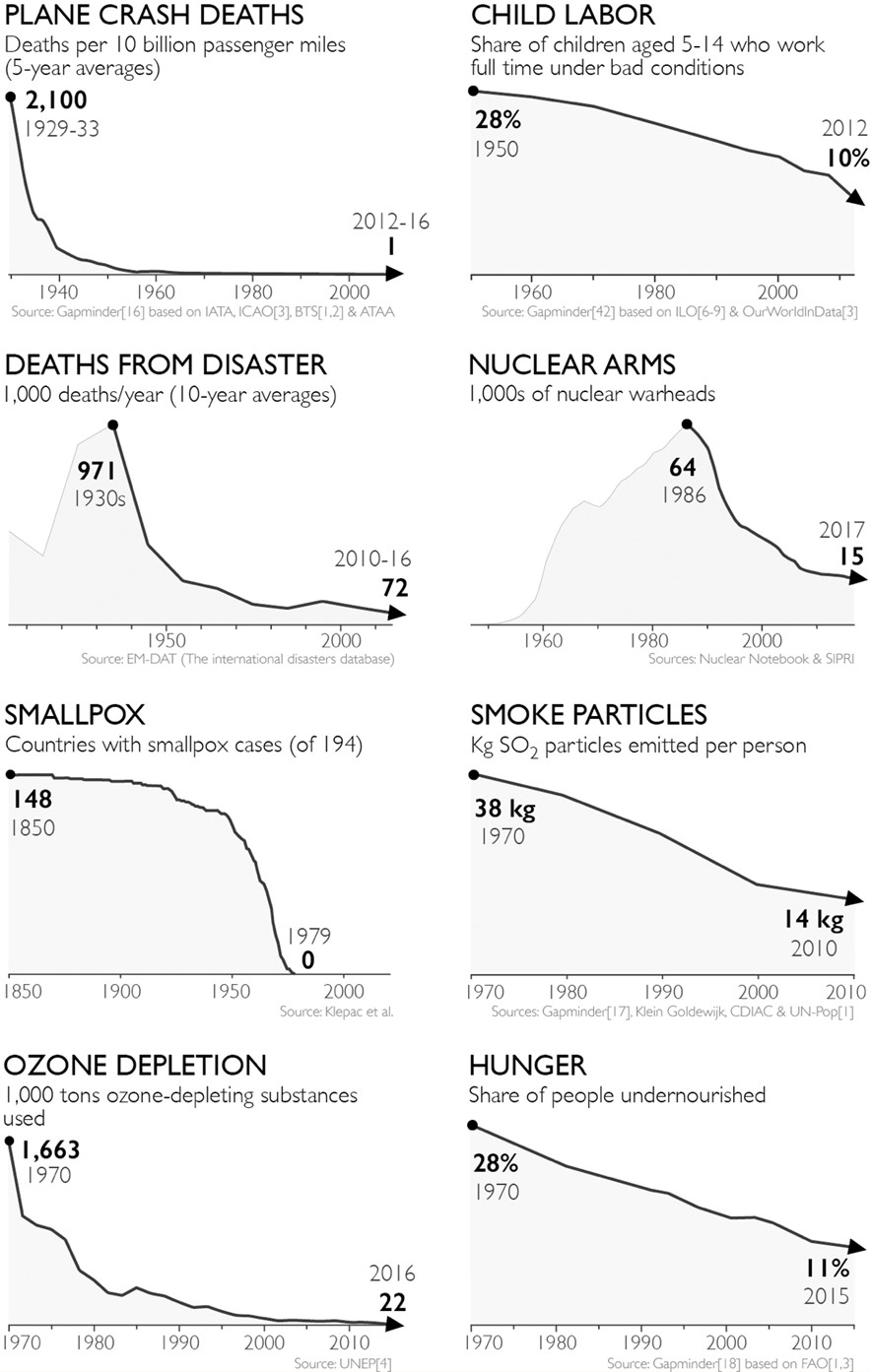

Similar trends are observed in many other areas such as terrorism, crimes, nuclear contamination or natural disasters. Fear is only useful if it is directed at the right things. But it is a terrible guide for understanding the world. While we should continue to be aware of these dangers and seek to make the world a better place, we don’t want to ignore all the tremendous progress we’ve made over the years.

The Destiny Instinct

This is an interesting one for me. It talks about the idea that the current state of things has always been this way and is unlikely to change. And the evolutionary reason is that humans historically lived in surroundings that don’t change much, and learning how things worked and assuming they would continue to work that way was an excellent survival strategy.

However, societies do change, and often much faster than we think. Just not fast enough to be noticeable or newsworthy. Examples of these are the spread of the internet, smartphones, social media or even the way we interact or make financial transactions.

When it comes to cultures and societies, it is also commonly believed that certain countries or religious belief systems can never catch up with the more “developed” ones. And the destiny instinct makes it hard for us to accept that countries like Africa and Iran can catch up with the “West”. But if we look back in history, what we see today is how countries like Sweden were back in the 1970s.

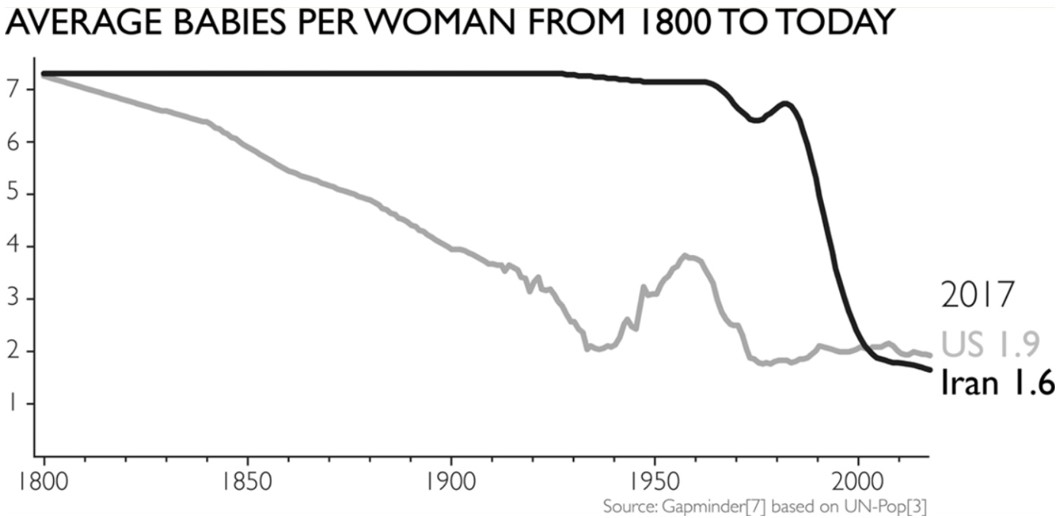

A strong indicator of a country’s progress is the average number of babies per woman. This is due to higher infant survival rates (you don’t have to overcompensate by having more), greater access to family planning and higher education levels. And Iran has shown one of the fastest drops ever since 1984.

The Negativity Instinct

Lastly, the negativity instinct is about our natural tendency to notice the bad more than the good. And there are a few reasons for this. From an evolutionary standpoint, the ability to notice bad things kept us alive for the most part. People also tend to forget how much worse the past was when they look back at the “good old days” and don’t recognise how much advancement was made. This, coupled with selective reporting from the media about catastrophes, financial collapses, wars and crimes, makes this instinct extremely widespread and hard to overcome.

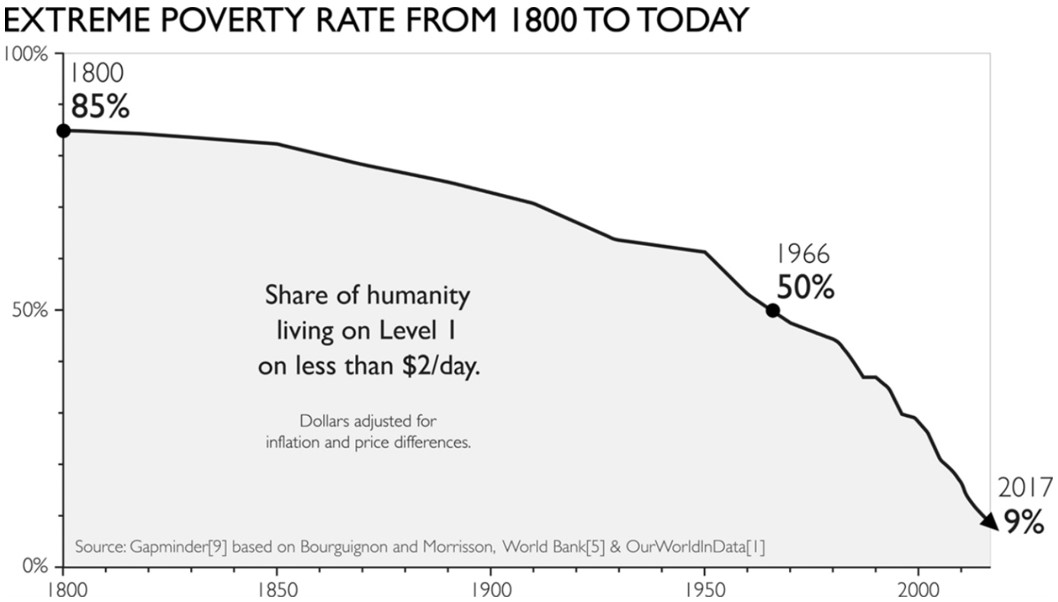

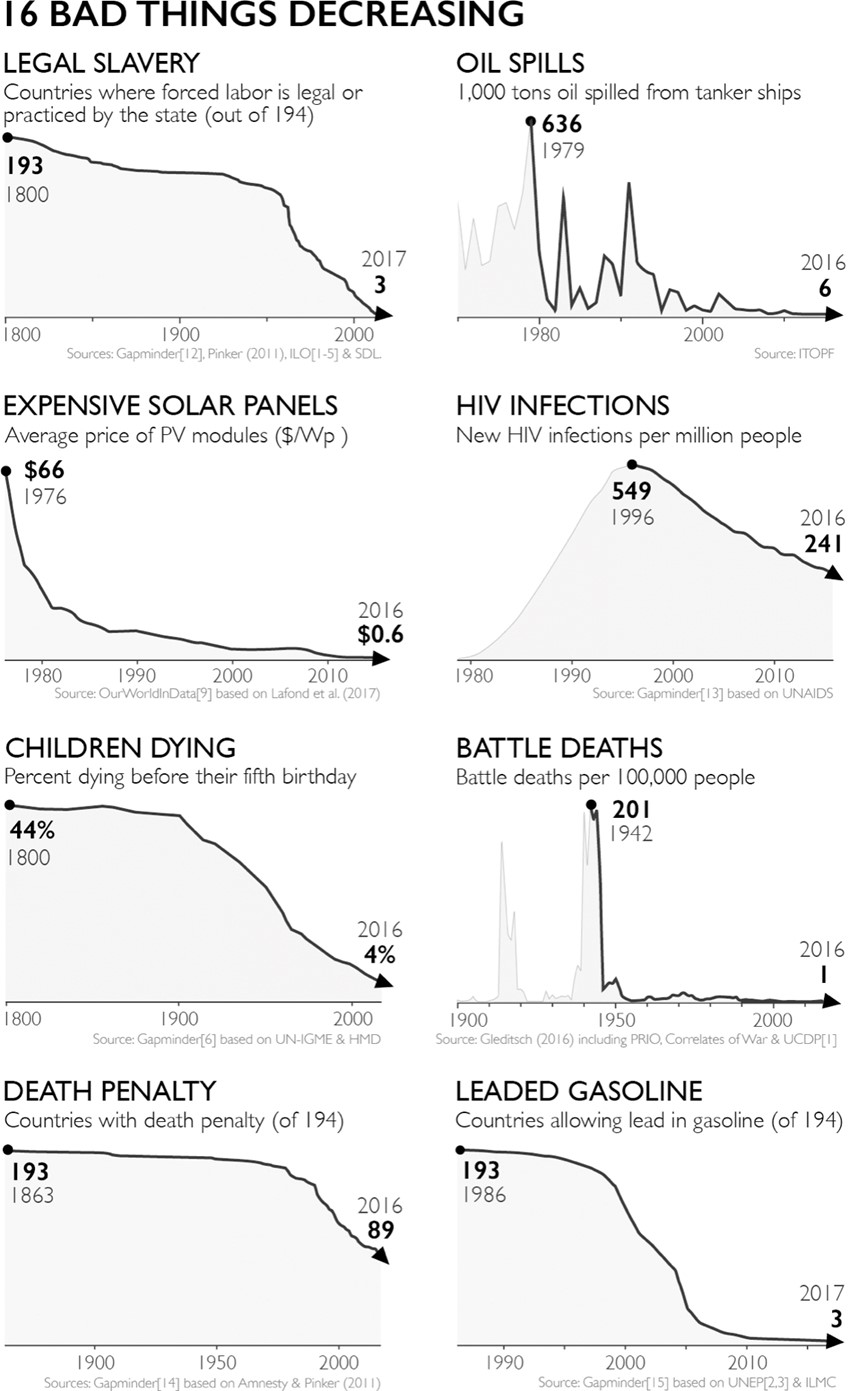

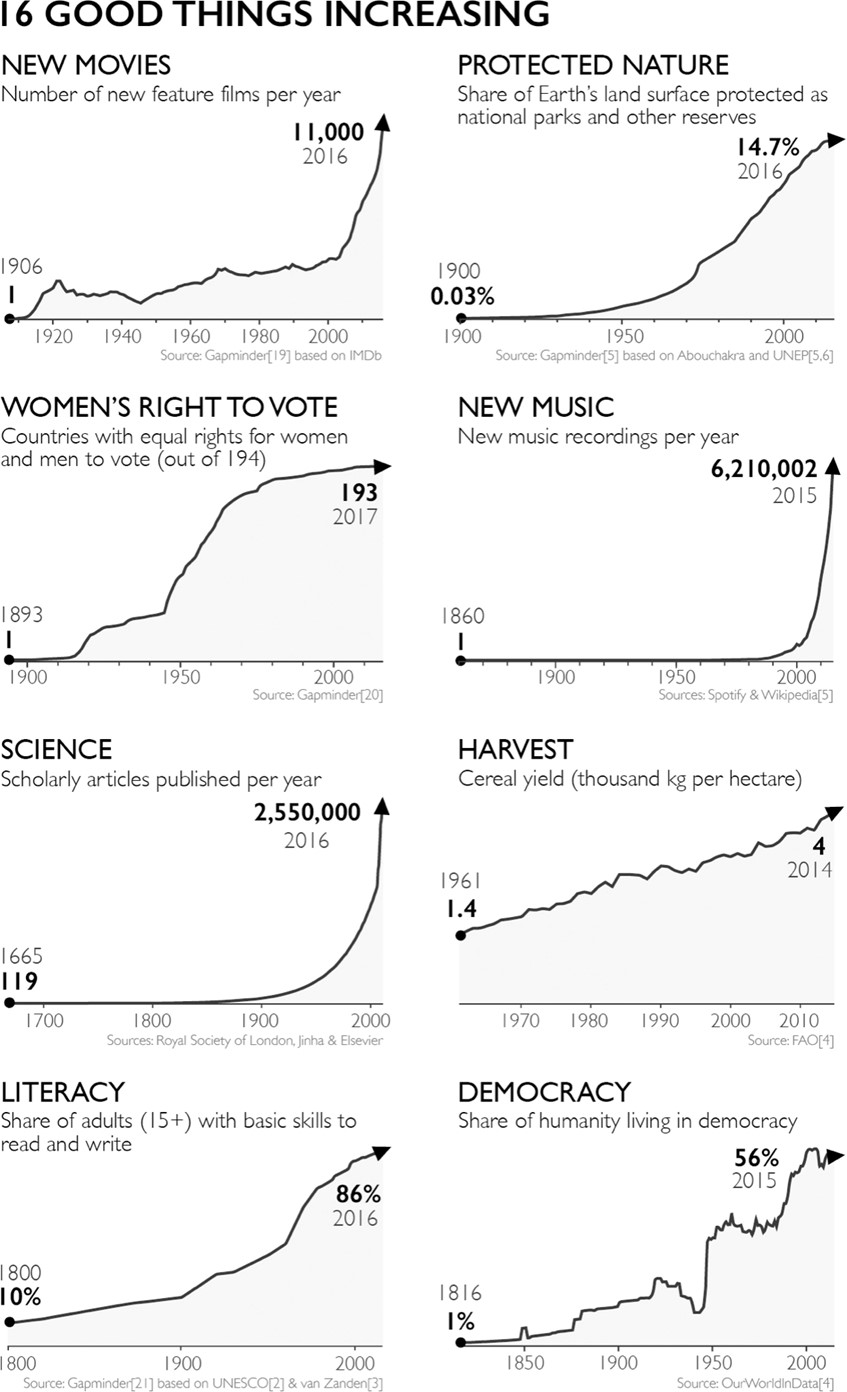

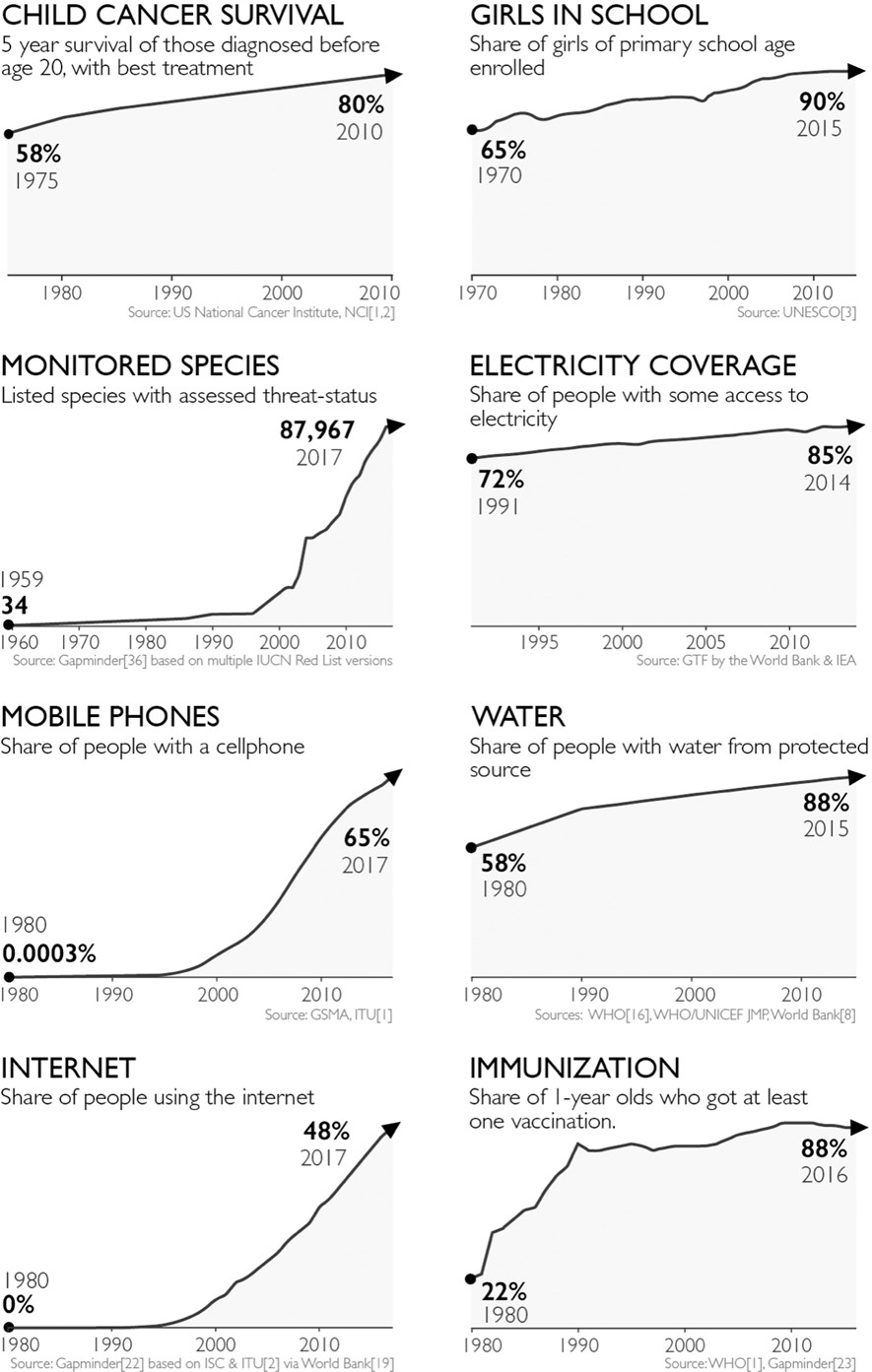

But if we want to overcome this bias, we must look at the facts and figures on how things actually are. And for this, I’ll let the charts speak for themselves, I’ll start with the extreme poverty rates from the 1800s to today, as well as 32 other metrics that you can find in the appendix below.

As a conclusion

Why am I sharing all of this? It is because we had undergone so much negativity over the past few years, ranging from the pandemic to wars, political unrest and of course the current ongoing battle with inflation, that it starts to become ingrained in our minds that things will always continue the way it is and that the future is bleak.

Yes, it is true that there will always be new crises that come along that catch us off-guard. And this will be compounded many times over as we get overwhelmed by the media and our personal daily interactions. But such is the nature of how the world works and has always been.

At the same time, human ingenuity has well beyond proven itself that it has the ability to overcome and progress beyond the challenges that come our way.

If you have been investing in the global markets, it has no doubt been a bumpy ride this year and I like to congratulate you on your resilience in weathering through the turbulence. We all understand that investing is for the long term and it is for sure easier said than done. However, just like how we had progressed across centuries, it is evident that we will be able to ride through the challenges and prevail once again.

For now, wishing all of you a lovely holiday season and here’s to a better 2023!

This is an original article written by Tan Chin Yu, Senior Client Adviser of Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. Holding Cash Might Not Be as Safe as You Think

2. Retire Well in a High Interest, High Inflation Environment

3. Money Wisdom Podcast Episode 28: Don’t Use Short-Term Information to Make Long-Term Decisions

Appendix

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.