Cash, a “thing” that we deal with almost daily, yet can be controversial over its use.

And to complicate things further, you have articles with counter-intuitive titles like this one that you are reading.

For some time, I pondered about our perception of how we view this asset class called “cash” that we are exposed to on a daily basis.

The concept of risk is also subjective and how we perceive risks, both known and unknown, can be interesting. Hence, I thought to explore through this article, how this “safe” asset, can also be one of the riskiest to be holding.

To explore cash is to first understand what it is and how it came about. Fundamentally, cash is a man-made invention.

1. Fiat Money

Looking back into history, what we are used to seeing today is what is termed “Fiat Money”. Fiat money is basically paper money (or digital these days) that is issued by a government. It is not backed by any commodities such as gold but its value is derived from the full faith and trust in the government and that someone else is willing to accept it in exchange for goods and services. Hence, while there is no intrinsic value in cash, the real value comes from what it can buy.

Fiat money is preferred in the modern economy because it allows ease of transactions compared to the historical methods of barter or being tied to a scarce resource such as gold. At the same time, it is not without its challenges.

2. Biggest enemy of cash

When fiat money is being controlled by a central entity or government that has the authority to dictate its supply, the “value” of what it can be exchanged for does fluctuate, whether you like it or not. And generally in most successful economies, that value goes down over time, which is what we know as inflation. Or more commonly felt as the rising cost of goods and services over time.

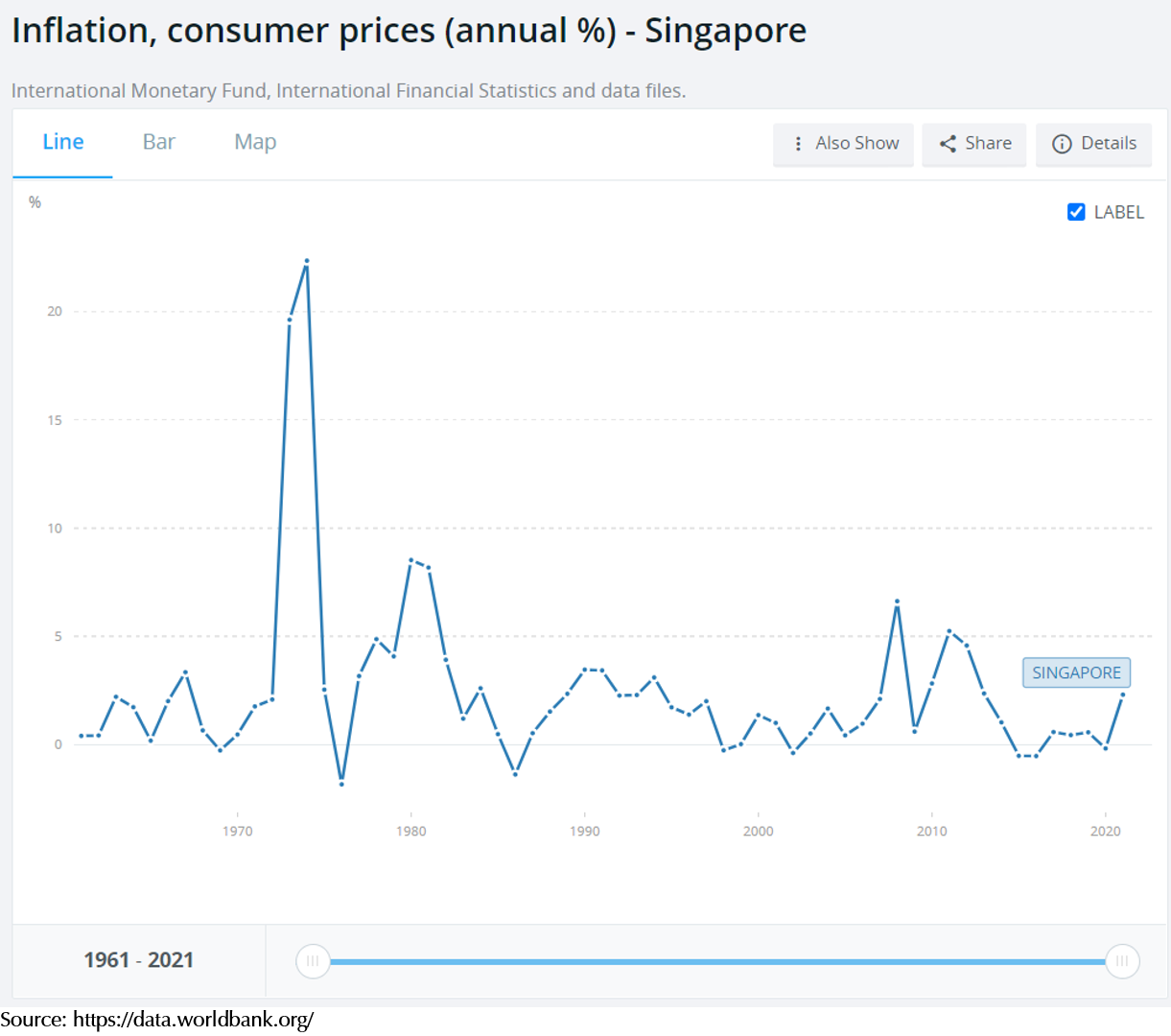

Particularly this year, inflation has been a major topic and challenge globally. Below is a chart on how inflation rates have been historically in Singapore. On average, inflation in Singapore had been under 2% for the past 30 years, but has also seen some higher than usual swings during the 1970s Great Inflation period and in the early 1980s. So far, this year has reported headline inflation of above 6% in Singapore, which resulted in concerns amongst citizens.

3. Being “real”

The reason why inflation is so important to pay attention to is because you want to remember that the true value is in what it can buy. And our view of cash is distorted because we are used to viewing money in “nominal” terms, which is the numerical value of what you see in your wallet or bank statements.

However, while less intuitive to think about, we should be looking at it in “real” terms instead, or the actual value that has been adjusted for inflation.

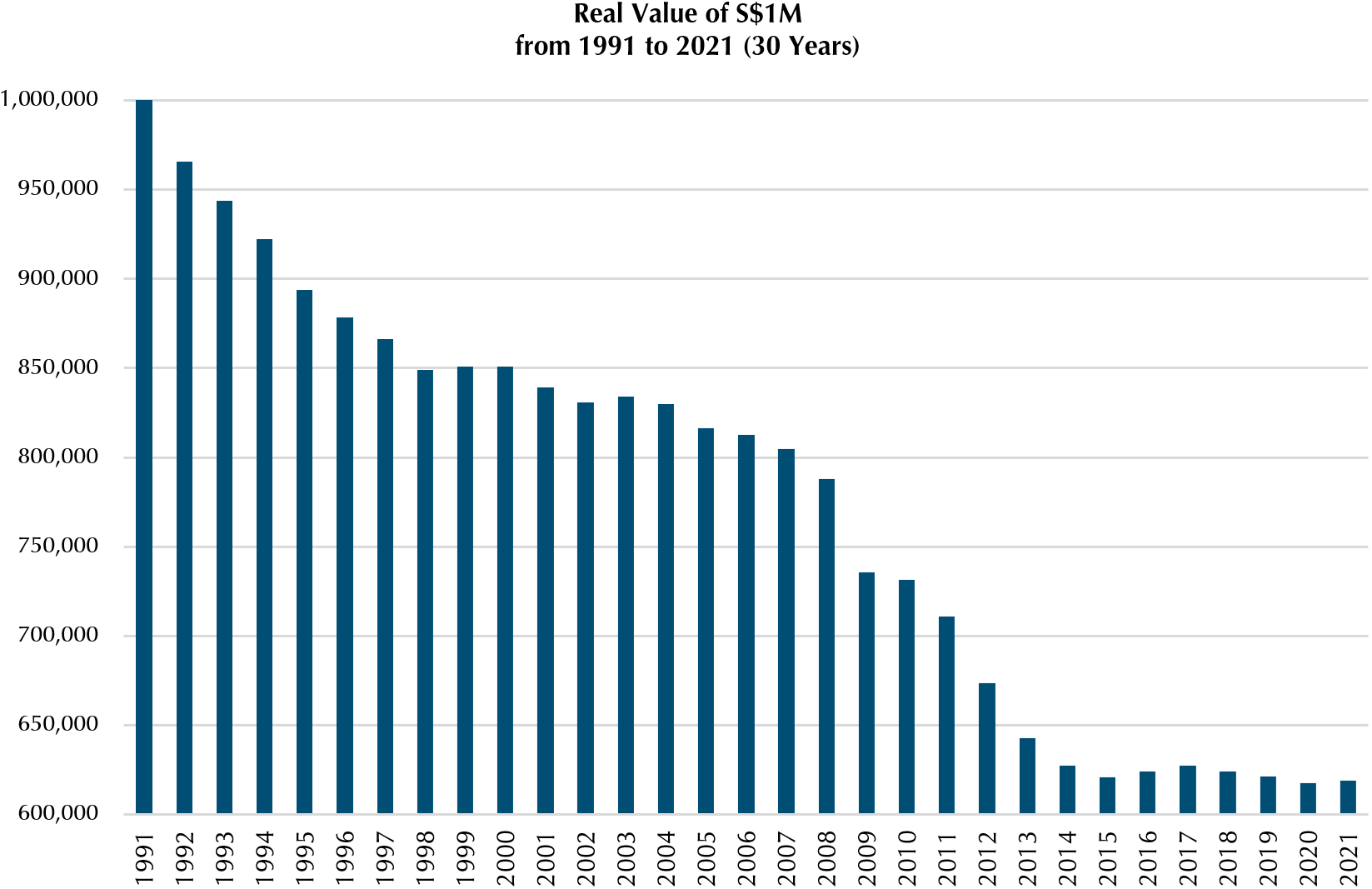

Consider a thought experiment. Imagine that we live in a world where the cost of living does not change. Instead, the cash balance in your bank account reflects the real value instead.

What you will observe is illustrated in the chart below as an example of a bank account with a starting balance of $1m in year 1991. After 1 year, the balance goes down to about $965k, and then to $943k after another year, all the way down to $618k at the end of 30 years.

In a world like this, it will be interesting to ask ourselves how different would it change our views of cash and decisions surrounding its allocation. Putting it in another way, if we define risk as the risk of loss, cash is an asset class with a 100% probability of loss over time.

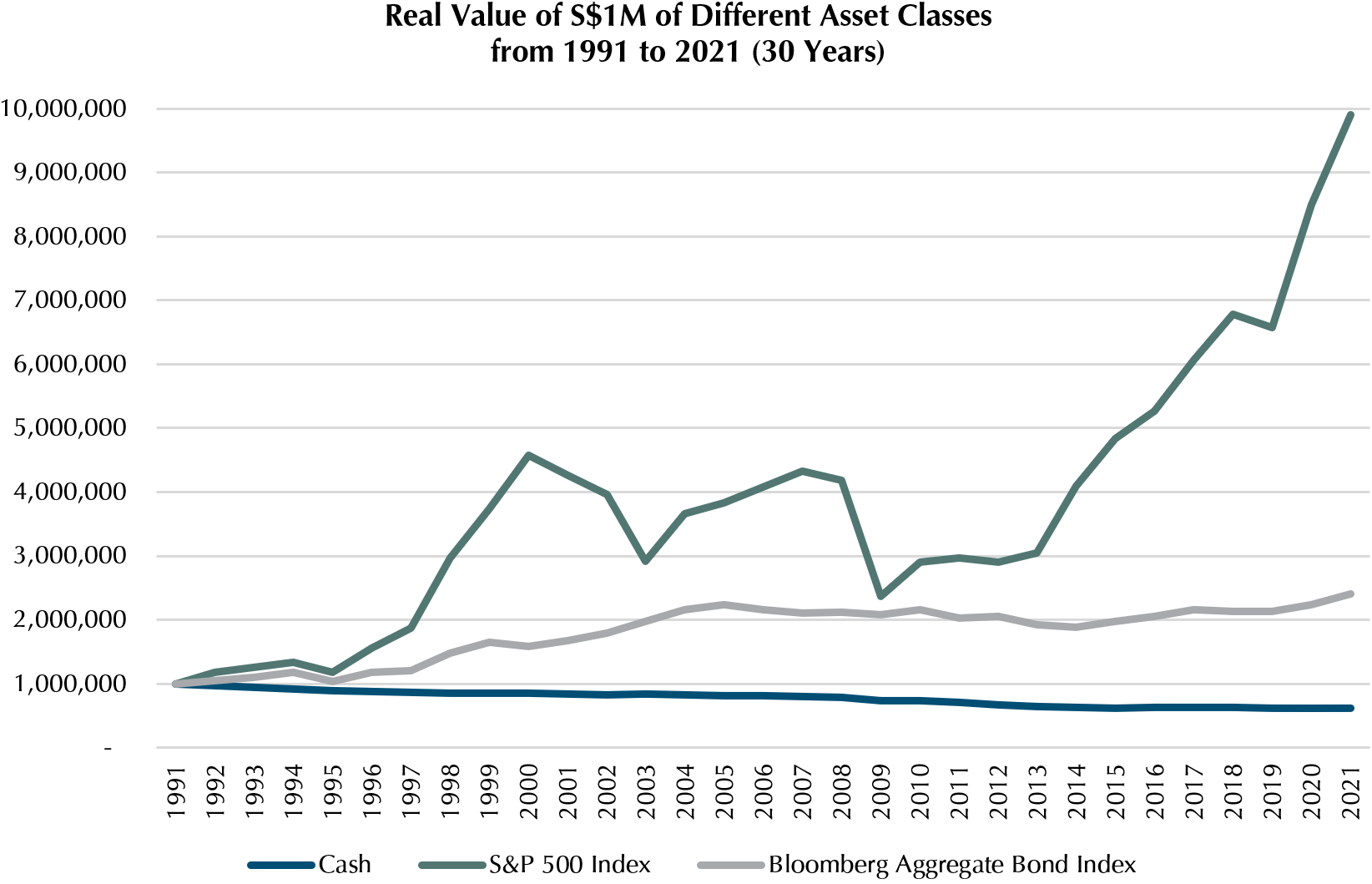

And to further put things into perspective, here is how the chart looks like if we include equities (represented by the S&P 500 Index) as well as bonds (represented by the Bloomberg Aggregate Bond Index).

4. Holding ONLY cash is the most dangerous for a retiree

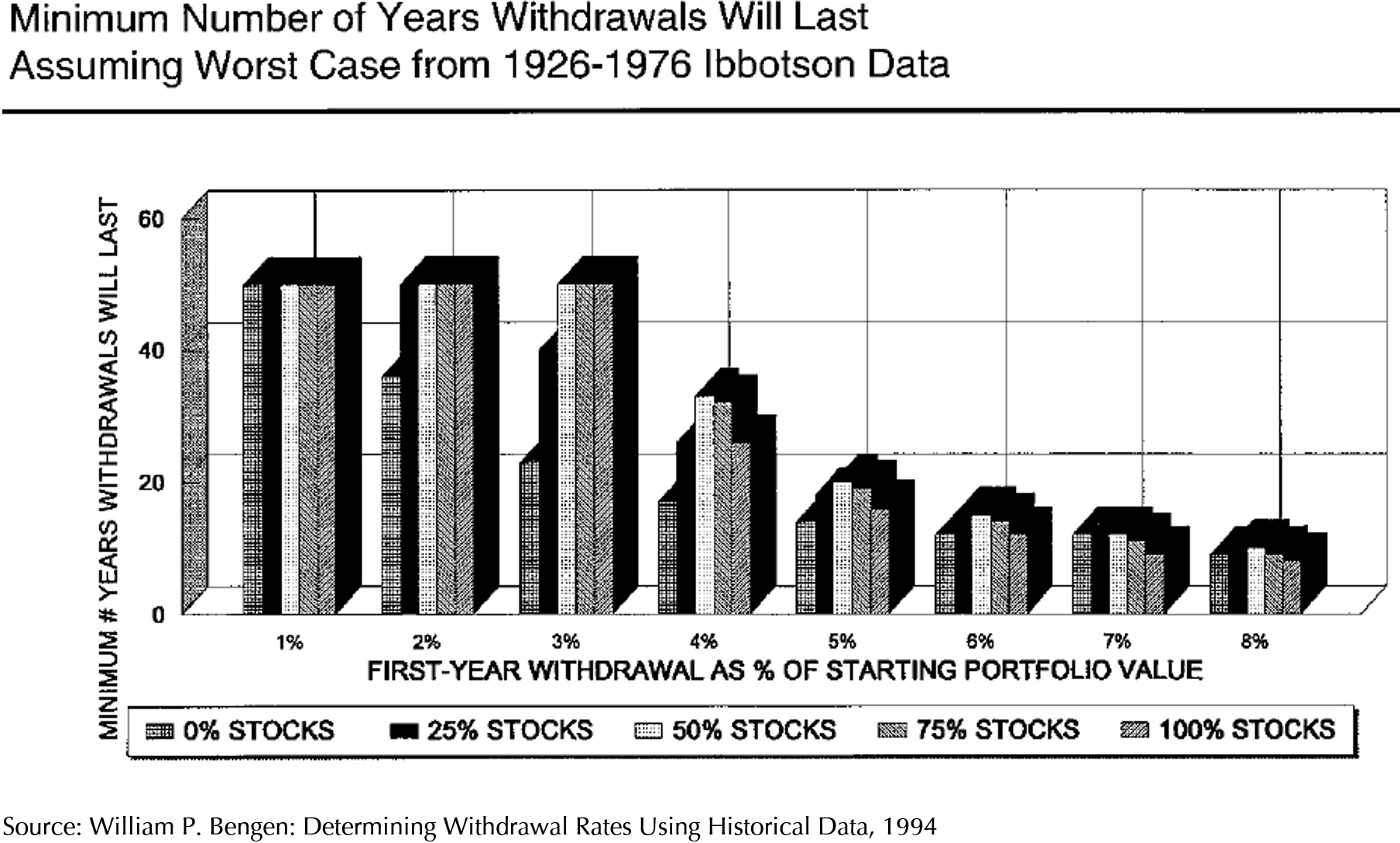

If you have read up on how much you require for retirement, you might have come across the 4% rule, which basically is a rule of thumb on how much you can afford to safely withdraw from your nest egg every year without running out of money during your retirement.

The 4% rule originated from a paper written by William P. Bengen in year 1994, who sought to use historical returns of equities and bonds, and inflation rates to compute the safe withdrawal rate.

While the basis of how he determined the 4% safe withdrawal rate was based on a portfolio with a 50% equity and 50% bond allocation, he also explored the success rates of various allocations and different withdrawal rates.

What he observed was that regardless of the withdrawal rate, the success rate of 0% or even a small 25% equity allocation of the overall portfolio is consistently worse off. Of course, a 100% equity allocation has its issues as well, but what this tells us is that if we have a long time horizon, we cannot afford to have too little equity exposure.

Furthermore, considering that this data uses bonds as the non-equity allocation, cash will look much worse.

To find out which spending strategy – 4% Rule, Dividend Investing, RetireWell™ – works best for retirees, listen to this podcast here.

5. What is cash good for?

With all that said about cash being a poor asset class to hold over the long term, so what do we hold cash for?

While I did mention that cash has a 100% probability of loss, it is also true that it has the lowest risk if you view it in terms of volatility.

Hence, it is good for situations where you require a high certainty to cater for very short-term liabilities, as well as setting aside sufficient to provide for emergencies that you cannot afford to fluctuate due to market events.

For some, they also like to hold cash reserves as a form of “dry powder” to be deployed into the markets if there is a downturn. In this case, one must be very aware of the downside which is the cash drag if the downturn takes a while to show up.

As a conclusion

To end off, while it does not come naturally, I think that it is again important to remind ourselves to frame things in the right perspective when deciding on the allocations across assets. Even though cash often feels safer, note that nothing is certain, and the “real losses” that cash experience still largely depend on global events.

What we should do is to allocate our resources towards the goal of providing a high certainty that our goals can be achieved, both short- and long-term ones.

This is an original article written by Tan Chin Yu, Senior Client Adviser of Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. How Can I Invest Confidently?

2. Lump Sum Investing vs DCA, Is There a Clear Winner?

3. Do Not Use Money Meant to Fight Inflation in the Long Term to Mitigate Inflation Now

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.