Bonds are not typically the best asset class if there is unexpected inflation, but one type of bond which investors use to keep pace with the inflation rate is the Treasury Inflation-Protected Securities (TIPS). TIPS are a type of U.S. Treasury security but unlike traditional Treasuries where their principal or par value remains fixed, TIPS’ principal value is pegged to the rate of inflation. When inflation rises, the TIPS’ principal value is adjusted up. If there’s deflation, then the principal value is adjusted lower. Thus, they will always give you the same percentage return adjusted for inflation over the life of the bond. And like traditional Treasuries, TIPS are backed by the U.S. government. While there are many measures of inflation, TIPS are referenced to the U.S. Consumer Price Index (CPI). Let me use an example to illustrate how a TIPS of US$100 par value works.

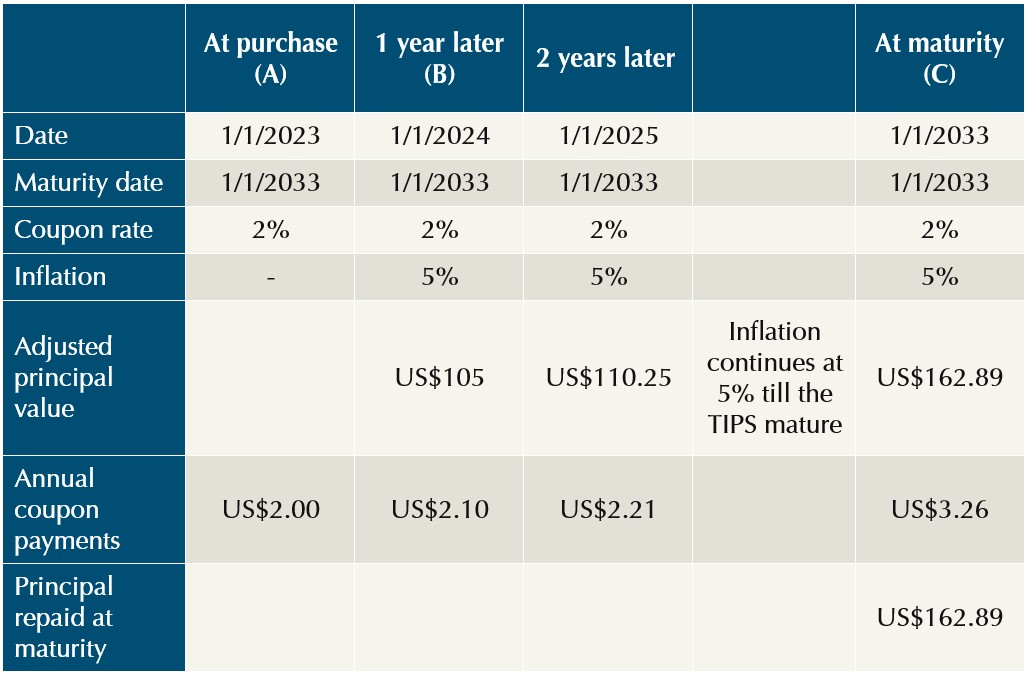

In column A of the table, the par value (which is the price a bond is first issued at) of the TIPS is US$100 with a 2% coupon rate. If inflation rises by 5% one year later (column B), the TIPS principal value adjusts upwards by 5% to US$105 while the coupon rate remains unchanged. If the 5% inflation persists on till the TIPS mature in 2033, the investors will receive US$162.89 (column C). It is also possible that the principal value is adjusted downwards in a deflationary environment but at maturity, the investors will receive either the par value or the adjusted principal value of the TIPS, whichever is higher.

Like all bonds, the par value (and in the case of TIPS, the adjusted principal value) is not the market price. The adjusted principal value of the TIPS is adjusted only when inflation or deflation happens and is announced. But on a daily basis, one of the factors that affect TIPS prices is the investor’s expectation of the inflation rate. So, the difference between the 10-Year Treasury Yield and the 10-Year TIPS Yield is the market expectation of future inflation which is the breakeven rate. Let’s just say that the 10-Year Treasury Yield is 1.5% but the 10-Year TIPS yield is negative 1.3% (TIPS yield can become negative when strong demand caused the price of TIPS to skyrocket). This means investors expect the average inflation rate over the next 10 years to be 2.8% p.a. If it is not so, then this TIPS will provide a lower return than the Treasury. The implication for portfolio management is this: If you use TIPS as part of your asset allocation to tactically mitigate unexpected inflation, you have to include it before there is an expectation of a rising inflation rate, otherwise, you will be too late to the game. TIPS are often strategically used to mitigate inflation for a specific period of time and for a certain amount of capital, but as in all hedges, there is a cost to “buying this insurance” instead of just holding traditional Treasuries. If there is lower than expected inflation over the period you held your TIPS, you will have a lower return compared to holding a similar maturity Treasury bond.

Sometime last year, my firm’s investment committee sat down to deliberate on whether our portfolios’ strategies remain sound to give our clients enough returns to achieve their life goals after adjusting for inflation. You see, we have not included TIPS in our portfolios, and we have decided to continue not doing so after that meeting. Some of our reasons are:

- Our clients are mainly Singapore-domiciled and intend to spend their money in Singapore dollars. TIPS’ adjustment of principal value is pegged to U.S. CPI which doesn’t matter as much for Singapore-domiciled investors. Also, TIPS are naturally only available in USD and are unhedged, so a Singapore-domiciled investor would have to incur extra costs of hedging back into SGD which will further impact the effectiveness of the inflation hedge due to higher costs.

- Our clients typically have other assets such as physical real estate that are already very good hedges for inflation, and these also comprise a significant proportion of the clients’ net worth, thus clients already have fairly large parts of their personal portfolios hedged against inflation.

- Our use of bonds is mainly for the purpose of moderating the volatility of the portfolios so that our clients can stay invested and capture the returns in the long term. Instead, we use equities in our portfolios which have been shown to beat inflation over the long run and are also a higher-returning asset class, which allows our clients to achieve their life goals.

Your situation is likely to be similar to our clients’ and so if you want to beat inflation in the long term, besides having physical real estate, you should be investing into equities. Instead, over the past 18 months, we observed that many investors in Singapore flocked to put their money into fixed deposits, Singapore Savings Bonds, Singapore’s Treasury bills and even money market funds due to their attractive interest rates and yields. This is a correct decision if you want to mitigate inflation for the short term, that is, investing with money that you may need now or soon, such as your emergency funds or money that you need to put down soon for the deposit of a house or funds to send your children to university in a year or two. But it would be unwise if you are using money that was meant to fight inflation and enhance future purchasing power in the long term. Some may say that they will wait for the recovery of the equities markets to be more certain first. But just as TIPS is only useful as an inflation hedge when there is no inflation, you want to be invested in the equities markets at all times to capture the returns when it happens. Besides, there is no way to know when a strong recovery will happen and when it happens, your money may still be stuck in instruments like T-bills and thus cannot participate in the recovery of the equities markets.

We often worry about the risks today because they can be seen but ignore the potential dangers tomorrow because they are yet to be seen. But in the past, if we have prepared ourselves well for today, there will be lesser to worry about now. So, think far ahead. Do not use money meant to fight inflation in the long term to mitigate inflation now. This is not wise at all.

The writer, Christopher Tan, is Chief Executive Officer of Providend, Singapore’s first fee-only wealth advisory firm and author of the book “Money Wisdom: Simple Truths for Financial Wellness“.

The edited version of this article has been published in The Business Times on 22nd May 2023.

For more related resources, check out:

1. Achieving Contentment Is the Greatest Gain

2. Positive Returns Do Not Mean Enough Returns

3. Here’s Why We Charge a Higher Fee Than Robos

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.