Why do we need to be adequately insured for critical illness (CI)? We already have an Integrated Shield Plan, why do we need a CI plan? What is CI coverage for? These are some of the thoughts we may have when we are doing our insurance planning or review. Through this article, you will gain an in-depth understanding of the purpose and importance of getting CI coverage.

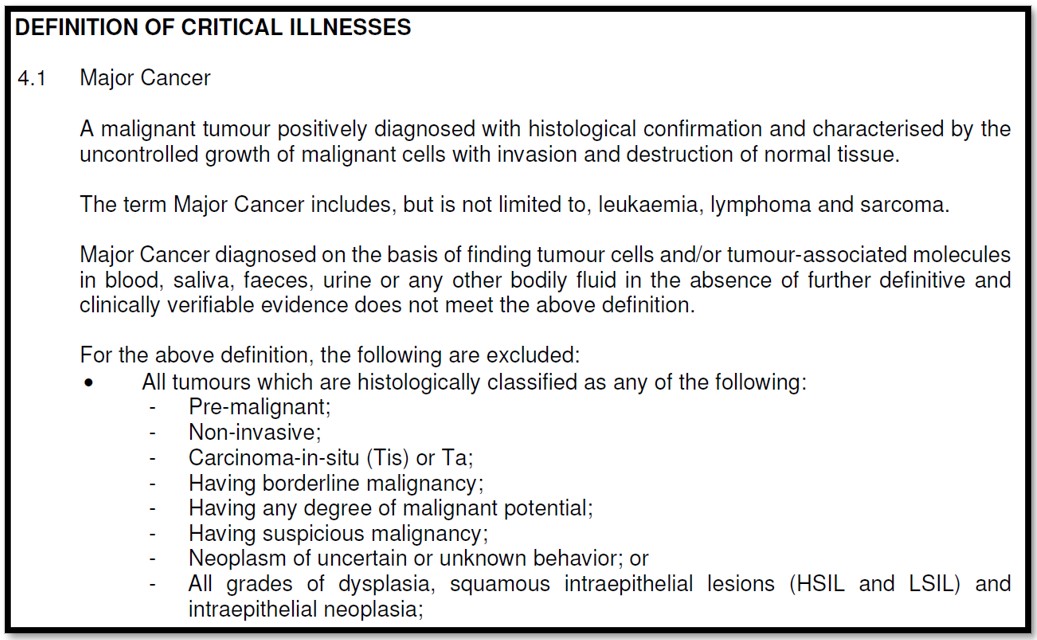

To understand the need for CI coverage, we must first understand the main feature of a CI plan. Generally, the plan provides a one-time lump sum payout to the policyholder in the event that the life insured is diagnosed or suffers from a condition that is listed in the policy condition. Once the payout has been made, the policy will be terminated. Below is an example of the condition definition.

There are different types of CI plan in the market which provide different stages of CI coverage such as early, intermediate, and advanced (severe) stages. Here is a typical example of defining each stage using the cancer condition:

- Early stage is often associated with stage 0 or stage 1 cancer,

- Intermediate stage for stage 2 cancer, and

- Advanced stage for stage 3 and 4 cancer.

However, the stages mean nothing as the claim is always associated with the definition of the policy terms which may differ between insurance companies.

Critical illness which is also known as the dread disease has evolved over the last 3 decades. Its coverage started in the 90s with coverage of only 4 severe-stage critical illnesses. Throughout the years, Life Insurance Association has standardised 37 severe-stage conditions. In recent years, early-stage CI plan has been introduced to provide wider coverage and there is also multi-pay CI plan that provides for continuous CI coverage, even in relapses situations.

The severe-stage used to be associated with a form of death sentence but with the advancement of medicine, it is now more treatable. Thus, early-stage CI plans have gained popularity due to early detection to receive a payout. However, getting early-stage CI plans is more costly as compared to the usual severe-stage CI plan. So, the next question would be whether it is worth paying for an early-stage CI plan which we will be addressing in the later part of this article.

Medical treatment and cost

Some common motivations for purchasing a CI plan include:

- Coverage for hospitalisation bills and medical treatment costs.

- Coverage for an ancillary medical service fee.

- Coverage for alternative medical care/supplement costs.

- Replacement of the loss of income due to a decreasing ability to earn.

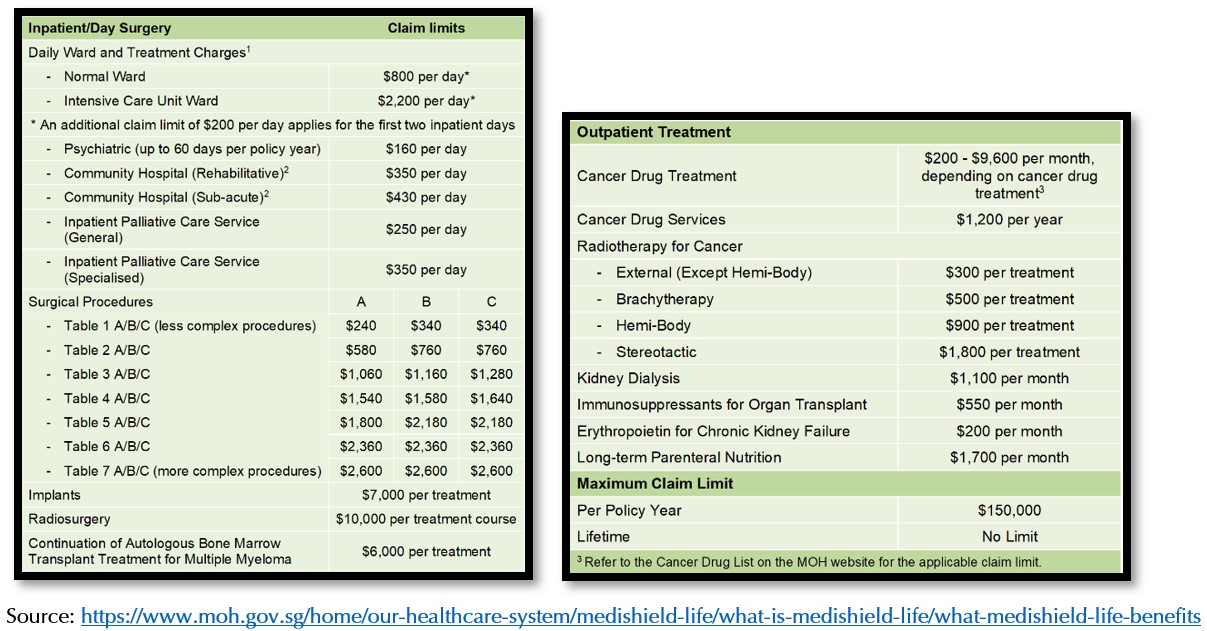

Would the lump sum payout be enough to pay off the aforementioned costs? Let us first take a look into our national healthcare insurance – MediShield Life:

MediShield Life (MSL) is a basic health insurance plan, administered by the Central Provident Fund (CPF) Board, which helps to pay for large hospital bills and selected outpatient treatments, such as dialysis and chemotherapy for cancer. It is structured in a way where patients pay less from MediSave or cash for large hospital bills.

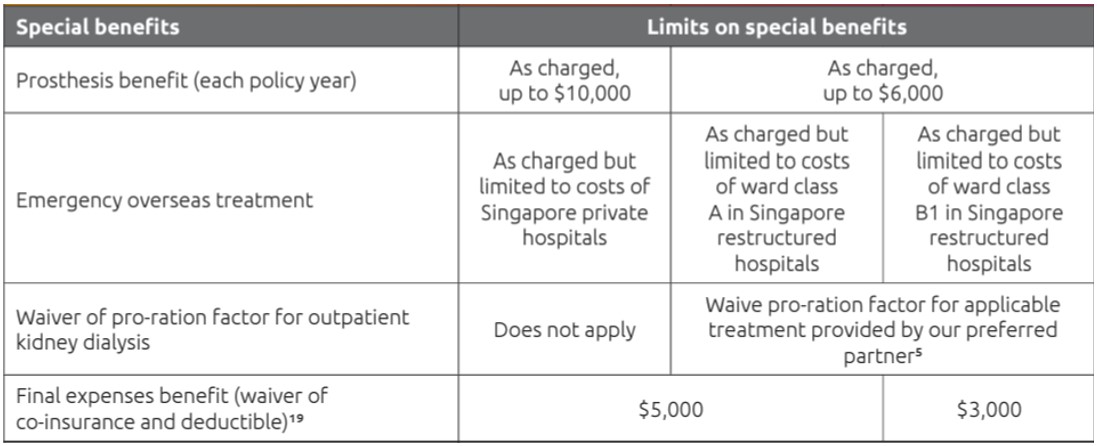

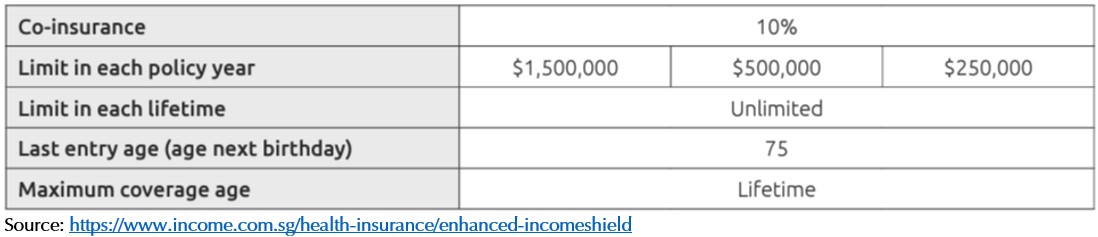

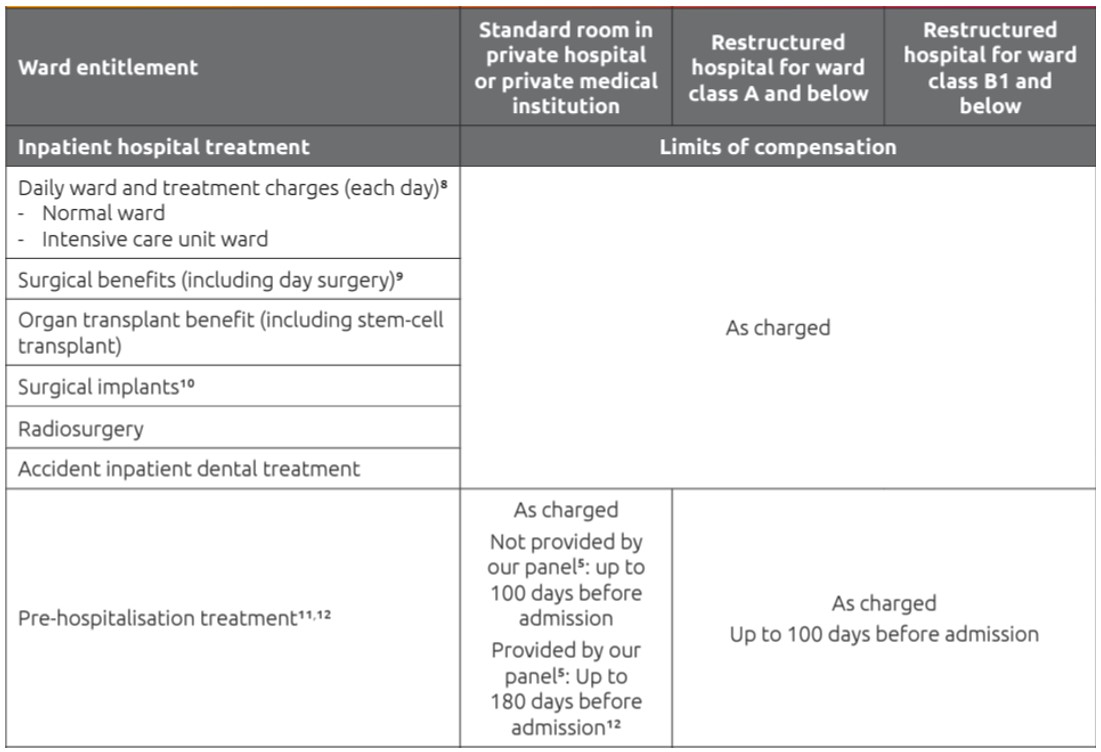

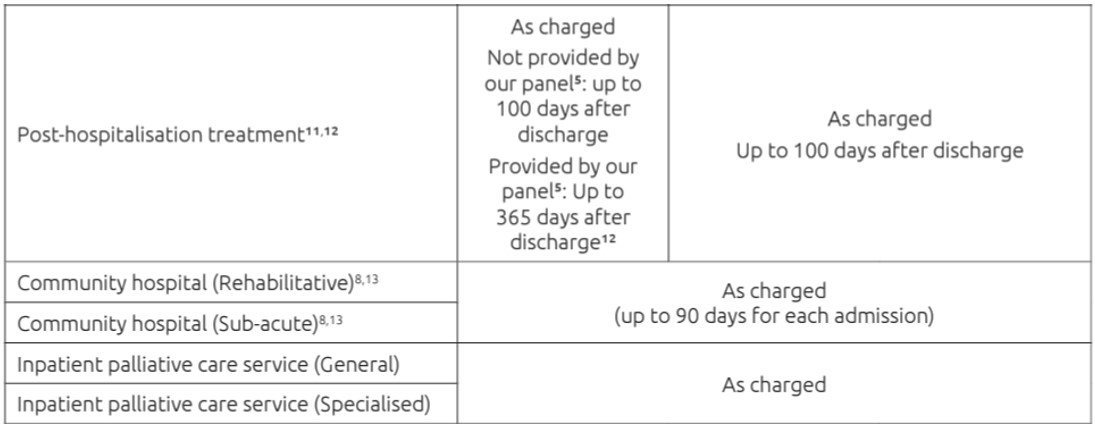

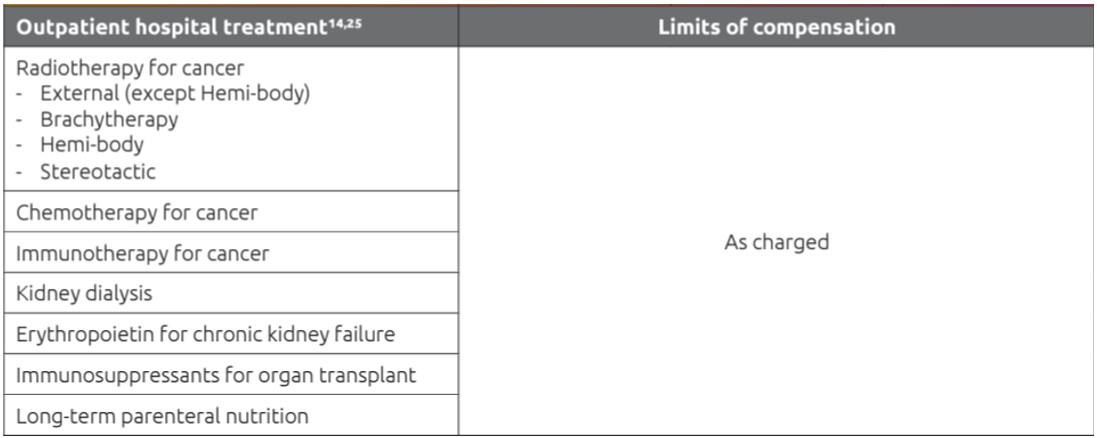

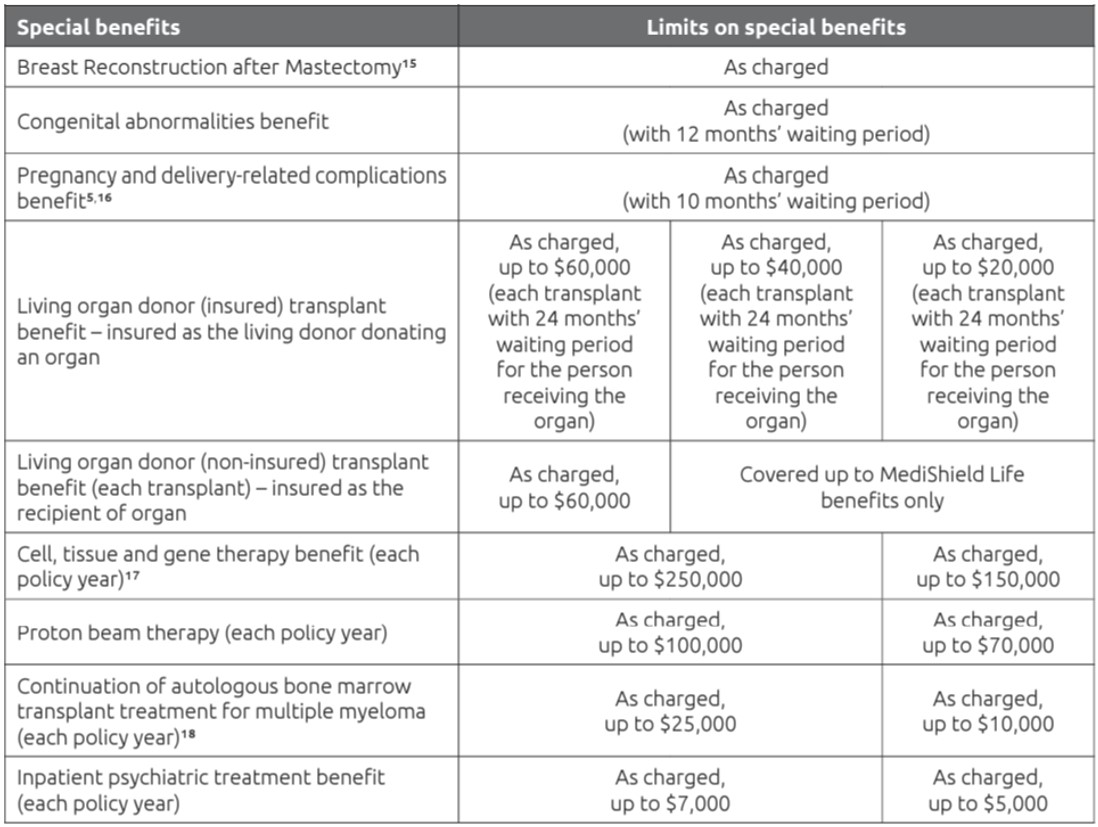

MSL is a basic plan for all Singapore citizens and permanent residents. To enhance its coverage, one can add on Integrated Shield Plan (aka IP) to have better quality healthcare coverage. Below are some examples of IP benefits:

IP provides a lifetime hospitalisation coverage whereas, a CI payout is once-off. Hence, using a CI plan to cover hospitalisation throughout one’s lifetime is not a cost-effective way.

Since medical treatment costs can be covered by a good health insurance plan, why is having a CI plan still important?

Here are a couple of reasons:

- Income replacement during the period of suffering from critical illness.

- Any other ancillary medical expenses which fall outside the scope of medical insurance coverage (medical expenses leakages).

- Alternative medical care/supplement costs which are usually not covered by the medical insurance plan.

Income replacement

As working professionals, we have our monthly commitments such as fixed and discretionary expenses, saving for retirement, or even saving for children’s education fund. So, in the event of critical illness, we may be “forced” to take a break from work to recuperate and focus on recovery. Having a CI plan with a lump sum payout should cover a decent “X” number of years with the provision of expenses as well as the saving portion while we recuperate from the illness. This form of coverage term should be temporary till the age of retirement (e.g., age 65). The reason behind this is that by the time one reaches retirement age, one should be financially independent and would not be working for income anymore, thus such coverage is no longer required.

Medical expenses leakages and alternative medical care/supplement costs

We have mentioned in the earlier article that medical insurance could cover the main bulk of the hospitalisation treatments (inpatient or outpatient). However, there could be instances where some of the medical expenses fall out of the coverage scope. For example, the recent update of the MediShield Life on the restriction of off-label cancer drugs. You may read the article on the impact of MediShield Life changes in the link – https://providend.com/impact-of-medishield-life-changes/.

In such cases, having a CI plan could help to reduce the out-of-pocket payments should one suffers from critical illness and requires alternative treatment or pay for any other medical expenses which are not claimable from the medical insurance. This form of coverage will last as long as we need (even after retirement) and has lifetime coverage to complement the medical insurance plan.

Life Insurance Association study in critical illness

According to Life Insurance Association study by Ernst & Young Advisory Pte Ltd in 2017, the average number of Singapore residents would require a 3.9 times annual income of CI coverage to cover at least 5 years’ worth of expenses which consists of saving for child education. This is calculated based on the median and average of Singapore residents’ earning and spending power.

The study was conducted to understand how much one should typically need in terms of CI coverage and create awareness among Singapore residents. Everyone’s financial situation is different from one another but it is important to note that at any point in time, we should not be underinsured.

Providend’s view on the critical illness framework

At Providend, we have conducted research and gathered data to form our view on how we craft our CI framework.

Different types of critical illness coverage

There are many different types of CI coverage out there in the market and people who are not in the industry will find it hard to understand which type of coverage would be more relevant and suitable for them considering the loss of income and costs of alternative medical treatment. Here are three key differences in the coverage between the various CI plans:

- Severe-stage critical illness

- Early-stage critical illness

- Multi-pay critical illness

Severe-stage critical illness plan, as the name suggests, only covers advanced stages of critical illness (e.g., stage 3 and stage 4 cancer). This is the stage where it will impact most working adults as they will be critically ill and, in most cases, unfit to continue working. As a rule of thumb, Providend recommends coverage of at least 4 to 5 times of one’s annual income.

Early-stage critical illness plan

Coming back to the earlier question of whether it is worth getting an early-stage critical illness (ECI) plan. This plan covers a wider range of critical illnesses starting from the early stage to the intermediate stage and the severe stage. According to our research and study, the financial impact of suffering early-stage critical illness will not be as bad as severe-stage critical illness. For example, a person with stage 0 or stage 1 breast cancer may only require treatment of typically surgery or radiation, or a combination of both. Chemotherapy is usually not part of the treatment regimen for earlier stages of cancer. (Source: https://www.nationalbreastcancer.org/breast-cancer-stage-0-and-stage-1)

In the event of a critical illness such as a stroke that leads to long-term disability, CI plan may not be sufficient for income replacement. In this instance, the solution would be having disability income insurance.

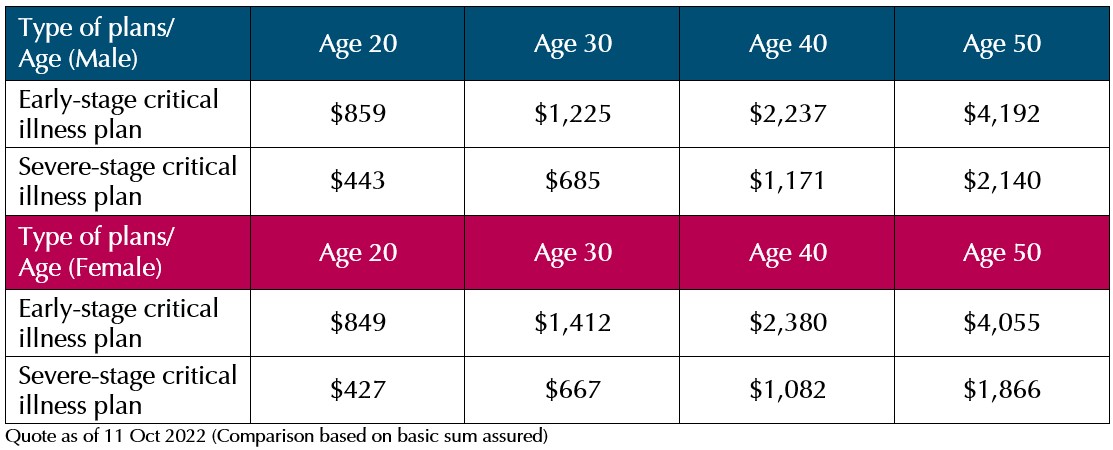

Premium comparison of early and severe-stage CI plans

We then compare the premium difference between early and severe-stage CI plans. For simplicity, we will compare using term plan with critical illness rider, coverage amount of $300,000 and coverage term till age 65.

From the table above, we can see that the premium for early-stage CI plan is about double the amount for severe-stage CI plan. As the financial impact from early-stage critical illness are unlikely to be significant, it may not be advantageous to be spending double the premium in this area unless you feel that you really need it and have additional budget to cater for its premium.

Multi-pay critical illness plan

Multi-pay critical illness (MPCI) plan is an interesting type of plan which is different from the typical CI plan. Generally, a CI plan will terminate once it pays out a lump sum. However, MPCI plan provides several times of payout in the events of suffering from multiple types of critical illness over the years. This is one of the key advantages because if one has suffered from a critical illness before, he/she will most likely be unable to be insured for critical illness again by most insurers. Hence, being insured by a MPCI plan would provide for continuous coverage even after a claim payout.

Another key advantage of a MPCI plan is that it provides relapse benefits which pays out an additional lump sum upon suffering the same critical illness again. However, this relapse benefit may differ across different insurance companies. We must understand if such a benefit is what we are looking for. Due to the unique feature of a MPCI plan which allows for multiple claims as well as its relapse benefits, it is therefore recommended to have this coverage for a lifetime, to complement your medical insurance to cover any medical expenses leakages or even alternative treatment costs.

Premium comparison of early-stage and multi-pay CI plans

Let us now compare the premium difference between early-stage and multi-pay CI plans. For simplicity, we will compare using a standalone ECI plan and MPCI plan with coverage amount of $100,000 and coverage term till age 70 (due to product restriction, policy term has a minimum of till age 70).

From the premium comparison table, we can observe that MPCI plan is definitely more expensive as they provide more benefits. This plan has the ability to claim up to 9 times including relapse benefits.

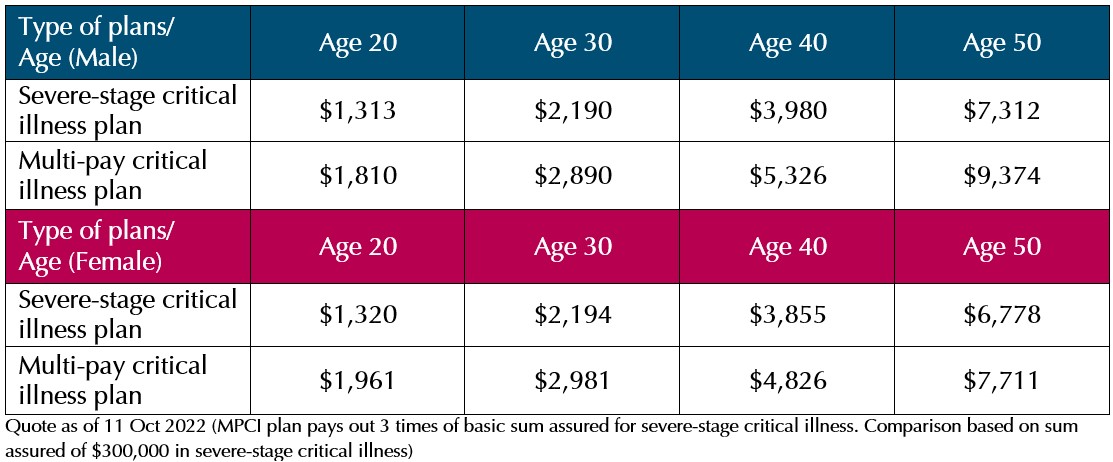

Premium comparison of severe-stage and multi-pay CI plans

Next, we will compare the premium difference between severe-stage and multi-pay CI plans using a term plan with severe-stage CI rider and MPCI plan with coverage amount of $300,000 and coverage term till age 99 (due to product restrictions, there is no standalone severe-stage CI plan available).

From the premium comparison table, the pricing difference between the MPCI plan and the term plan with severe-stage CI rider is not too far apart. As we know, once having suffered from a critical illness, it is extremely difficult to be insured again by most insurance companies. Hence, MPCI plan provides better value and keeps the insured covered by providing additional CI claims and relapse benefits (resulting in as much as 3 times more benefits), while the term plan with severe-stage CI rider only provides a 1-time coverage.

Conclusion

In summary, it is important to have an Integrated Shield Plan to cover for hospitalisation and specific outpatient CI treatment costs. To complement the shield plan, you can consider adding a MPCI plan which provides a lifetime CI coverage ranging between $200,000 to $300,000.

Next is to have severe-stage CI coverage based on 4-5 years of your annual income covering up to your desired retirement age (e.g., age 65).

Our insurance philosophy quotes “Insurance is not the main plan. It is the support plan”. As the support plan, it is our last line of defence should we lose our ability to generate wealth to fulfill our life purpose and objectives. The last thing that we wish not to encounter is to have loopholes in these support plans. I would strongly encourage all of you to review your insurance portfolio at least once a year to ensure that the plans and coverage remain relevant.

Lastly, if you have any doubts or are unsure of certain policies which you have bought a long time ago, do approach your trusted adviser to conduct a full review of your insurance portfolio.

This is an original article written by our Insurance Team at Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. Providend’s Risk Mitigation Solution

2. Post-Recovery Reflections on CI Coverage

3. Can You Still Buy Insurance if You Have Medical Conditions?

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.