On a recent episode of Providend’s Money Wisdom Podcast, I was asked a bonus question about retirement strategies that plan for a drawdown of one’s capital versus perpetuities. I shared that for most of us, it makes sense to develop an intentional plan to spend from one’s assets, like we do with RetireWellTM, instead of being fixated on finding a magical system that seems to both generate income and fully preserve our capital.

While achieving such an outcome is possible, it is not without some trade-offs because there is truly no free lunch.

The “Holy Grail”

What is most attractive about the idea of perpetual strategies is that we all wish we could have generational wealth. Who wouldn’t wish to have the type of wealth that could not only provide all that we need for ourselves, but also for everything that our children, their children, and their children’s children may ever need, without ever running dry?

That is often the key pitch of online investment gurus, and even some professional managers, because it speaks straight to our hearts. We want to feel secure during our own lifetime and take good care of our families when we are no longer around.

We have also often heard people say, “spend only interest, never your capital”. So, naturally, we think of scenarios where we buy assets that we will never sell, spending only whatever growth or dividends we may receive.

The result is that we are always looking for ways to invest that seem like they keep our capital intact while giving tangible returns in the form of dividends and coupons.

A Key Problem

There is a range of complex issues that affect how effective a chosen strategy may be. For example, the unknown sequence of future returns, accounting for inflation in planning for the income we hope to receive and how to ensure that income is reliable, etc.

But the most basic reason why this seems like it should be easy to do and yet often proves so unattainable is that simply switching from a well-planned spending strategy to one that automatically spits cash out of your portfolio is not going to yield significantly better results unless you start with more initial capital, or the strategy generates a significantly greater total return (which usually also implies the taking of significantly greater risk).

Total Return Concept

Kyith, our Senior Solutions Specialist, has written a comprehensive piece that, among other things, explains the total return concept very well.

In a nutshell, the total return on financial investments includes both the capital growth of one’s holdings as well as any cashflows that one were to receive from such investments. For example, if you were buying a stock, it would include both the potential increase in the price of the stock, as well as any dividends received over the investment period.

This approach to viewing investment returns is helpful because it reminds us that returns are, in essence, transmutable. Returns that investments generate come in different forms but from the same pool and are the result (in the case of stock and bond portfolios) of profits generated by the issuing companies. In other words, you receive your share of the profits from stock ownership either by a dividend being paid out, or reinvestment of those profits into the company’s operations which increase what the company is worth, and by extension, its share price.

Total Return Need

Relatedly, whatever income we demand from our portfolios must be supported by sufficient portfolio returns, wherever they come from, and however they are accrued.

It is sometimes easy to forget that this includes not just the income we spend but also the “income” that we do not intend to consume—what is required for our portfolio to maintain its value despite our spending from it.

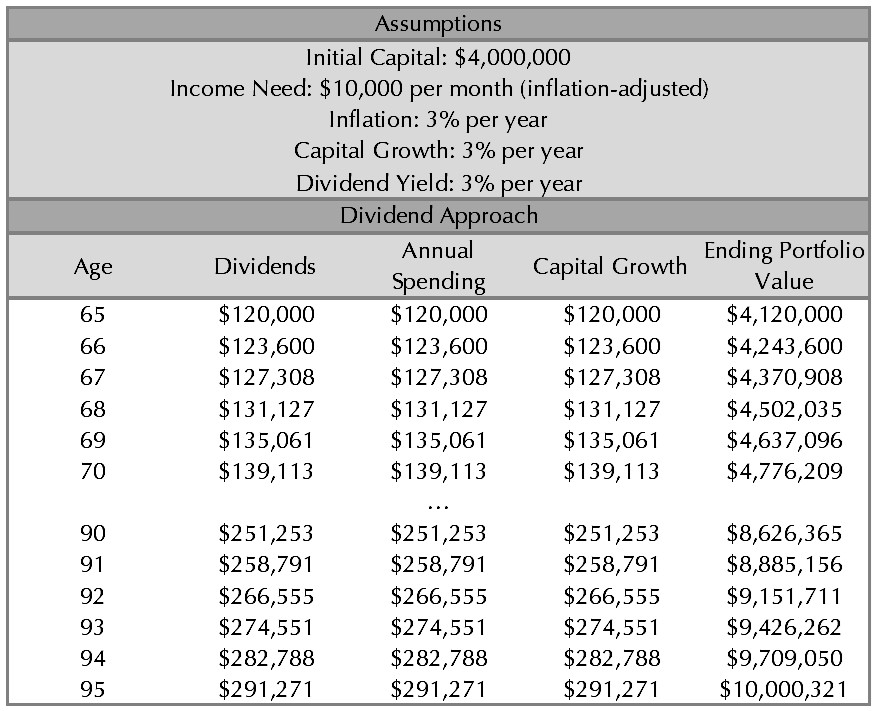

As an example, if we use a dividend approach, spending only dividends, we need to ensure that the dividends cover our expenses. But that alone is not enough, we also need to ensure that the portfolio grows in line with inflation so that each year’s dividends grow to meet increasing spending needs.

If we can do that, we can potentially realise the scenario in Table 1. Our spending needs are met, and the portfolio’s real value is maintained over a 30-year period.

Table 1: Dividend Approach

Table 1: Dividend Approach

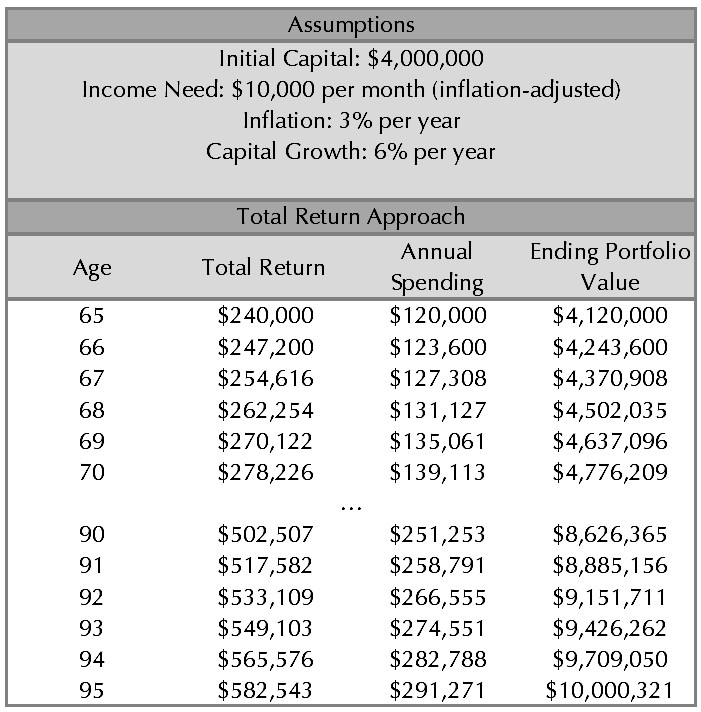

Alternatively, a mathematically equivalent approach, would be to rely on a portfolio that does not produce enough (or any) dividends but has a capital growth rate that makes up for that in terms of total return, selling some holdings in that portfolio to fund our expenses over time. If we can do that, then we can potentially realise the scenario in Table 2.

Table 2: Total Return Approach

Table 2: Total Return Approach

Both scenarios produce enough returns on a sufficient amount of initial capital to support this perpetual scenario.

However, if we needed more than the $10,000 per month as in the illustration, then it is inevitable that we will need to spend some of the capital and the real portfolio value will eventually decrease over time. There is no way around this without (a) gunning for a higher annualised return, or (b) allocating more initial capital to this endeavour.

Using a different framework or approach that does not directly address either of these two points will not work.

In most cases, (a) may require taking more risk (often more than we would advise), and (b) may not be an option if we have already allocated all that we could have to our various life goals.

Defining Perpetuity as a Separate Goal

What this means essentially is that having our capital maintain its real value is a substantial goal all on its own. As such, it takes up resources and effectively creates a drag on our ability to spend from our assets. To achieve it, we would have to spend a smaller proportion of our total assets per year (i.e., use a lower initial withdrawal rate).

Because it is a distinct goal, planning for perpetual capital separately from a retirement income programme is possible and may even be advantageous in making it clearer what each pot of our money is for. It is not at all incompatible with a retirement income strategy that involves planned spending from our assets.

For example, if we know that we need $10 million left over at age 95 to be considered as having met this perpetuity requirement, and we know that we can invest in a long-term portfolio with an expected return of 6.5% per year, then we can also determine how much we need to carve out and invest today to meet this additional goal in 30 years. (The answer in this case is $1.52 million.)

In that way, we can see clearly what the additional cost of meeting this desire for perpetuity is today and use it to more intentionally allocate our assets to this and the rest of our goals.

This approach can also be used in determining the cost of planning for a future gift in our later years not amounting to the full sum required for maintaining perpetuity.

Priorities and Trade-offs

At the end of the day, a drawdown plan and a perpetuity-like outcome are not mutually exclusive. Planning for residual capital that maintains its real value is a relatively simple matter.

However, it is important to keep in mind that creating a plan with that feature comes with significant trade-offs including potentially allocating a sizeable amount of your initial capital (directly or indirectly) toward that specific desire.

For some, this may be both affordable and a top priority, but for many others, when weighed carefully against their other life goals, it becomes clear that it may not be.

This is an original article written by Bryan Chan, Client Adviser at Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. Finding Conviction as an Index Investor

2. Sound Wealth Planning Does More Than Help You Reach Your Goals

3. Providend’s Money Wisdom Podcast S2E6: The Brain Behind – Achieving Contentment Is the Greatest Gain

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.