A few months ago, I had the privilege to conduct an indoor gardening workshop for our Providend family. Since the start of the pandemic, with more time spent at home now, there is a growing interest in home-based hobbies. Indoor gardening is one of them. Gardening is a trend not just within Providend Bearies, but in fact, around the world!

Everyone is a plant parent after the gardening workshop!

I find that we can derive many benefits from gardening.

Gardening can be very therapeutic to the heart and soul (provided that the plants don’t die in our hands). We get to bring nature into our brick-&-mortar house. Tending to plants over time also teaches us to be patient and more forgiving to ourselves. It is a sharing hobby where you get to exchange plant cuttings with your loved ones.

Part of the workshop was to share my gardening journey.

As I was recollecting my thoughts and reflecting upon my gardening journey, I started to see how this hobby actually influenced how I think about my personal finance. Like my fellow advisers who had shared their hobbies which influenced them (see related resources below), I hope to use this article to share my thoughts. If you are a plant parent like me, I hope this article will speak to you as well. 🙂

From my mother-in-law’s gift to a purposeful hobby

Like wealth planning, most of us do not just wake up and suddenly realise that we need to have a wealth plan. Often, we would need someone to market the virtues of setting your finances right.

My interest in indoor gardening was seeded by my mother-in-law. In 2017, she gave me my first plant as a house-warming gift. Initially, I was strongly against having plants at home because having plants means I had to be responsible for another life. But who would reject their newly minted mother-in-law’s well-meaning gift, right?

Little did I know that I had fallen into this nature’s rabbit hole. Today, I have reached an equilibrium of 50 houseplants in my house. Why the word “equilibrium”, you may ask? That is because there was a point in my life where I had more than 80 plants at home!

Looking back, I was simply on a plant craze:

- I looked at exotic plants on Instagram that others own and desired for it – a typical “keeping up with the Jones'” mindset.

- My house was cluttered with plants. They were everywhere – on plant racks, on the floor, kitchen countertop, balcony, etc.

- I spent most of my personal time caring for them. At the same time, I continued to buy more plants, even though I was getting frustrated with the plants and myself when they did not grow as well as the level of care I had endowed them with.

Eventually, I reached an inflection point where I felt there was no point to continue with this plant craze.

I found myself getting really lost in the whole cycle of accumulation without any real purpose. I was not truly happy, which is ironic because we should be happy when we engage in our hobbies.

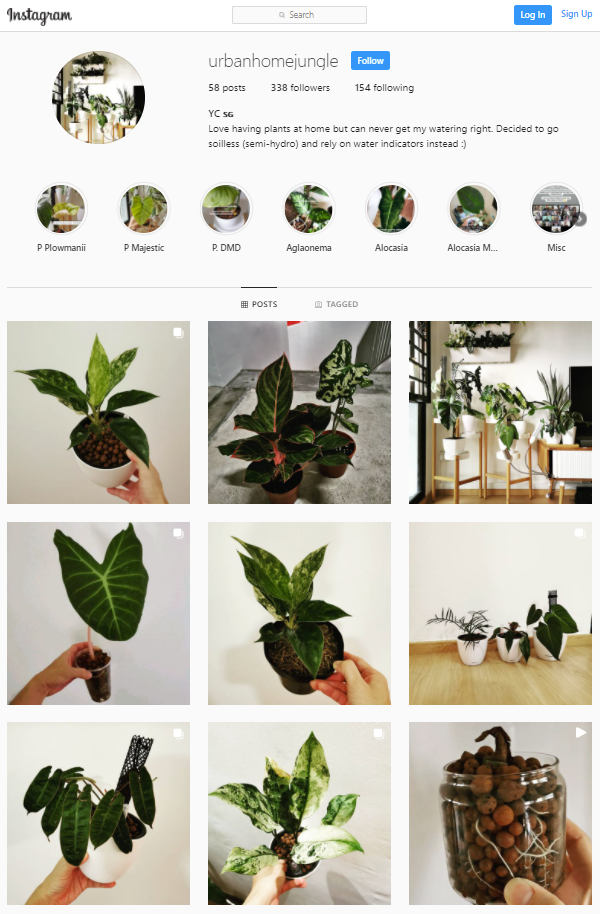

In the end, I had an Instagram account, @urbanhomejungle, to thank for. Initially, I set up the account for me to post my plant photos and indirectly, contribute to other people’s plant craze.

My other intention was to use it to share my experience in adopting soil-less (aka semi-hydroponic) indoor gardening. Slowly, I had friends, colleagues and even strangers approaching me for tips and how they can start off this hobby. It felt rewarding to be able to share my knowledge and give back to the plant community in my little way. I gave cuttings to my friends and colleagues and encouraged them to try soil-less methods to keep their house clean and minimise pests. The workshop was one good example. All these gave me immense purpose in the pursuit of this hobby.

There are parallels between gardening and wealth accumulation.

Beyond a certain point, excessive plant hoarding brings diminishing life satisfaction. Our life satisfaction rises with our income or our wealth until a certain level. Beyond that level, other factors such as life purpose, social connection, marriage quality and health, become relatively more important than money.

When I ask my clients about the role that money plays in their lives, many replied that money is an enabler for them.

One of my clients once told me, “Yong Cheng, I am not the sort who gives donations, but I prefer to give my time, knowledge and resources – by starting or supporting startups that impact the world positively. That gives me purpose.”

The experiences of this client and my own gardening journey made me reflect upon the true meaning behind the act of accumulation. Money must first enable us to provide well for ourselves and our loved ones. Once that is provided for, we wish to use the rest of the money, a gift that was endowed to us, to bless others.

I wish to be clear that not everyone needs to give away our wealth so that we can live a very purposeful life after we have taken care of our own needs. We have clients whose sense of purpose and identity greatly centers around wealth accumulation. And that is okay.

The deliberate allocation of our wealth to improve other people’s lives will give us a stronger purpose in life. This purpose will push us to do better, be it in our corporate or personal lives.

My daughter holding a Philodendron Splendid.

Our visit to World Farm.

Choose and grow plants that match the kind of life I want

During my blind plant-chasing days, I ended up with many houseplants of various species. As the number of my plants goes up, it greatly increases the complexity. Different species of plants require different types of care.

For example, sansevieria (commonly known as the snake plant) with its thick water-storing leaves prefer their medium to completely dry out before watering. On the other hand, calathea needs watering every other day because they do not like their medium to dry out. Most begonias thrive in areas of high humidity because they are usually found at the floor of the moist and cool rainforest.

I ended up killing many plants due to my incompetence and negligence. I also paid ‘school fees’ with my hard-earned money as a result. I was constantly in a vicious cycle of buying -> killing -> being angry with myself.

Over time, I have learnt to be selective with certain species of plants that are attention-free yet beautiful such as pothos, aglaonemas, selected philodendrons. These plants form the main bulk of my collection now. I keep the exotic yet fussy ones such as alocasias which are prone to spider mites, to the minimum so that they do not take up too much of my time.

My plant collection in the living room.

When it comes to investing our money, we have ample options out there to choose from. Just like the sansevierias, calatheas, begonias, aglaonemas, each category of investment products and strategies have differing level of sophistication and effort required of their owners.

Active stock strategies such as value investing can be likened to exotic yet fussy species such as alocasias and begonias. There is potentially greater long-term expected return but higher portfolio volatility too. The level of sophistication and effort needed is also higher.

Sound dividend investing may allow us to achieve a portfolio with lower-than-normal volatility, but dividend investing requires us to have consistent effort to decide where to reinvest our dividends during the accumulation phase.

As for myself, I choose to buy and hold a globally diversified, low-cost portfolio of stocks and bonds in a passive manner. Empirical evidence from history have shown me that equities and bonds have long-term positive expected returns. I called them my pothos and aglaonemas, which thrive on neglect and greatly reduce the level of time and effort needed of me, so I can spend more time on gardening (don’t tell my wife). The diversified nature of the portfolio and lack of financial complexity greatly reduces the risk of permanent capital impairment, which gives me a high level of comfort at night.

This strategy greatly matches the kind of activities I choose to do during my free time and the kind of life phase I am in. My attention to wealth building is like my garden. If I take on too many plants of different species, the plants control my life. If I take on plants that require more sophistication and effort than I can commit, the plants control my life.

In a way, I am glad that I took a step back, reflected on what I know, and did not let the plants take control of my life. Simply focusing on the plants (and investment strategy) gives me a great balance of life satisfaction, effort and sophistication needed.

Do share with us how your hobby has influenced how you look at other important aspects of your life.

This is an original article written by Loh Yong Cheng, Lead of Advisory Team at Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. Sailing and Wealth Planning: When It Is Smart to Play It Safe

2. 9 Investment Lessons That Make Me a Better Cyclist

3. Hiking and Wealth Management: The Great Adventure

Bonus: Do Wealth Advisers Need Wealth Advice?

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.