Property prices in Singapore have been rising for the past few years, particularly for landed projects, despite higher mortgage interest rates and government cooling measures. It is no surprise that many Singaporeans love buying properties, either for their own residential stay or as an investment. Historically, property in Singapore has done well in terms of growth, providing good rental income and allowing property buyers to leverage by taking on loans to fund the purchase. Psychologically, there is also the excitement of owning a physical asset that one can see or even “show off”, not to mention news of en-bloc sales that drive up sentiment.

However, since buying a property tends to be a huge commitment and takes up a large proportion of one’s overall net worth, how should one approach property investment?

While I will mainly focus on investment properties, it is recommended to own a property for residential purposes and have a roof over your head. This will provide peace of mind and the assurance of not worrying about fluctuating rental costs, especially as you approach retirement age.

Important factors to consider for core investments

Broadly speaking, let’s first consider the important factors to keep in mind when investing for essential goals like retirement, which require high reliability of returns, as opposed to short-term speculation.

At Providend, we often share our framework for assessing the suitability of investments. We look for a sound economic driver behind returns and strong empirical evidence that gives us confidence in the ability of the investment to deliver the returns we need.

Implementation is also crucial when considering how each asset fits into the overall portfolio. One very important factor is ensuring that a portfolio is well diversified and not overly concentrated in any particular investment, asset class, or sector. Diversification is well-known to be the only free lunch in the investing world, as it can improve a portfolio’s risk-return characteristics. There is enough evidence to prove that trying to outguess the markets by picking and choosing concentrated positions is not only a futile attempt, but also adds significant risk.

Historical performance of Singapore properties vs other asset classes

Aside from the risks, what is the historical performance of properties in Singapore, since it is so well-loved by many? Equally important, how does this asset class compare to other asset classes globally?

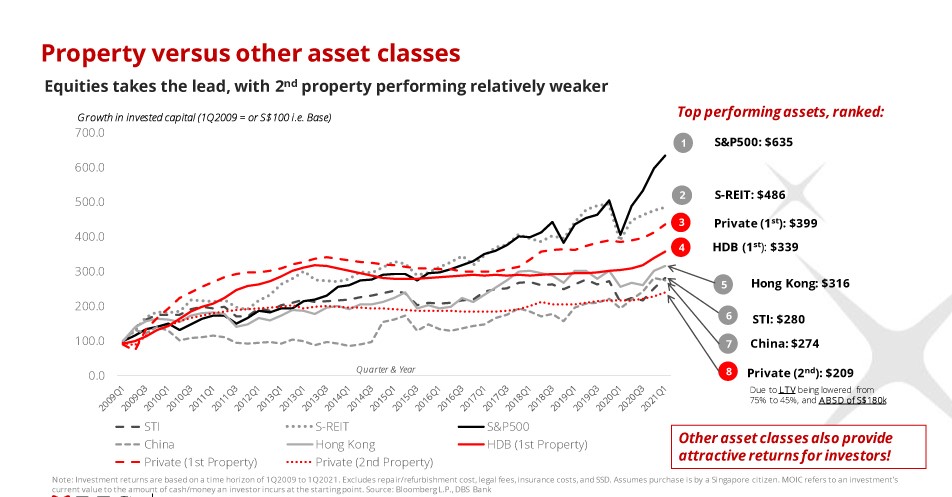

Several studies have been conducted by different sources, but one of the more comprehensive studies was done by DBS in 2021. This study not only considered capital price gains but also factored in rental assumptions in the comparison.

Some of the findings are shown in the table below for reference. Admittedly, the time frame looks rather short to be conclusive. However, the focus of this article is not to review which asset class will outperform in the future. Rather, in general, there is enough data to show that property returns are not as superior as what many people think when compared to other asset classes.

Source: DBS

There are several psychological reasons why property performance is perceived as superior. The primary reason is that property prices are not priced as frequently as publicly traded financial instruments or indexes. This creates a perception of steady returns, and that prices only increase over time.

In reality, the same applies to global equities, which also benefit from long-term inflation and increasing demand. However, due to the volatility of daily pricing and the added noise from the financial media, investors often make poor decisions. Property investors, on the other hand, are “forced” to stay invested due to the illiquidity of property, which helps them avoid being overly reactive.

Biggest concerns about property investments

Concentration Risks – Due to the large capital outlay required for buying a physical property for investments, an investor not only becomes concentrated in a single asset class but also into a single unit, which is no different from buying a single company stock. This goes against the principle of diversification in investments, which is important not only to spread out risks but also to ensure that returns are captured from various sectors when they come. It is not to say that buying investment properties will not work, but it is important to avoid being overly dependent on a single investment to ensure a good retirement.

Policy Risks – Properties are highly regulated assets, and it is in the interest of governments to ensure affordability and a roof over citizens’ heads. Therefore, there are policy risks to be aware of. In Singapore, for example, numerous cooling measures have been implemented since 2009, such as changes to Loan-to-valuation limits and additional stamp duties in an effort to bring down housing and rental prices. This is great for those looking for a home but not so good for investors.

Flexibility & Liquidity – Properties are also largely illiquid, and it takes time to sell them when money is needed. Furthermore, an investor does not have the option to sell only a small portion of their investment, in the event that they do not require the entire sum.

Active Management – Investing in a property requires active management, such as finding and dealing with tenants, maintenance and furnishing if things break down, as well as ensuring administrative matters such as taxes are promptly settled.

Interest Rate Risks – As most people take on a loan when buying a property, they would be further subjected to interest rate risks. This concern likely increased over the past year when interest rates went up to 3 to 4%, with many wondering how long more this will continue.

How should we have exposure to property as an asset class?

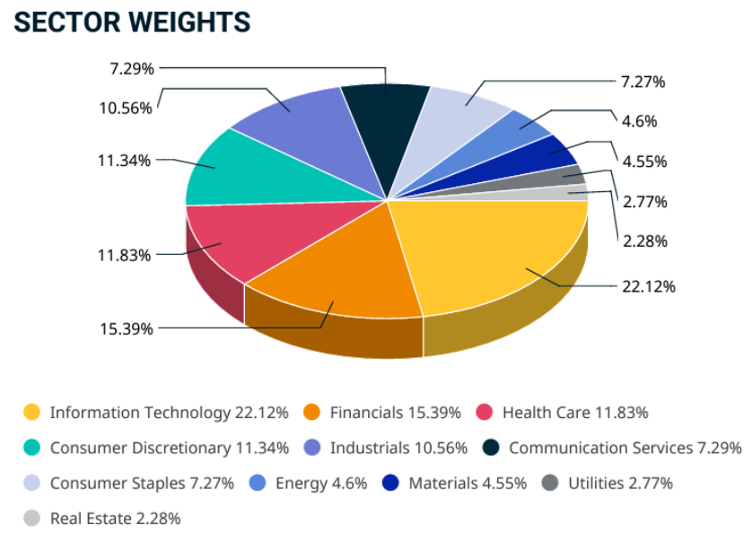

Given the number of concerns, how should we consider property in our portfolio? Property, like any other sector, geography, or asset class, should be treated as part of a diversified portfolio. Therefore, it is essential to capture exposure to that asset class alongside other sectors. For instance, you can examine the equity holdings in the MSCI All Country World Index below that have exposure to the direct real estate business. Additionally, companies in other sectors typically possess buildings and properties, meaning that their assets would benefit if overall property values increase. A sound investment portfolio should have a balanced mix of holdings from different sectors and geographies, instead of being overly concentrated in any specific one.

Source: MSCI All Country World Index

Conclusion

We tend to focus and invest in instruments that we are familiar with, such as property. It is also intuitive to understand how returns are derived from property investments, based on demand that drives rental and resale values.

However, it is necessary to be rational and step back to look at the data and wider universe of available instruments. We need to be objective when making investment decisions. Similarly, we must understand how returns are derived from other options, so that we can make informed decisions and feel comfortable with them.

This is an original article written by Tan Chin Yu, Lead of Advisory Team at Providend, the first fee-only wealth advisory firm in Southeast Asia and a leading wealth advisory firm in Asia.

For more related resources, check out:

1. Do Not Use Money Meant to Fight Inflation in the Long Term to Mitigate Inflation Now

2. Complex vs Simple Wealth Solutions

3. Where to Invest Your Money When Inflation is High

*Providend is very excited to share that we are now ready to extend our service offerings to the younger accumulators who are looking for holistic, independent, conflict-free wealth advice!

For this group of younger accumulators, we know that it is not easy to make retirement planning a priority when other financial goals – buying a first home, for example, or saving for a child’s education – appear more pressing. Learn how we can help here.

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.