“Siao on” (a Singaporean term for being overly serious or on the ball) is how my closer friends would describe me when it comes to national service (NS). I started serving my NS in the army at the age of 19 and continued to volunteer beyond my liability till March this year at the age of 50. People asked me why I do it and my answer is that because I believe in the need to defend our own country. As I read the events unfolding in Afghanistan and watched the horrific video of people falling to their death mid-air from the US airplane taking off at Kabul, it further reinforces this conviction. The late Mr. Lee Kuan Yew knew this when Singapore was thrust into independence in 1965. He understood the vulnerability of our tiny island-state and was concerned with the security of the fledgling nation that had just been separated from Malaysia, and even more so when the British troops pulled out of Singapore in 1971. So, our leaders decided to build our own armed forces.

Besides putting in place military defence, our leaders also understood the importance of a strong economic defence. As a small country with no natural resources, which imports most of its food, dependent on external trade for income and with no hinterland, Singapore was not expected to survive. These gave our leaders 2 convictions. Firstly, we need to make ourselves relevant to the world so that we can survive and secondly, we need to build strong reserves so that we can withstand any crisis that may come our way. This gave birth to the Government Investment Corporation (GIC) as well as Temasek Holdings and together with Monetary Authority of Singapore (MAS) manage 3 pots of our country’s reserves. Because of these farsighted decisions to build our own armed forces as well as strong reserves, it has given us the peace and security that we enjoy today. Security not just in fending off would be invaders but during the Asian Financial Crisis in 1997, having strong reserves gave investors’ confidence in Singapore. In the Global Financial Crisis in 2008/09, reserves were drawn down to finance a package of measures, to preserve jobs by subsidising employers’ wage bills and to help viable companies stay afloat by sharing the risk of bank lending. And in the most recent Covid-19 pandemic, the strong reserves bought us sufficient vaccines quickly and also supported companies to protect the workers’ livelihood.

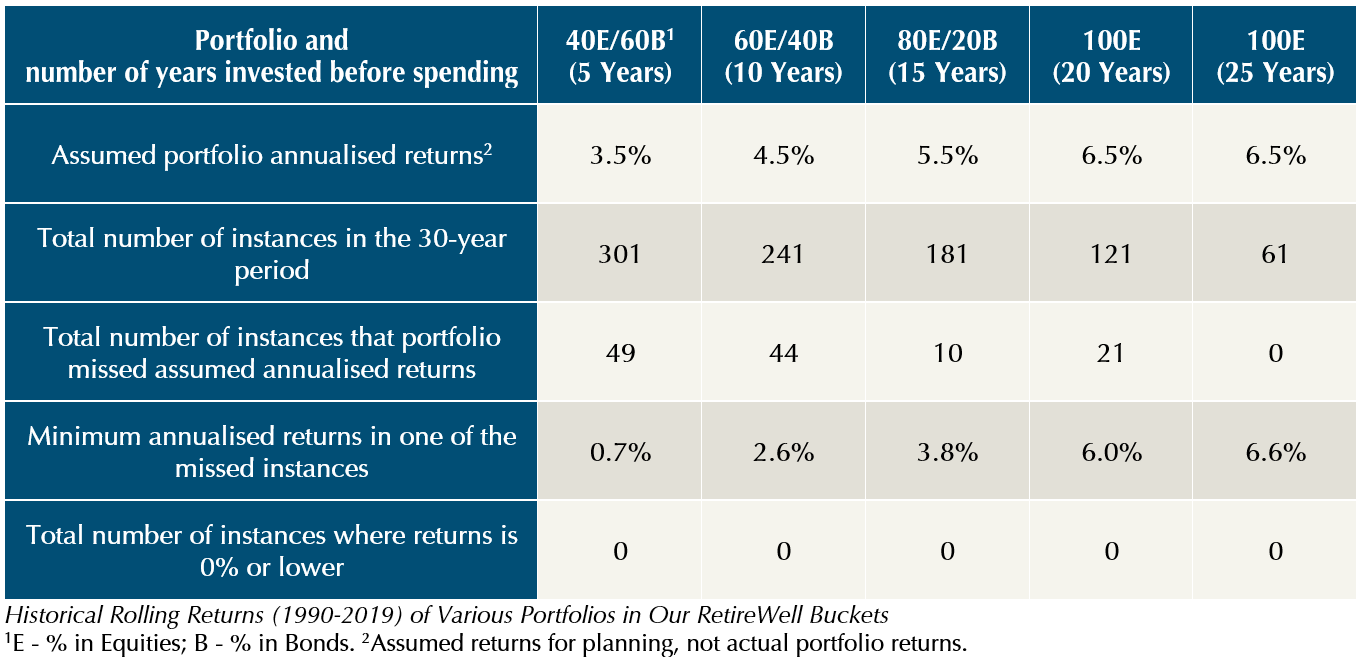

The Singapore experience has taught us that whether we are in the accumulating phase or withdrawal phase of our lives, there is a need to build sufficient reserves to buffer against unpredictable events. But while a lot is written about having an emergency fund in our accumulating years, very little is discussed about having reserves in our retirement, which is even more important. In Providend’s RetireWell™ methodology (you can read about it from my previous articles on our website), we integrate various retirement assets (properties, CPF, insurance endowments, equities, bonds, etc.) into a spending plan that ensures a reliable income to spend on during retirement and still leave behind a financial legacy if desired. The assets are optimally divided into 7 buckets with assets in each bucket being used at different periods of time in retirement. For financial assets such as equities and bonds in these buckets, we assume a certain rate of return for planning purposes but if the assumptions do not hold true, we may not be able to have the expected income as planned. So we did a study on the rolling returns of our portfolios spanning over a 30-year period (which included many volatile market events such as the 2000 Dotcom bubble, the 2000-2002 bear market and of course, the 2008 Global Financial Crisis) and the results are shown in the table.

The good news is that over this 30-year period, none of our portfolios returned 0% or lost money in any instances. This evidence supports our belief that in the long run, the stock markets always give a positive annualised return. The bad news is that positive returns do not always mean sufficient returns as can be seen by the various instances where the portfolios’ returns were lower than the assumed returns used in our planning. That means we may not have the desired income in retirement. One way to mitigate this risk is to spend lesser. But that may not always be possible or desirable due to various “life decision” reasons. Our solution is to create a “Reserve Bucket” (patent pending) where certain amount of assets are set aside and invested way before it is needed. But the question is how much should one set aside as reserves? If we want to set aside for every possibility, we will need too much capital which is not practical. But if we set aside too little, then when circumstances call for it, the reserves may not be enough. Space constraint does not allow me to elaborate how we determine what is enough and the kind of portfolios the reserves are invested into. Suffice it to say that a lot of empirical work have gone into finding that optimal balance.

Since young, I love to celebrate National Day and would not miss a single National Day Parade (NDP) because the parade in its entirety always tells the Singapore story. For me, celebrating National Day and watching NDP is the time of the year where I set aside to be grateful for being a Singaporean. If you are a Singaporean, when you watch the parade this evening, enjoy the parade and feel the sense of pride and gratitude for how far we have come. At the same time, I hope you will also remember the precious lessons that our forefathers have passed down to us. Build strong reserves for yourselves and before you are gone, perhaps put in place a legal structure and guide your future generation on how the reserves can be used wisely, if needed.

Happy National Day Singapore and Majulah Singapura!

The writer, Christopher Tan, is Chief Executive Officer of Providend, Singapore’s first fee-only wealth advisory firm. Besides being financially trained, he is also an Associate Certified Coach with the International Coach Federation.

The edited version of this article has been published in the Money Wisdom Column of The Business Times Weekend on 21st August 2021.

For more related resources, check out:

1. Here’s Why We Charge a Higher Fee Than Robos

2. Active Investing That Adds Value to the Client

3. Drawing Down Your Assets vs Making Them Last Forever

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.