Interest rates had been on a steep rise since last year as central banks around the world moved quickly to fight inflation. I previously wrote about how higher interest rates impact leveraged insurance policies as we hear concerns from many who bought these products.

Along the way, another question that I get frequently that stands out strongly is whether one should still invest in equities and bonds when what they are getting from their fixed deposits and treasury bills (T-Bills) are already yielding close to 4% risk-free. And this is compounded by the fact that both equities and bonds fell significantly in 2022, making investors question why they should even bother with the volatility when returns turn out disappointing.

Inflation

While it can be quite exciting to see a wide range of risk-free instruments such as fixed deposits or T-Bills yielding such high returns, the main culprit that started it all is inflation, which went up to a high of around 9% last year in the US, before coming down to about 5% today. In an effort to tackle rising inflationary concerns, central banks around the world had to raise interest rates very quickly to prevent inflation from spiralling out of control. Hence, in real dollar terms, after factoring in inflation, you’re still losing purchasing power.

There are what we label as “short-term inflation” and “long-term inflation”. For short-term inflation, it is prudent to use short-term risk-free instruments to mitigate its impact, as longer-term instruments would be too volatile.

However, it is also extremely important to beat inflation for monies that you intend to hold for long periods of time to avoid your purchasing power being eroded significantly. For this, you have to hold equities because essentially, company profits are driven by overall market demand and pricing, which goes up with inflation. And as long as we continue to need to buy goods and services, equities will continue to grow in the long run.

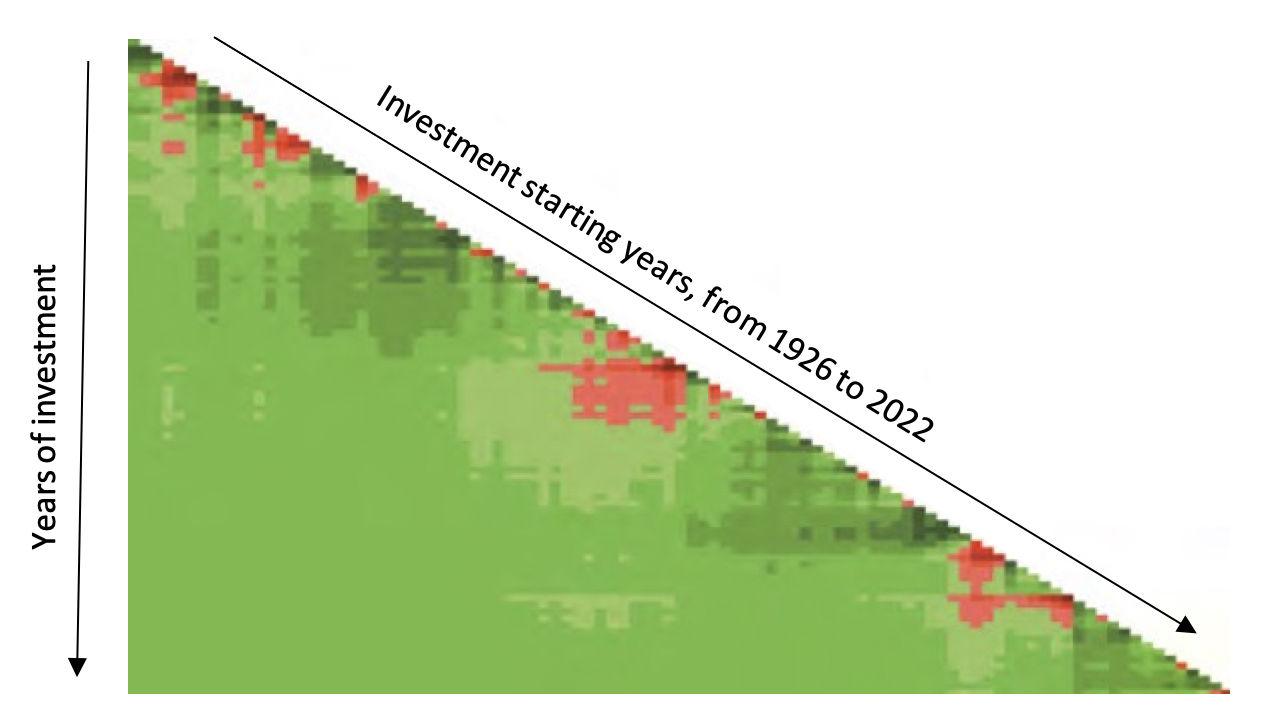

To illustrate this point, here is a heat map of historical returns of US Treasury Bills from 1926 to 2022, after factoring in inflation, with green representing positive returns and red representing losses. The diagonal border represents the different starting years of investments, which shows the returns across various holding periods as you move down. And what it tells us is that there are a lot of periods where T-Bills end up with negative real returns over time.

One-Month US Treasury Bills, 1926-2022, Real Returns

Source: Dimensional Matrix Book 2023

We contrast this with the equity market, represented by the S&P 500 Iindex. You can see that although there are still red patches due to times of market volatility, given enough time horizon, real returns always end up green.

S&P 500 Index, 1926-2022, Real Returns

Source: Dimensional Matrix Book 2023

Always look forward, not backwards

A common question that I often get is whether it is better to just buy T-Bills that yield close to 4% at no risk, compared to equities and bonds that had performed poorly over the past few years.

To think about this question, we must first think about returns looking forward, not backwards, and also that forward expected returns are not static.

Take bonds as an example. The US 10-year treasury yield before 2022 had been in a low interest rate environment with yields hovering around 1.5%. This swiftly rose to a high of 4%, then coming down slightly to about 3+% today.

What this means is that if you were holding a bond that was yielding 1.5% previously and intending to hold to maturity, you would get your promised yield when you first bought. However, because bonds are also publicly traded instruments which allow you the option to sell if you need to, the markets have to price your bond at a lower price in order to be competitive against the higher-yielding bonds that are 4%. And this drop in price often makes investors feel that the instrument they are holding is a poor one, just because they see this short-term loss in their portfolio.

In reality, it is exactly because of the drop in price that results in a higher yield looking forward.

Bonds are more straightforward to understand in this context but how about equities and does the interest rate affect their expected returns?

There are many ways to determine the expected returns of equities but you want to think about them simplistically as the Equity Risk Premium + the Risk-Free Rate. The Equity Risk Premium means that because you are taking on higher volatility and risks through equities, market prices would demand a certain premium in returns over the risk-free rate. So as the risk-free rate goes up, the expected returns of equities would go up as well.

Some might also ask whether it makes sense to hold assets in risk-free instruments temporarily, since they are yielding so high return today, and only buy into longer-term instruments such as equities when interest rates are no longer attractive? Well, while it sounds intuitive, we also need to understand that when we wait until interest rates go down, bond prices would have moved up, and likely for equities as well since the risk-free rate has gone down. And higher prices would tend to mean lower expected returns or yield looking forward. So, you can choose to do that if you wish to sit out the short-term market volatility but it is not as straightforward as it sounds, and is not the most optimal approach.

End of the day, we need to remind ourselves that the markets are largely efficient and dynamic in the sense that they would have taken into consideration the information that is available today, including risk-free rates, in deciding the fair price and returns expected from different instruments. Remember that market prices are set by buyers and sellers like you and me. If an instrument has higher volatility and risk, an investor would be expected to be compensated through higher expected returns.

Case Study

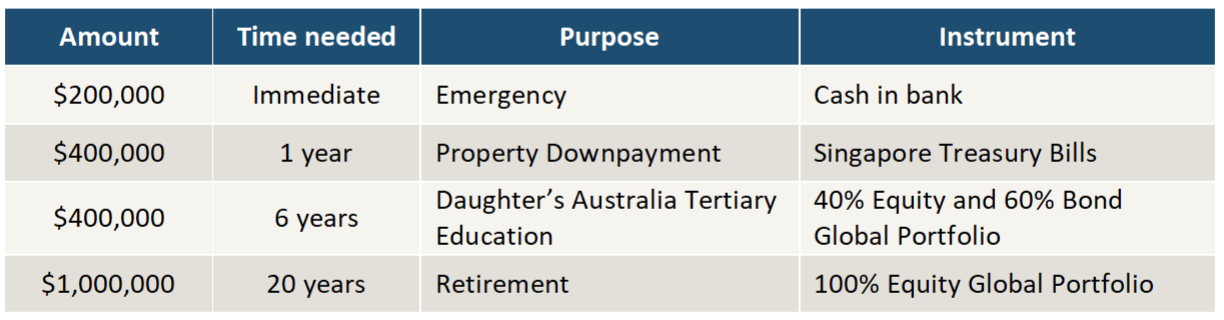

Let me put this all together in a case study of a fictitious couple, Kenny and Karen, both age 40. To keep it simple, assuming that they are holding $2m in cash and are deciding how they should be allocating those funds into various assets.

There are a few areas that they need to use their monies for in the future, and these include:

1) $200k as emergency liquidity to cover 6 months of expenses

2) $400k for a residential property downpayment next year

3) Australia university education for their 12 years old daughter in 6 years’ time

4) Their retirement of $10k per month when they reach 60 years old

First off, in every person’s financial situation, they should have cash for at least 6 months of expenses, and these should be liquid that can be accessed anytime in the event of an emergency and should not be locked up. As such, their first $200k should be kept very safe in a bank account, potentially taking advantage of many high-yield accounts available today.

For the property downpayment that they require in a year’s time, they can park the next $400k into a 1-year Singapore Treasury Bill, which gives about 3+% interest that does not need to be as liquid as the emergency funds. This helps them mitigate part of the short-term inflation today.

After making sure that they have kept their near-term needs very safe, they can start putting assets into the markets to capture higher returns.

To fund their daughter’s university education in 6 years, they should start going for bonds with a duration not longer than their time horizon in their portfolio and limit their equity exposure to about 40%. As such, to ensure that they have enough to support their daughter, about $400k should be allocated towards a globally diversified portfolio of 40% equities and 60% bonds.

Lastly, for their retirement that has a good 20-year time horizon, short-term instruments such as fixed deposits or T-Bills would be a bad idea, as it is almost certain that inflation will significantly diminish the purchasing power of their assets. Because they have a long time horizon that allows them to weather through market volatility and adequately capture the long-term returns, they can allocate the remaining $1m for their retirement into a 100% equity global portfolio.

As a Conclusion

I hope that this provided you with more clarity on how we should be thinking about our asset allocation that best suits our personal situation and needs. Many of these fundamental planning principles still apply, whether or not we are in a high interest rate environment or a low one. What is most important is that we want to have a proper framework in structuring our assets, rather than investing in a haphazard way based on unpredictable market conditions.

This is an original article written by Tan Chin Yu, Lead of Advisory Team at Providend, the first fee-only wealth advisory firm in Southeast Asia and a leading wealth advisory firm in Asia.

For more related resources, check out:

1. Do Not Use Money Meant to Fight Inflation in the Long Term to Mitigate Inflation Now

2. Retire Well in a High Interest, High Inflation Environment

3. Where to Invest Your Money When Inflation is High

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current investment portfolio, financial and/or retirement plan, make an appointment with us today.