When I first started my investment journey about 10 years ago, the first question that I asked is how much money can I make?

In the same way, in my day-to-day conversations with clients, it is very common for clients to ask about the expected or historical returns of investments. However, what is seldom asked is what are the risks that should be taken into account. This is understandably so, because firstly, it is always more exciting to look at the potential profits and secondly, risk is often a very vague measure that is difficult to discuss.

How Do We Define Risks?

Wikipedia (https://en.wikipedia.org/wiki/Risk) defines risk as the possibility of something bad happening. And as risk also involves uncertainty, the international standard definition of risk is the effect of uncertainty on objectives.

When it comes to investments, the industry usually quantifies risk using the probabilistic measure of variance or standard deviation, which defines the probability of an outcome differing from the expected return. And risk and return are often correlated.

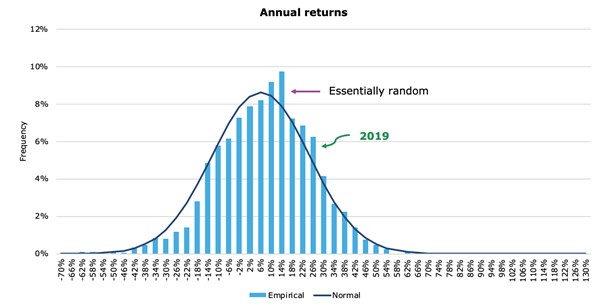

To illustrate what I mean, an investment with an expected return of 10% and a standard deviation of 15% means that historically, the average of all the outcomes in the past average 10% p.a. returns but your actual returns in any 1 given year have a 68% chance of falling within plus and minus 15% (1 standard deviation) away from the average (i.e. between -5% and +25%). If we widen the range to 2 standard deviation (i.e. between -20% and +40%), there is a 95% chance of your returns falling within this range each year.

Source: https://klementoninvesting.substack.com/p/the-distribution-of-stock-market

Source: https://klementoninvesting.substack.com/p/the-distribution-of-stock-market

However, while it makes sense to be able to quantify these factors when doing asset class comparisons or portfolio construction, it also often does not mean anything to a person who is building their own personal wealth plan.

Standardised Risk Profiling Tools Do Not Tell the Whole Story

When it comes to the typical financial planning process, the standard way to decide on suitable investments for a person is to use standardised risk profiling questionnaires to document one’s risk tolerance before recommending instruments. While it is necessary to fulfil regulatory requirements, the big gap is that it does not address a person’s real need or desire to be subjected to various outcomes. Deep conversations are needed to really understand what is most appropriate.

A Better Way to Frame Risks

It is firstly important to understand the various aspects of risks:

- Risk capacity or ability – this is the most basic and is determined based on a person’s financial health (e.g. basic liquidity or cashflow) and time horizon

- Risk perception – how a person views the riskiness of an asset class and this can be influenced by the familiarity of an instrument and might not reflect the true nature

- Risk tolerance or willingness – this not only encompasses the ability to ride through volatility but also what are the potential outcomes that are acceptable

While 1 and 2 can be easily addressed, balancing between potential outcomes in 3 and the need to take risks requires more time to assess.

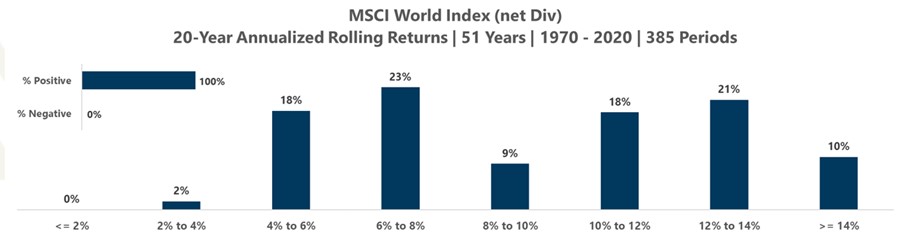

Investing is not about focusing on a single return number but rather, should be thought of as a range and one of my favourite charts is the following that shows the 20-year rolling returns of 385 independent outcomes of the MSCI World Index from 1970 to 2020. It shows that historically, if you had invested for a 20-year period, you would have a 2% chance of ending up with a return between 2% and 4%, a 10% chance of getting above a 14% annualised return, and the remaining falling somewhere in between.

Hence, what we want to understand is whether the situation allows for a 20-year investment time horizon, how much return is needed to achieve the goal, and what to do if you fall towards the lower end of the spectrum. All this is also noting that at the same time, past performance might not be reflective of future returns, but should still be studied as a framework.

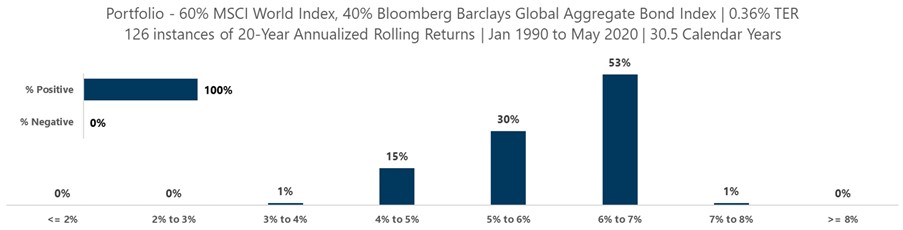

If higher level of certainty is preferred, which means narrowing the range of outcomes, both at the upper and lower end, then balancing out with a higher bond allocation would be more prudent in the planning. This level of certainty tends to also likely be driven by the type of goals. As an example, a baseline retirement income to cover essential expenses requires more certainty compared to expenses for other quality of life desires such as upgrading a car or a house.

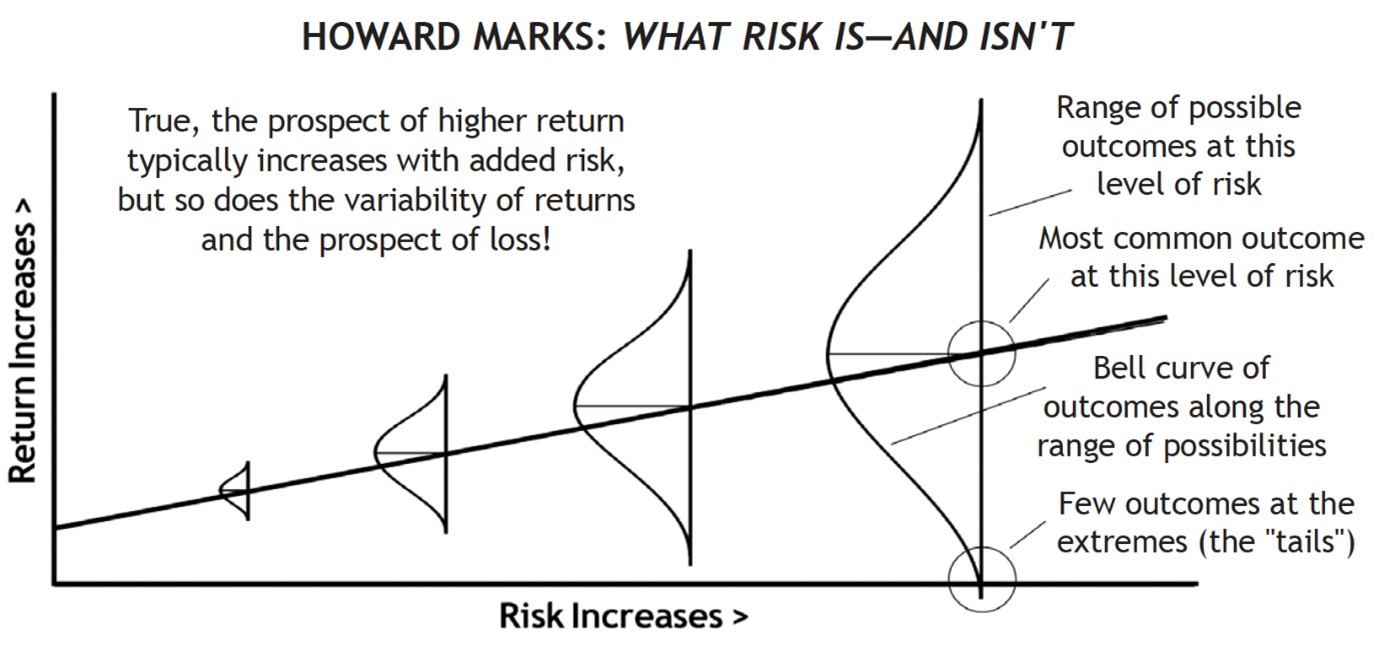

I also like this other chart below by Howard Marks that provides another visualisation of the different portfolios and their risks involved. While you can see that your expected returns go up as you move to the right, your range of outcomes also increases, both towards the upper end and the lower end. You can think of it as the more certain you need your outcome to be, the lower the return you should be expecting.

Source: https://soundmindinvesting.com/articles/view/two-types-of-risk

Source: https://soundmindinvesting.com/articles/view/two-types-of-risk

Totally Avoiding Risks Might Be Counterintuitive

In my previous article (https://providend.com/can-you-trust-your-head-when-you-invest/), I talked about psychological biases when it comes to investing and it is no different when it comes to thinking about risks.

I have come across clients who loves holding tons of cash because it provides a strong sense of certainty and stability. Yes, it is indeed so when we view risks as the possibility of losing value when measured in the currency in itself.

However, it is important to note that money is a created concept and the true value is not in the currency itself, but rather, its purchasing power. Some food for thought is that if we were to measure in real terms, holding cash has a 100% risk of losing money. There are also risks in being too conservative, and that risk is not being able to fully live out our lives.

The solution for tackling inflation and the fear of losing money is usually opposite from each other. There are always risks present, regardless of whether we decide to take an action, or not.

As a Conclusion

The main takeaway that I hope to bring across from all of this, is that again you do not just want to focus on the returns of investments. It is very easy to look at historical average returns and hope that you get the same moving forward. The harder piece is in having a plan to navigate through if the investments fall short of expectations.

We cannot control nor predict how the markets will behave in the future. It is better to focus on the things that we can control, which include:

- Having a plan to define our desired future goals and aspirations

- Ensuring that we understand the risks and range of returns, and mapping the right asset allocation towards those goals

- Being highly diversified to take care of risks that are unique to a specific company or industry

- Always be prepared for deviations, and our ability to navigate them well

I wish you all the best in your journey!

This is an original article written by Tan Chin Yu, Client Adviser of Providend, Singapore’s First Fee-Only Wealth Advisory Firm.

For more related resources, check out:

1. Investing Is NOT Just About Returns

2. Generating Superior Returns vs Just Enough : Focusing on Your Goals When You Invest

2. My Realisations of What Wealth Planning Is Really About

We do not charge a fee at the first consultation meeting. If you would like an honest second opinion on your current estate plan, investment portfolio, financial and/or retirement plan, make an appointment with us today.